The Smarter Web Company, the UK’s largest corporate Bitcoin holder, is preparing for bold expansion moves even as its stock faces heavy declines.

CEO Andrew Webley revealed in an interview with the Financial Times that the firm is considering acquiring struggling competitors to grow its Bitcoin treasury at discounted rates.

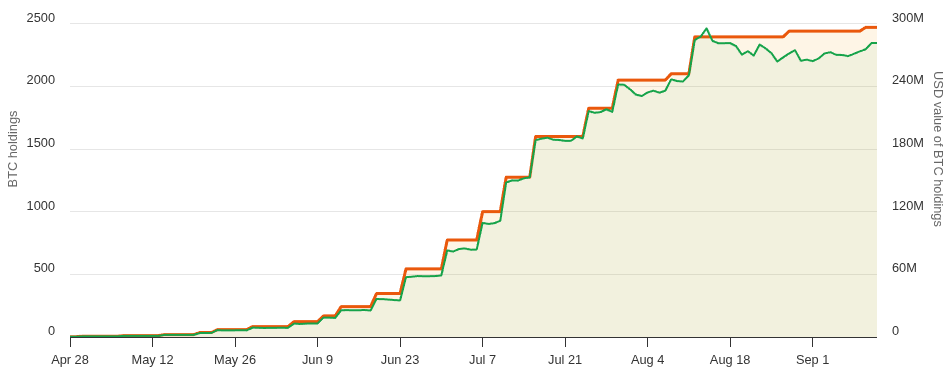

With 2,470 BTC worth nearly $275 million, Smarter Web ranks as the world’s 25th-largest Bitcoin treasury according to BitcoinTreasuries.NET.

Webley also outlined long-term ambitions for the firm, including a rebranding and an eventual bid to enter the FTSE 100, the index of the UK’s top 100 listed companies.

Opportunities and Risks in Acquiring Crypto Assets out of Bankruptcy

Although it may initially appear attractive to acquire Bitcoin for cheap from bankrupt companies, many experts have advocated that the process may incur hidden costs.

Alex Obchakevich, founder of Obchakevich Research, noted that initial discounts may reach 60–70%.

Notably, liabilities, court-ordered encumbrances, and tax expenses ultimately modify the real discount to a range of 20–50%.

Historical cases, such as FTX and Celsius, reveal how acquiring distressed assets can be more complex and less lucrative than they may otherwise seem.

Therefore, Smarter Web’s acquisition may be riskier and conventionally more complex than expected.

Also Read: Cango Reports Strong Q2 2025 Results With $139.8M Revenue As Bitcoin Mining Expansion Drives Growth

Stock Struggles Amid Crypto Market Headwinds

Smarter Web’s expansion vision comes at a time of financial pressure. The company’s stock dropped nearly 22% on Friday, sliding from $2.01 to $1.85 despite Bitcoin itself gaining more than 1% in the same period.

Over the past month, Smarter Web’s share price has fallen about 35.5%, compared with Bitcoin’s 4% decline.

Analysts link part of this underperformance to the UK’s recent approval of crypto exchange-traded notes (cETNs) for retail investors, effective October 8.

With cETNs providing a new regulated way to gain crypto exposure, investor interest in treasury firms like Smarter Web may be diminishing.

Also Read: Polymarket Acquires QCEX For $112M, Clears Path For U.S. Expansion

A Competitive and Crowded Treasury Market

Industry observers believe that the Bitcoin treasury space is entering a cutthroat phase.

Coinbase analysts David Duong and Colin Basco have described the current climate as a “player vs player” stage where firms will battle fiercely for capital and investor trust.

They predict that only a select number of strategically situated companies will survive, as some of them will go bankrupt and the treasuries will be smaller or less efficient.

Josip Rupena, the CEO of Milo and a former analyst at Goldman Sachs, even went on to liken the sector to the CDOs, which means collateralized debt obligations that were a huge part of the 2008 financial crash.

They cautioned that over-engineered financial systems may leave investors uncomfortable with their actual risk.

Previous Smarter Web Strategic Moves

Despite its present predicament, Smarter Web has a history of going through periodic treasury expansions that they clearly execute. On June 13, the company acquired 74.27 BTC worth $8.11 million at that time, according to UnoCrypto.

This lined up nicely with its ten-year plan. A plan that is partially dedicated to integrating Bitcoin into its operations over an extended period of time, while issuing full disclosures of the risks it carries with the crypto.

Then on September 4th, we reported that Smarter Web announced it would issue 21 million new shares through Shard Merchant Capital to bolster its capital reserves and dilute current holders.

These moves are a demonstration of Webley’s stated aggressive growth strategy and eagerness to fortify the balance sheet when available, while it is generally engulfed in a boom-bust cycle and expanding competitive grouping.

Also Read: UK’s FCA Reverses Ban on High-Risk Crypto ETNs to Support Digital Asset Expansion in the Nation