The U.S. Securities and Exchange Commission (SEC) has formally accepted Franklin Templeton’s application for a spot Solana (SOL) exchange-traded fund (ETF), marking a crucial milestone for institutional adoption of the cryptocurrency.

While this does not mean immediate approval, it signifies that the proposal has advanced to the next phase of regulatory review.

The development comes after the SEC previously delayed decisions on multiple altcoin ETF applications, including Solana (SOL), XRP, Dogecoin (DOGE), and Litecoin (LTC), citing the need for further evaluation.

The acceptance of Franklin Templeton’s proposal has sparked renewed optimism in the crypto industry, with many investors hopeful that Solana may soon receive its first spot ETF.

Franklin Templeton’s Solana ETF Could Pioneer Staking Rewards Integration

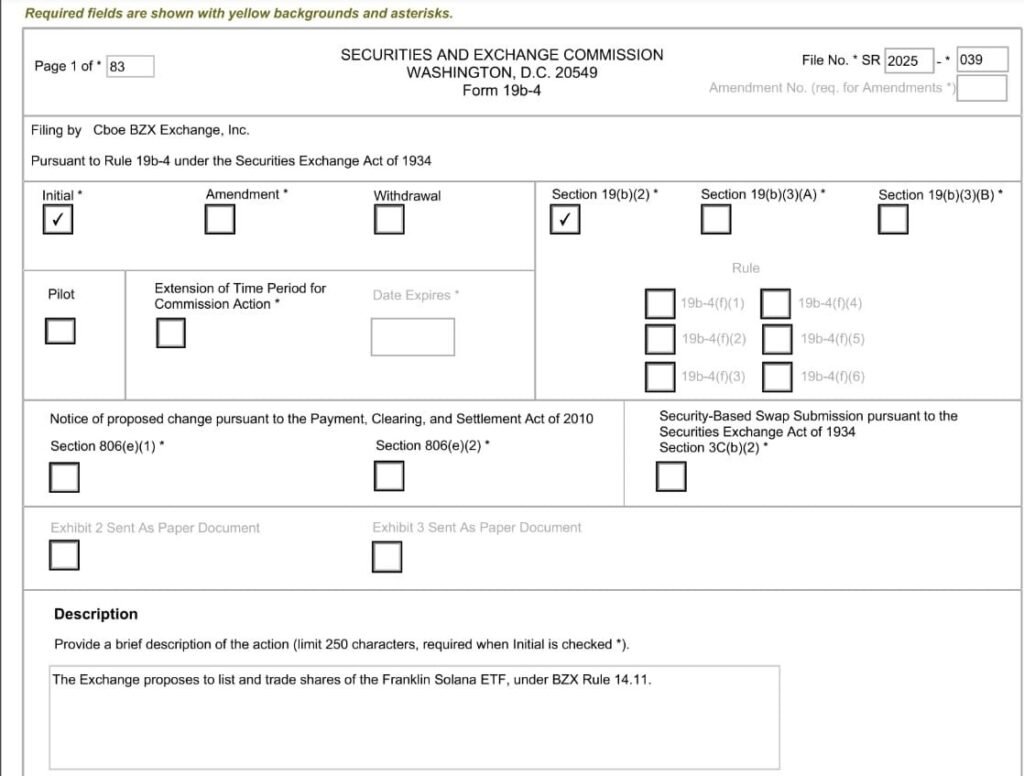

Franklin Templeton has taken a bold step in expanding its crypto investment offerings, with its spot Solana ETF proposal formally submitted by the Cboe BZX Exchange on March 12.

Although, after the filing was made by Cboe, VanEck and 21Shares’ Solana ETF filings were reported to have been missing from the Cboe website, raising questions about their status.

Unlike futures-based ETFs, which track asset prices via derivatives, this ETF would hold physical SOL tokens, allowing investors direct exposure to the cryptocurrency.

A key feature of the filing is its request to integrate staking rewards into the ETF structure, arguing that restricting staking would be akin to preventing equity ETFs from distributing dividends.

If approved, this could set a precedent for future crypto ETFs by offering yield-generating opportunities, potentially making it an attractive investment vehicle for both institutional and retail investors.

Franklin Templeton’s Expanding Role in the Crypto ETF Market

With $1.5 trillion in assets under management, Franklin Templeton has emerged as a significant player in the cryptocurrency investment space.

The firm first registered a Solana trust on February 10, laying the groundwork for this ETF application.

By joining prominent industry firms like Grayscale, Bitwise, VanEck, 21Shares, and Canary Capital in filing for a Solana ETF, Franklin Templeton demonstrates growing confidence in a regulatory shift toward broader cryptocurrency acceptance.

Many analysts believe that changes in political leadership, particularly under a potential pro-crypto administration led by former President Donald Trump, could accelerate the approval of spot crypto ETFs, further legitimizing digital assets in traditional financial markets.

Solana Price Outlook: Will the ETF News Trigger a Rally?

The acceptance of Franklin Templeton’s ETF application has fueled speculation about a potential price rally for Solana (SOL).

Historically, ETF-related developments have influenced crypto prices, as seen with Bitcoin and Ethereum ETFs, which triggered substantial market activity.

If the Solana ETF progresses favorably through regulatory hurdles, institutional demand for SOL could rise, driving its price higher.

As of today, Solana (SOL) is priced at $124.66, with a 24-hour trading volume of over $3.1 billion. This represents a 0.60% increase in the last 24 hours, though the token has declined by 11.80% over the past week.

With a circulating supply of 510 million SOL, the token’s market capitalization stands at approximately BTC 775,672, reflecting strong market interest despite recent price fluctuations.

Also Read: Brazilian Securities Regulator Approves First Solana Spot ETF, Price Surges