Renowned financial educator and Rich Dad Poor Dad author Robert Kiyosaki has once again expressed his strong support for Bitcoin, calling it a “smarter and safer” alternative to saving in U.S. dollars.

In a recent post on X (formerly Twitter), Kiyosaki highlighted the risks of fiat currency, emphasizing that inflation, government policies, and excessive money printing continue to erode the dollar’s purchasing power.

As an advocate of financial independence, he urged investors to protect their wealth by investing in assets like Bitcoin and gold, which he believes offer long-term stability.

His endorsement adds to the growing narrative that Bitcoin is a hedge against economic uncertainty and government-controlled monetary systems.

U.S. Dollar Devaluation and the Appeal of Bitcoin’s Fixed Supply

Kiyosaki’s latest remarks align with his long-standing criticism of fiat currency, particularly the U.S. dollar, which he argues is losing value due to aggressive monetary policies by the Federal Reserve.

He believes that traditional savings accounts no longer provide real financial security, as inflation steadily diminishes their worth.

In contrast, Bitcoin’s fixed supply of 21 million coins makes it immune to inflationary pressures, reinforcing its status as a superior store of value.

Institutional adoption of Bitcoin has further bolstered its credibility as an asset, with major corporations and governments now integrating digital currencies into their financial strategies.

The shift toward Bitcoin-backed investments reflects a broader transition in how wealth preservation is approached in the modern economy.

U.S. States Push for Bitcoin Regulations as Crypto Adoption Grows

Amid the rising mainstream acceptance of Bitcoin, 22 U.S. states have introduced various legislative measures to regulate cryptocurrency mining, trading, and digital assets.

Leading the charge, states like Wyoming and Arizona are exploring ways to integrate Bitcoin into their state treasuries, signaling a progressive stance on digital asset investments.

The diversity in regulatory approaches across the U.S. reflects growing governmental interest in establishing a legal framework for cryptocurrencies while addressing regional concerns.

The push for regulation coincides with Kiyosaki’s vision of Bitcoin as a foundational asset in the evolving financial landscape, further validating his belief in its long-term potential.

Market Volatility and Kiyosaki’s Predictions on Bitcoin’s Future

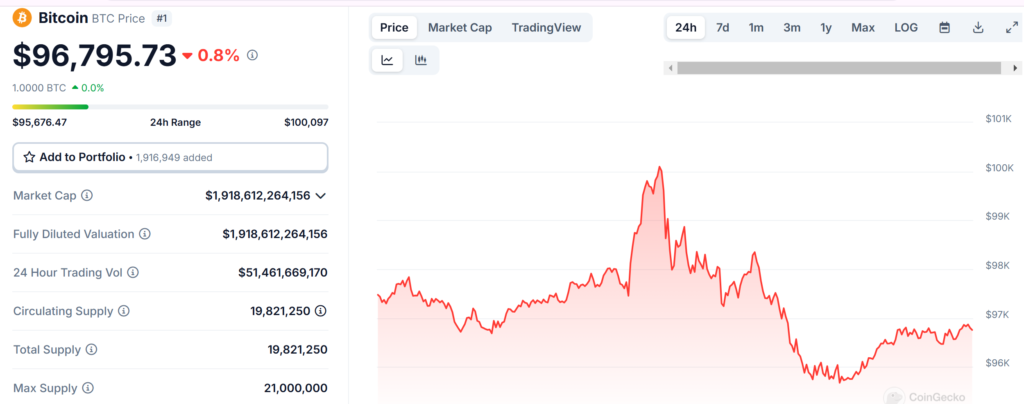

Despite Kiyosaki’s optimism, Bitcoin has recently faced price fluctuations. As of today, Bitcoin (BTC) is trading at $96,647.95, marking a -0.87% decline in the past 24 hours and a -5.53% drop over the past seven days.

With a circulating supply of 20 million BTC, the cryptocurrency maintains a market capitalization of $1.91 trillion. Kiyosaki, however, remains undeterred by short-term volatility.

Referring to a prior post he made on X, he predicted that the “biggest stock market crash in history” will occur in February 2025, and afterwards there will be a push of Bitcoin’s price to new highs.

He believes that gold, silver, and Bitcoin will experience a short-term drop before skyrocketing, calling it the “time to get richer.” As economic uncertainties persist, Kiyosaki’s predictions fuel growing discussions on the role of Bitcoin as a financial safe haven.

Also Read: Rich Dad Poor Dad Author Robert Kiyosaki Says “Why I Love Bitcoin, It Makes Getting Rich Easy”