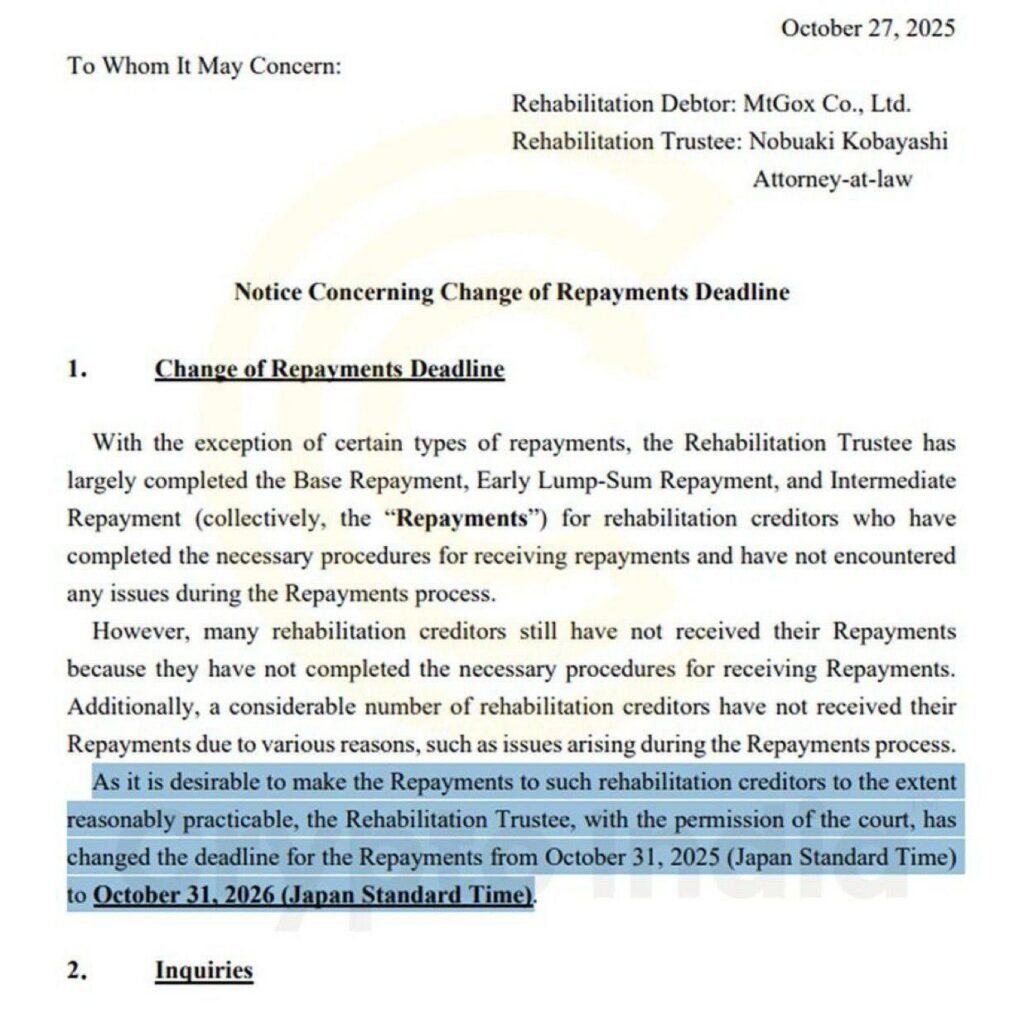

Four days before its due date of October 31, 2025, the defunct cryptocurrency exchange Mt. Gox extended its payment deadline by another year, to October 2026.

The Mt. Gox rehabilitation trustee stated in a statement on Monday that it had “largely completed” the basic repayment, early lump-sum repayment, and intermediate payments for creditors who had completed the repayment eligibility process.

Also Read: Bitcoin Hits $61K As Bankrupt Crypto Exchange Starts Repaying Its Users

The delay in repayments

According to the notification, many creditors have yet to receive their repayments because they either failed to complete the required steps or encountered issues during the process.

“As it is desirable to make the Repayments to such rehabilitation creditors to the extent reasonably practicable, the Rehabilitation Trustee, with the permission of the court, has changed the deadline for the Repayments from October 31, 2025, to October 31, 2026,” the announcement said.

The payback date for the defunct exchange, which was originally scheduled for October 31, 2023, has already been postponed three times.

The history

The Tokyo-based exchange Mt. Gox was founded in 2010 and was at one point one of the biggest Bitcoin trading platforms. In 2014, Mt. Gox suffered a security breach, losing 850,000 Bitcoin. Losing that much bitcoin forced the exchange to stop withdrawals and file for bankruptcy.

In September 2023, they announced that the 69 billion J.P. yen (approximately 510 million U.S. dollars) fiat currency and the 142,000 Bitcoin and 143,000 Bitcoin Cash, which were seized, would be used to partially repay the initial creditor’s lost balance.

Creditors have reported receiving payments since the middle of 2024 via Kraken and Bitstamp exchanges. On March 27, 2025, the rehabilitation trustee notified that 19,500 creditors were repaid using Bitcoin and Bitcoin Cash.

The community reacts

Analysts observed that payback incidents were preceded by comparable conduct in the past. The most recent announcement of a one-year postponement, however, calms the market and acts as a stabilising event for Bitcoin.

Mignolet, a CryptoQuant analyst, had previously cautioned that the ultimate release of 34,000 BTC would “become a catalyst for creating FUD once again” if the trustee is unable to obtain more extensions. Now, this has been prevented.

Dave Ripley, the CEO of Kraken, had earlier said that the exchange has effectively distributed Bitcoin (BTC) and Bitcoin Cash (BCH) to creditors from the Mt. Gox trust.

Whether this is it or more delays in repayments are coming in the future, with the deadline being pushed again, is still to be seen. For now, the creditors are left with disappointment as the repayment fails for the third time.

Also Read: Mt.Gox Transfers Continues, $340M Worth BTC Shifted To Four Bitstamp Wallets