On Friday, Ripple announced that it had successfully acquired global prime broker Hidden Road and renamed the company Ripple Prime, a clearing desk, financing, and trading bundle for institutions.

According to Ripple, since the first announcement, the business of the newly branded company has quadrupled, and Ripple Prime currently serves over 300 institutional clients with over $3 trillion cleared across markets.

A new branding

Citing SOC 2 Type II compliance, real-time risk management, and cross-margining, the business presents Ripple Prime as an all-in-one solution that covers digital assets, foreign currency, exchange-traded derivatives, over-the-counter swaps, fixed income clearing and repo, and precious metals.

A prime broker is a one-stop shop for market makers and funders. A customer utilises a single desk that offers market access, extends financing, so deals are not entirely pre-funded. It also manages post-trade clearing and settlement, and combines collateral and risk across positions rather than juggling numerous exchanges, lenders, and custodians.

Also Read: Ripple CEO Denies Attempt Of Circle Acquisition, Emphasises Focus On Ripple’s Own Infrastructure

The Hidden Road acquisition

This consolidation can increase balance-sheet efficiency and lower friction in conventional finance. Ripple claims that in addition to FX and derivatives, Ripple Prime offers a comparable mechanism for digital assets.

The revelation comes after Ripple announced that it planned to pay $1.25 billion to purchase Hidden Road. Ripple presented the transaction at the time as the first cryptocurrency business to own and run a worldwide prime broker that deals in several assets.

Quotes from the leaders

In a news statement, Ripple CEO Brad Garlinghouse stated, “We are at an inflexion point for the next phase of digital asset adoption.”

According to the same announcement, Marc Asch, the creator of Hidden Road, stated that the merger will “unlock significant growth” by providing risk capital and licenses

Additionally, Ripple claims that the prime-brokerage unit would strengthen the position of its U.S. dollar stablecoin, RLUSD. According to the fintech company, some clients who deal in derivatives already have RLUSD balances and utilise them as security for prime-brokerage products.

In July 2024, researcher Bluechip gave Ripple a “A” rating for stability, governance, and asset backing, and Ripple earlier designated BNY Mellon as the principal reserve custodian for the RLUSD.

Additionally, a digital asset swap business targeted at institutional clients in the US has been formally launched by Hidden Road. The new product gives users access to cash-settled over-the-counter (OTC) swaps, filling a long-standing vacuum in the U.S. market.

XRP’s Price Actions

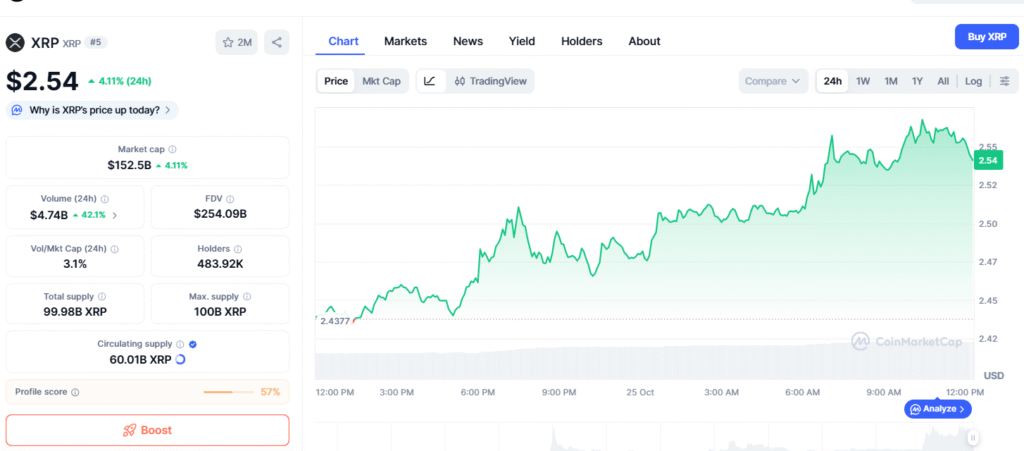

After the news broke out, XRP is up by more than 5% in the last 24 hours, and it is trading at $2.55. The global market cap is at $153.18 billion, and the 24-hour trading volume is up by 41.31%.

Ripple’s institutional effort has expanded with the introduction of Ripple Prime, going beyond payments and custody to include a wider range of broker-dealer-like services that big trading businesses require.