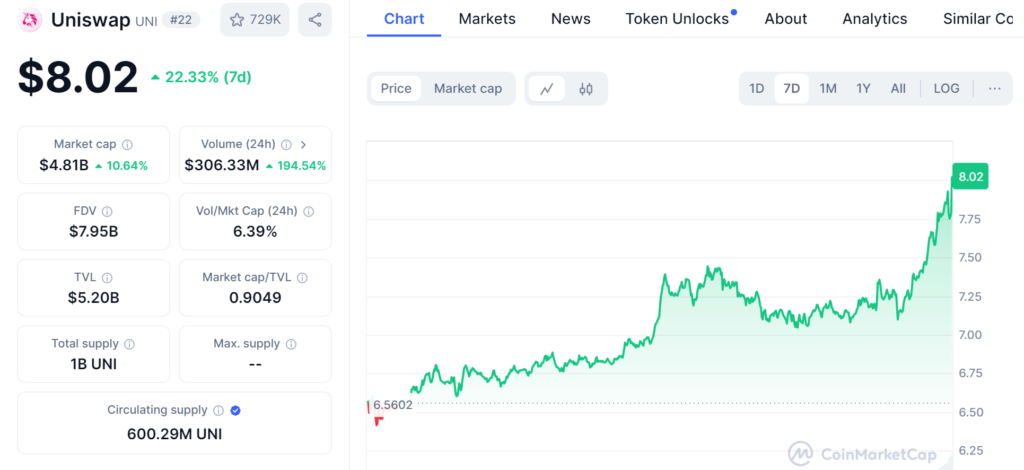

Uniswap (UNI) has experienced a significant surge, with its price increasing by 22.33% over the past week. Market participants are closely watching key price zones, particularly the $10 mark, which could serve as the first significant resistance level. A breakthrough above this threshold might pave the way for further gains, potentially testing the $11 and $12 levels.

In an optimistic scenario, some analysts suggest that UNI could rally towards the $20 mark, which would represent a substantial gain of over 170% from its current price point.

As of the latest data, UNI price is trading at $7.86, with a 24-hour trading volume of $364,799,791. This represents a whooping 8.61% price increase in the last 24 hours.

Technical Indicators and Whale Activity

The Relative Strength Index (RSI) for UNI is currently hovering between the 55 and 65 zone, indicating growing bullish sentiment without yet reaching the overbought zone. Indicating strong bullish presence.

Notably, UNI’s price is showing signs of a bullish trend, coinciding with an increase in whale transactions. The heightened activity in large trades suggests accumulating interest from strategic buyers who are stepping in during price fluctuations.

These recent whale movements align with periods of volatility, potentially indicating accumulation phases. However, it’s worth noting that large transactions have fallen by 63%, which raises some questions about the level of institutional interest at present.

On-Chain Metrics and Exchange Activity

Uniswap has seen a remarkable 1195% increase in exchange netflows, indicating a significant uptick in platform activity. This surge has sparked debates about whether it could signal an imminent price bounce, especially considering that active addresses have also recorded an 11.9% increase.

The spike in Uniswap’s netflow implies that more money is flowing into the market, possibly reflecting a rush to capitalize on highly volatile price movements. This usually translates to higher trading volumes as retail traders become more active.

Such a heavy upsurge in activities often leads to short-term volatility in an asset’s price. For Uniswap, this could mean greater buying and selling pressure.

Market Implications and Future Outlook

The recent performance of Uniswap (UNI) reflects growing interest in the decentralized finance (DeFi) sector. The significant increase in exchange netflows and active addresses suggests that users are increasingly engaging with the Uniswap platform, which could bode well for its long-term adoption and value proposition.

However, the decrease in large transactions raises questions about the current level of institutional involvement. As the market watches for a potential break above the $10 resistance level, it’s important to consider that the crypto market remains highly volatile.

While the current indicators and on-chain metrics paint a bullish picture for UNI, investors should remain cautious and consider both the potential for further gains and the risk of sudden market reversals.

The coming weeks will be crucial in determining whether UNI can maintain its momentum and reach the higher price targets that some analysts have proposed.