A prominent user identified as “mlmabc” has caused a stir in the crypto and digital asset community by racking up an incredible $241 million after successfully betting on the HYPE token.

By analyzing the blockchain, we can see that the entity’s initial withdrawals four years ago included 8,634 ETH valued at $29.63 million and 205,087 SOL valued at $8.51 million from the OKX exchange, resulting in a total invested sum of $38 million.

Nine months ago, the entity sold the holdings for $82.3 million, and then rotated 100% of the proceeds into Hyperliquid’s native token ($HYPE) with an average purchase price of $16.24.

This brilliant move has resulted in an astounding value today of approximately $279 million.

From ETH and SOL to Becoming a Top HYPE Holder

This whale’s courageous movement into HYPE has been one of the most lucrative high-risk, high-reward trades of the year.

Purchasing 5,067,903 HYPE tokens gives the entity a rank as one of the top five holders of HYPE across the world.

The recent on-chain activity indicated that the investor unstaked all of their holdings, moving 5.07 million HYPE tokens back into circulation, or almost 75% of the entire amount from the unstaking queue.

The tokens were broken up into 29 different wallets to allow for better distributed risk and diversified staking, which is a common strategy with nearly all whales to ensure liquidity and security.

Also Read: Bitcoin Trader Turns $690,000 USDC into $1.826 Million Via Rapid BTC Trades In A Three-Hour Window

Wallet Clusters Reveal Different Entry Prices

Decomposing the data, we see that roughly the HYPE tokens fell into four distributions, of which vary in terms of average entry prices.

Cluster 1 holds 1,285,891 HYPE for purchases totalling $15.2 million with an average of $11.8 per token.

The next Cluster has just over 2 million HYPE with total purchases of $17.4 million, and subsequently a lower average entry price of $8.7 per token.

Cluster 3 has 930,851 HYPE at a higher average entry price of $29.9 and $27.8 million invested.

Lastly, Cluster 4 contained 843,594 tokens purchased at $25.9 for $21.8 million.

What is observed from this distribution, and what is apparent beyond just the size of the whale’s acquisition, is their level of calculated risk over buying price ranges that can maximize long-term returns.

Also Read: Crypto Investor Turns $8.25M To $60M Via Bitcoin Trade After 6 Years

Hyperliquid’s Rising Price and Market Cap Growth

The strong appreciation, which will likely continue, comes as Hyperliquid (HYPE) has been a strong performer across the larger crypto market.

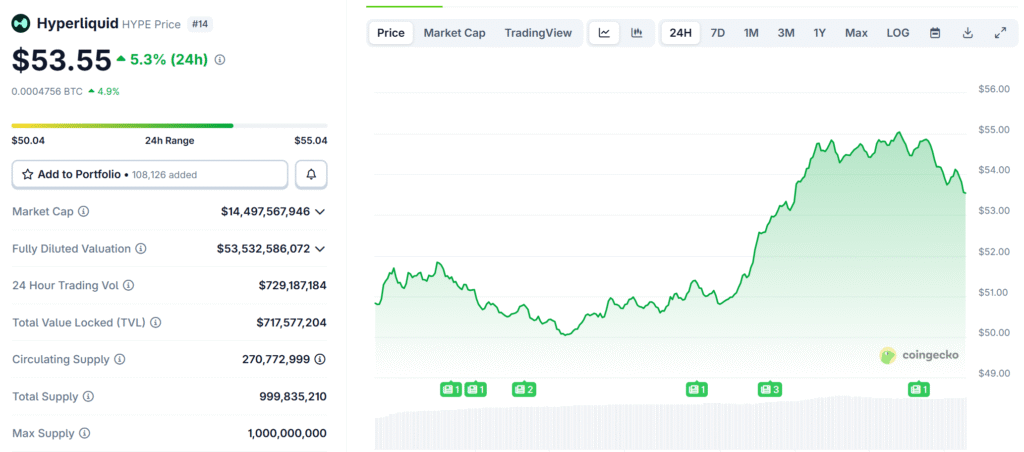

As of today, HYPE is trading at $53.65, which is a 5.32% gain from yesterday and is a gain of over 20% for the week.

HYPE has a 24-hour trading volume of $729 million, a market cap of $14.49 billion, and a circulating supply of 270 million Tokens.

The strong price increase indicates well-founded investor optimism about the project, and the fact that a whale purchased HYPE is a further indication of the token’s perceived long-term value.

Other Traders Reaping Massive Gains in a Bullish Market

The case of MLMABC isn’t an outlier, as many traders have made similarly modest investments that have yielded staggering profits in favorable market conditions, according to UnoCrypto.

On May 29th, trader 0x15b3 turned a $2.95 million investment into $29.76 million by longing 16 tokens during a dip in the market as he took advantage of Bitcoin’s push to $111K, according to UnoCrypto.

Also, on the 18th of August, we reported that another trader had transformed a stake of $125,000 in Ethereum (ETH) into $29.6 million, thereby achieving an almost 236x return on investment through highly speculative and leveraged trading.

These examples show that extreme volatility allows for extremely lucrative opportunities in crypto markets, where success or failure can depend on timing, strategy, and risk tolerance.