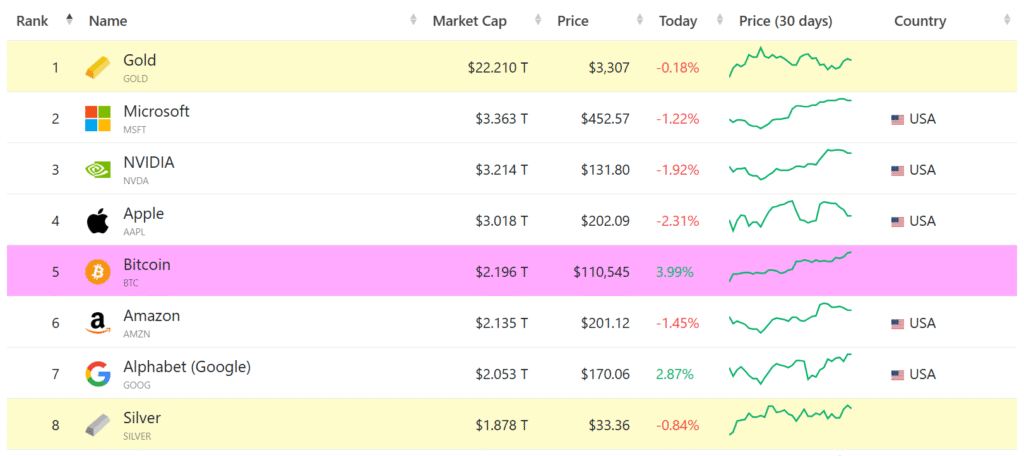

Bitcoin has officially surpassed Amazon in market capitalization, reaching a staggering $2.16 trillion and cementing its position as the fifth-largest asset globally.

This milestone underscores Bitcoin’s growing influence and investor confidence amid renewed institutional interest and expanding global adoption.

Amazon, one of the world’s most valuable technology companies, now trails Bitcoin in market value—a testament to the cryptocurrency’s maturing role as a store of value and hedge against inflation.

The flip in rankings reflects broader sentiment shifts in financial markets, with digital assets becoming a core component of diversified portfolios.

Bitcoin’s rise is fueled by institutional demand and wider ETF adoption

Bitcoin’s rise is fueled by strong demand from both retail and institutional investors, the increasing prevalence of Bitcoin ETFs, and growing acceptance in traditional finance.

The recent rally also comes on the back of macroeconomic uncertainties and fiat currency concerns, pushing investors toward decentralized, deflationary alternatives.

Being ranked as the fifth-largest asset places Bitcoin behind only gold, Apple, Microsoft, and NVIDIA in terms of valuation. As it continues to defy critics and evolve into a mainstream financial instrument, Bitcoin’s latest milestone marks a historic moment, not just for crypto enthusiasts but for the global investment landscape as a whole.

Also Read: Saudi Central Bank Moves Towards Bitcoin, Taps MicroStrategy With 25,656 Share Acquisition

Bitcoin hits record $111,000, marking a historic milestone for the largest cryptocurrency

The largest cryptocurrency in the world has officially reached a new all-time high of $111,000, which is a major turning point in its history.

In the last 24 hours, the price has risen 3.4%, and in the last week, it has increased 8.49%.

Bitcoin’s market valuation has surged to almost $2.2 trillion as a result of this boom, making it one of the most valuable financial assets in the world.

The momentum stems from robust institutional inflows, growing investor confidence, and the ongoing acceptance of Bitcoin as a valid store of value and an inflation hedge.

This new milestone also emphasizes Bitcoin’s growing significance in the mainstream financial system and shows how resilient it is in the face of global economic instability.

Corporate and institutional Bitcoin accumulation drives its rapid growth

The growing accumulation of Bitcoin by corporations and institutional investors is a significant contributing cause to its meteoric growth.

These organizations integrate Bitcoin to their balance sheets in order to diversify risk since they see it as a useful hedge against inflation and currency devaluation.

Improved custody options, increased regulatory clarity, and the rising acceptance of Bitcoin as a mainstream asset have all stimulated institutional interest.

Large acquisitions by investment funds and publicly traded firms have increased market confidence, which has raised demand and prices.

The fact that Bitcoin is now widely accepted as a store of value with long-term potential rather than just a speculative asset is indicated by its institutional acceptance.

Also Read: Metaplanet Buys Additional 1,004 Bitcoin For $104M Amid Growing Crypto Push