The long-standing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) may soon come to a close, as both parties have jointly filed a motion requesting the resolution of the case.

At the center of the motion is a proposed settlement that includes releasing $125 million currently held in escrow.

From that amount, $50 million would be paid to the SEC as a civil penalty, while the remaining $75 million would be returned to Ripple.

The motion argues that approving the relief would avoid further appeals, save judicial resources, and formally conclude over four years of litigation that has drawn widespread attention across the cryptocurrency sector.

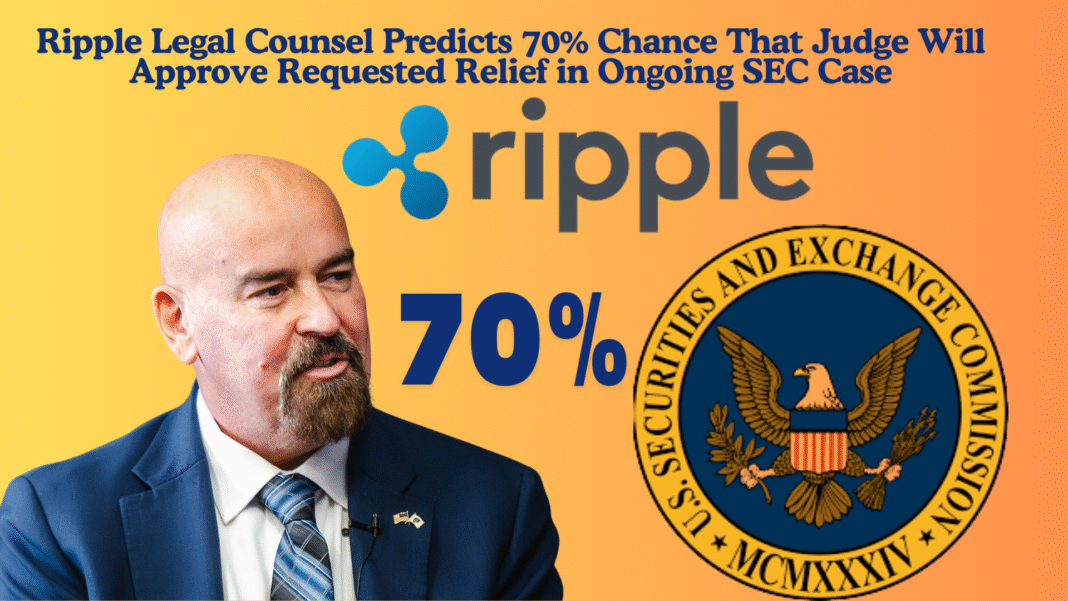

Legal Experts Assess the Likelihood of Approval

Attorney John E. Deaton, a key legal figure who has closely followed the XRP case, publicly shared his belief that there is a 70% chance Judge Analisa Torres will approve the requested relief.

Deaton, known for defending XRP holders’ interests, emphasized that while he did not expect any praise or recognition, he had hoped the SEC would acknowledge past missteps.

Specifically, he criticized the agency’s historically aggressive approach to crypto enforcement, suggesting the SEC should demonstrate accountability for what he called regulatory overreach.

He referenced earlier comments from Judge Sarah Netburn, who criticized SEC lawyers for lacking a “faithful allegiance to the law,” as well as the recent Debt Box case where SEC attorneys faced sanctions for misconduct.

Also Read: Ripple CEO Brad Garlinghouse Calls Memecoins “Maybe Grossly, Overrated,” At The XRP Apex 2025

Broader Reactions from Legal Community and Implications

Former SEC official Marc Fagel expressed skepticism about the SEC’s legal reasoning in the latest filing, particularly its reference to changing regulatory focus due to elections.

Fagel argued that such a rationale may not carry much legal weight.

Meanwhile, Deaton highlighted potential support from emerging legislation such as the Crypto Clarity Act and the Genius Act, which could serve as frameworks for resolving such disputes.

These comments suggest that while the joint motion represents a step toward finalizing the case.

The opinions remain divided on whether the resolution adequately addresses the larger regulatory and legal concerns surrounding digital assets.

Also Read: Ripple Expands University Blockchain Research Initiative Across Asia-Pacific With $5M Funding

Market Reaction and the Future of XRP

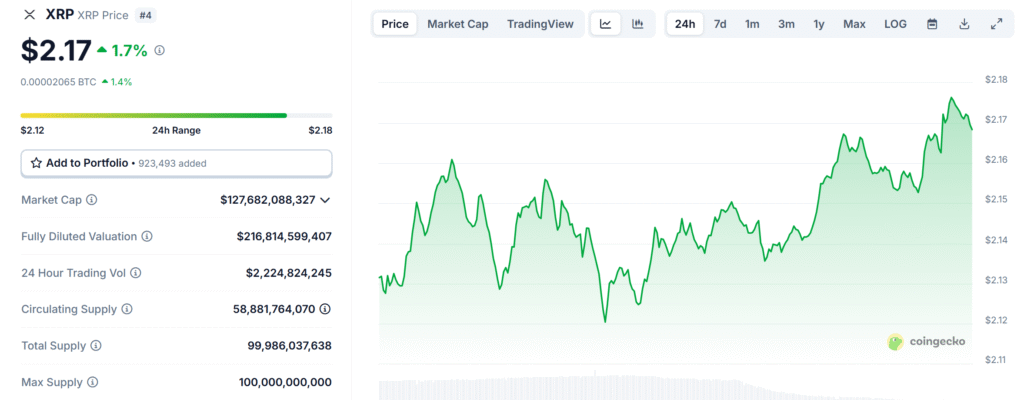

Following the news of the joint motion, XRP’s market price experienced a modest uptick. As of today, XRP is trading at $2.17, with a 24-hour trading volume of over $2.2 billion.

The recent price move marks a 1.71% price increase in the last 24 hours, though the token remains slightly down by 0.50% over the past week.

With a circulating supply of 59 billion XRP, the total market capitalization now stands at approximately $127.6 billion.

Analysts like Bill Morgan believe Judge Torres is likely to approve the motion, noting that while the legal arguments remain largely procedural.

The potential end to this landmark case could inject renewed optimism and stability into Ripple’s future operations and broader crypto regulation efforts.