A crypto investor operating under the alias “goofyahh.sol” has made headlines by securing an impressive $496,000 profit in just 40 minutes after selling 10.4 million $LIBRA tokens for $5.49 million USDC.

The swift and highly profitable trade revealed by Onchain Lens earlier today has highlighted the immense potential and volatility within the Solana ecosystem.

The investor’s ability to capitalize on rapid price movements showcases the lucrative opportunities available in the crypto market for those who can time their trades effectively.

The transaction has drawn significant attention, sparking discussions about whale influence and the risks and rewards of speculative trading.

Whale’s Total Profit From $LIBRA Exceeds $2.1 Million

This recent trade is just one of many successful transactions involving $LIBRA for “goofyahh.sol.”

In total, the investor has amassed a staggering $2,147,376 in profits from trading the token. Just a day before the latest sale, the same trader purchased 10.4 million $LIBRA tokens for $5 million USDC at an average price of $0.48 per token.

The ability to generate such massive returns within short time frames highlights the token’s liquidity and volatility, as well as the investor’s sharp trading acumen.

With each well-timed move, “goofyahh.sol” continues to establish a strong track record of navigating Solana-based assets effectively.

Past Trades Indicate a Pattern of Success with $LIBRA

Before this latest transaction, “goofyahh.sol” had already demonstrated a pattern of consistently profitable trades with $LIBRA.

In an earlier trade, the investor purchased 5.02 million $LIBRA tokens for $5.7 million USDC and later sold them for $7.35 million USDC, securing yet another substantial profit.

The repeated success suggests a well-calculated strategy that takes advantage of short-term price fluctuations and liquidity shifts.

Such profitable cycles indicate that experienced traders and whales can exert significant influence over token price movements, leveraging volatility to their advantage while smaller investors often struggle to keep pace.

$LIBRA Market Shows Extreme Volatility, Risk for Retail Investors

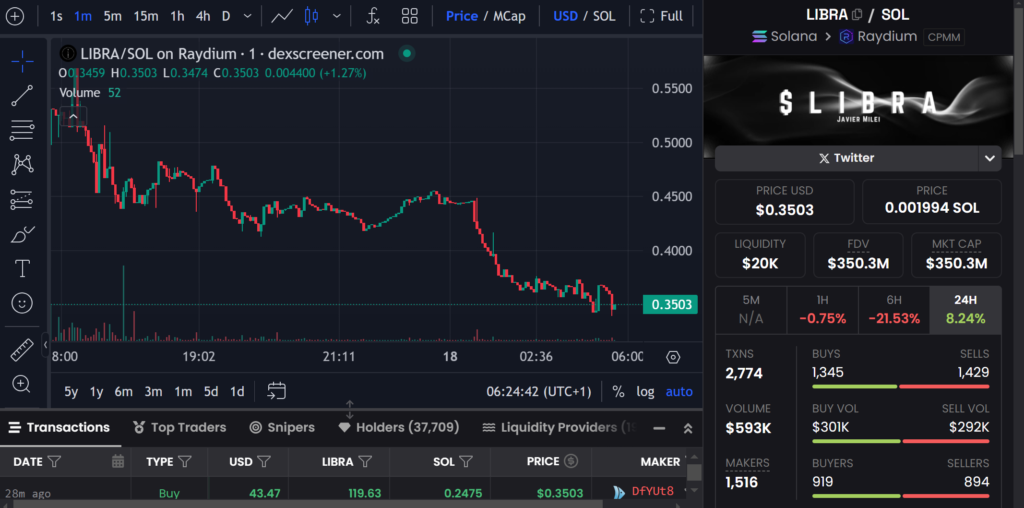

Currently, $LIBRA is trading at $0.3503 (0.001994 SOL) with a fully diluted valuation (FDV) and market capitalization of $350.3 million.

Over the past 24 hours, the token has increased by 8.24%, but it has also seen sharp declines, including a 21.53% drop in just six hours and a 0.75% dip in the past hour.

The extreme volatility makes $LIBRA both an attractive and highly risky asset for traders.

With liquidity estimated at only $20,000, the token remains vulnerable to price manipulation and sudden fluctuations, making it a challenging environment for retail investors who lack the resources of major whales.

Insider Trading, Market Collapse, and Retail Investor Losses

While whales like “goofyahh.sol” have been profiting immensely from $LIBRA trades, the broader market has experienced major disruptions.

11 insider investors collectively made $43.8 million in profits by selling off $LIBRA immediately after launch, triggering an 85% price crash as liquidity was removed.

The sudden collapse has led to devastating losses for nearly 75,000 traders, with total financial damages reaching approximately $286 million, according to crypto lawyer Wassielawyer.

Despite this turmoil, trading activity remains high, with $593,000 in daily volume across 2,774 transactions.

With a nearly balanced distribution between buy and sell orders, traders remain engaged, but concerns about insider trading and market manipulation continue to cast a shadow over $LIBRA’s future.

Also Read: Crypto Investor Invests $1.82M In $TRUMP Following Upbit Exchange Listing, After Earning $2M Profit