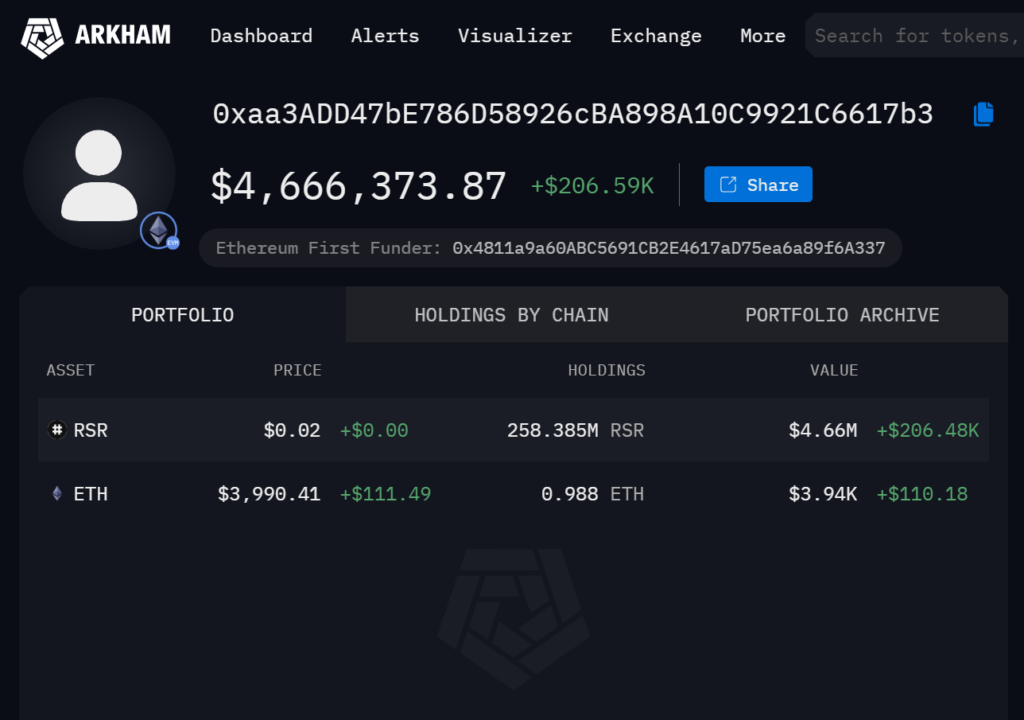

According to Arkham’s blockchain monitoring, a suspected Reserve Protocol investor address, 0xaa…17b3, has transferred a massive 680 million RSR tokens to the Binance exchange.

This amount is valued at approximately $12.84 million, based on the current RSR price.

The transfer occurred on the date of April 11th this year, when the address in question unlocked around 863 million RSR from the Vesting Escrow contract.

Current Holdings Amid Recent Price Action

After this large sell-off, the suspected Reserve Protocol investor address still maintains a significant holding of around 258 million RSR, valued at $4.66 million.

Potential Factors Influencing the Dump

The motivation behind this large RSR sell-off by the suspected investor is not entirely clear.

However, it’s worth noting that Paul Atkins, who was recently selected by former President Trump to serve as the chairman of the U.S. Securities and Exchange Commission (SEC), has previously acted as an advisor to the Reserve Protocol.

This connection to the SEC leadership may have played a role in the investor’s decision to liquidate a portion of their RSR holdings.

Also Read: PEPE Investor Cashes Out Big, Dumps 356.2 Billion Tokens on Kraken For 31x Profit

Impact on the RSR Market

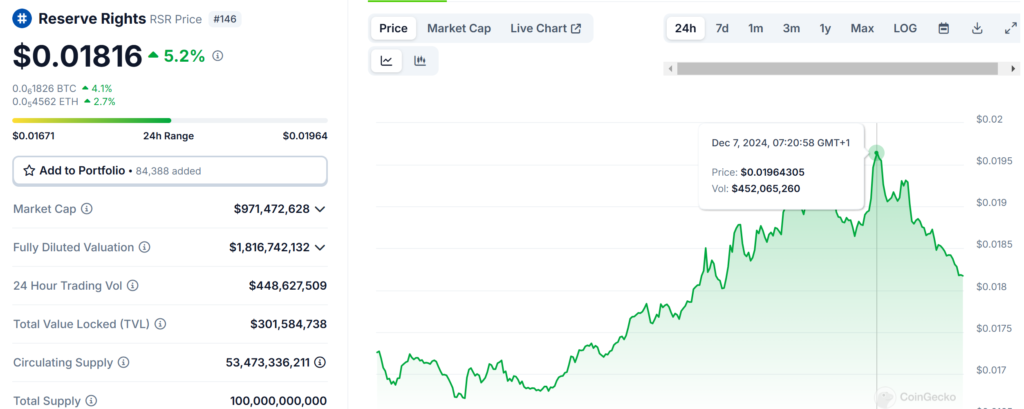

The impact of this dump on the RSR market appears to have been relatively muted, with the token’s price remaining resilient and continuing its upward trajectory.

This could suggest a robust demand for RSR, or potentially indicate that the market has already factored in the potential sell pressure from this large investor.

Interestingly, despite this substantial dump, the price of Reserve Rights (RSR) has actually increased over the past 24 hours by 5.23%, and has surged by an impressive 93.41% in the last 7 days.

Nonetheless, the substantial nature of this transaction warrants close monitoring of the RSR ecosystem and its underlying fundamentals.

Reserve Protocol Future Outlook

The Reserve Protocol, which is the project behind the RSR token, has garnered significant attention in the blockchain space.

The involvement of a high-profile figure like Paul Atkins as an advisor has likely contributed to the protocol’s visibility and credibility.

However, the sudden liquidation by this suspected investor raises questions about the long-term strategic alignment and confidence within the Reserve ecosystem.

As the protocol continues to evolve, the reaction and behavior of its key stakeholders will be crucial in shaping its future trajectory.

Also Read: Crypto Influencer Arthur Hayes Dumps $ATH at Loss, Shifts Focus to $ENA Amid 11% Plunge