The FTX and Alameda estate has continued systematically liquidating its assets through one more set of redemptions of Solana (SOL) tokens from staking.

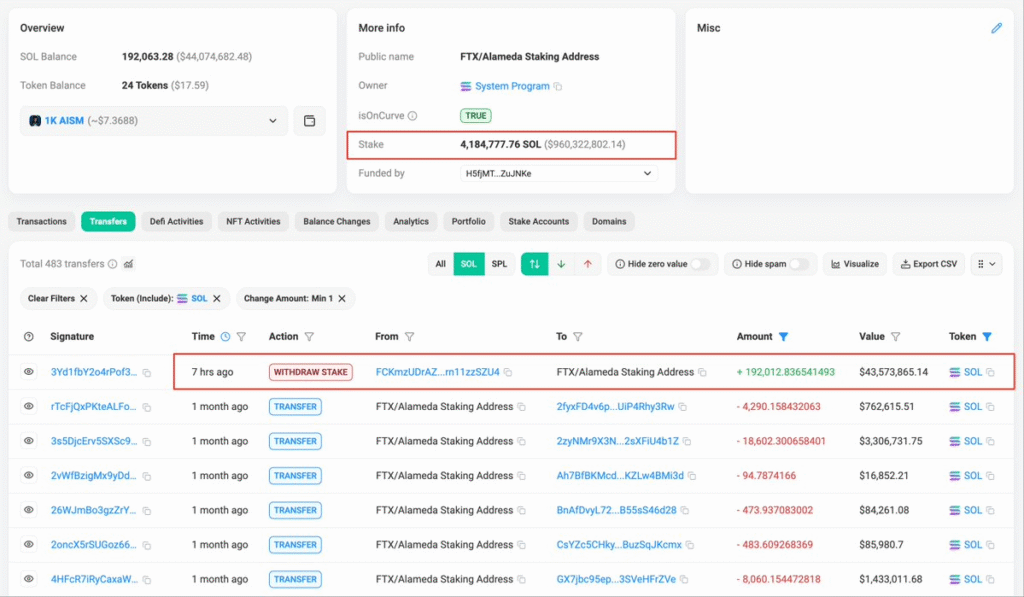

On Thursday, on-chain data showed that bankrupt entities withdrew roughly 192,000 SOL, worth around $44.9 million, from staking.

These redemptions are in line with the estate’s typical monthly cadence of asset liquidations to raise liquidity for creditors, per their bankruptcy plan.

This liquidation approach shows the estate’s planned strategy in unwinding large holdings without significantly disturbing the market.

Billions Paid Out, Major Holdings Still Staked

As of November 2023, total FTX and Alameda estate payouts are 8.98 million SOL or approximately $1.2 billion USD at an average price of $134 coin.

Despite the meaningful liquidation, the estate still owns a considerable amount of SOL.

Sources from Solscan show that as of last Thursday, nearly 4.18 million SOL, which is currently worth almost $977 million, are staked.

These numbers illustrate both the size of the estate’s holdings and continuing influence on the greater Solana ecosystem, especially as staking redemptions are still in rolling redemption status.

Solana’s Market Performance Reacts to Developments

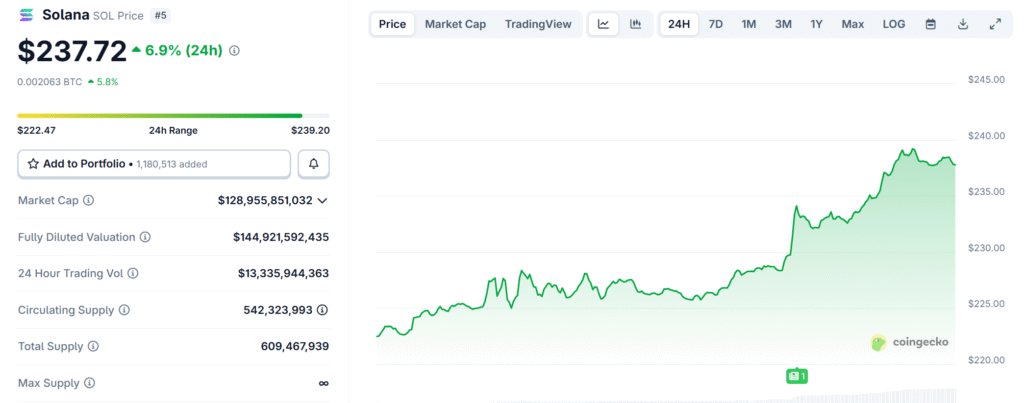

Solana’s price has remained strong against the backdrop of these large redemptions, rising 6.9% in the past 24 hours to $237.72 late Thursday.

In the past week, the token has gained an impressive 14.4%, indicating strong demand in the market despite ongoing liquidations from FTX-associated wallets.

Analysts stated that the controlled redemptions of the estate, combined with Solana’s significant growth as an ecosystem, have helped provide a buffer against any downward pressure on the price.

In turn, this stability will help calm buy-side traders who are concerned about large sales being misinterpreted as a negative impact on market sentiment.

Creditor Repayments and Legal Disputes Continue

Beyond asset redemptions, FTX is preparing for its next round of creditor repayments scheduled for September 30.

While the repayment size has not been disclosed, the collapsed exchange has already returned about $6.2 billion to customers across two distributions this year, $1.2 billion in February and $5 billion in May.

Nevertheless, the bankruptcy case is still tangled up in legal wrangling.

On July 10, Chinese creditor Weiwei Ji lodged a $15 million objection against restrictions on jurisdiction-based payouts, urging FTX to allow legitimate U.S. dollar distributions through avenues such as Hong Kong accounts, UnoCrypto reported.

Notably, on August 22nd, UnoCrypto reported that creditors filed a lawsuit against Kroll, FTX’s bankruptcy claims agent.

They claimed that there was negligence following a data breach in 2023 that produced a wave of ongoing phishing scams.

These disputes highlight the continuing complication with the conclusion of FTX’s bankruptcy.

Also Read: FTX Rejects 3AC Liquidators’ $1.53B Bankruptcy Claim, Cites Risky Trading Strategy