Michael Saylor, executive chairman of Strategy, told the Coin Stories podcast on YouTube on Friday that Bitcoin’s growing appeal to big institutions may calm the wild price swings that thrill many retail traders.

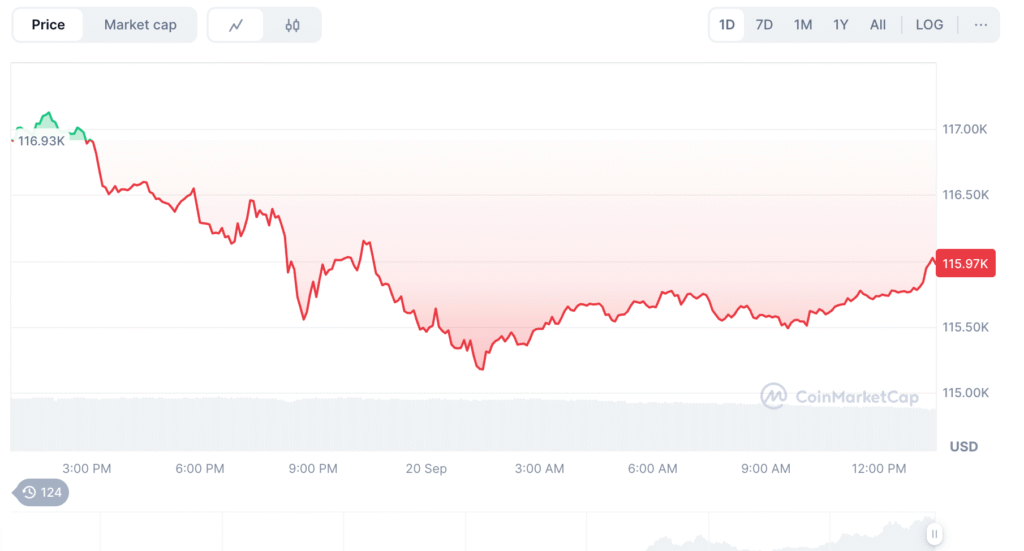

He said this shift is part of Bitcoin’s natural growth. The comment came after Bitcoin hit a record high of $124,100 on Aug. 14, and while the coin trades near $115,760 with a market cap of $2.31 trillion.

The debate over whether the US Federal Reserve’s Sept. 17 interest rate cut was priced in is one of the reasons traders remain divided about where the price will go next.

Saylor on volatility and retail sentiment

Saylor said that lowering volatility helps large investors feel secure enough to invest substantial amounts in the market. He noted that when volatility drops, the market can feel boring.

He said people who bought for the thrill may lose interest. “It’s like they had this big high and now the adrenaline is wearing off and they’re a little bearish,” he told host Natalie Brunell.

He called the current phase a “growing stage” and added that falling volatility can be a good sign for long-term adoption.

Why institutions matter?

Big funds want steady moves, and they need clearer rules and smaller daily swings before they commit large sums. Saylor said that as institutions enter, demand could rise more stably.

That could help Bitcoin gain wider acceptance. At the same time, that stability can reduce the rapid gains that attract individual speculators.

Bitcoin’s run to $124,100 in mid-August surprised many traders. Since then, the price has pulled back. At the time of writing, the coin trades around $115,760. Some analysts say the Fed’s expected rate cuts helped lift markets, but others think the cuts were already priced in.

Views on the year-end vary, but BitMEX co-founder Arthur Hayes sees $250,000 by year’s end. Several other traders point to roughly $150,000, and analyst PlanC said he does not expect a new peak this year.

Crypto analyst Benjamin Cowen warned that Bitcoin could see a large drop, as much as 70% from whatever the final all-time high becomes.

Market forces at work

ETF flows and growing institutional interest are two of the main forces now shaping the market. If more institutions buy, trading may become less wild.

That would likely reduce the size of sudden rallies and crashes. For some retail traders, that is a loss of excitement. For institutional investors, it is a gain in safety.

Innovation and the next decade

Saylor said Bitcoin is still in an early phase of development, and he compared the coming years to a digital gold rush from 2025 to 2035. He expects new business models and products to arrive.

He also warned that there will be many mistakes. He said these errors will come alongside big rewards for some founders and early backers.

How might traders react?

If volatility falls, short-term traders could look for other places to chase big gains. Some may move into smaller coins or into different markets.

Long-term holders may welcome a calmer market. Companies building services around Bitcoin could find it easier to plan and grow if price moves are steadier.

Also Read: Bitcoin Mining In Ethiopia Costs $20,000 Per Coin Due To Abundant Hydropower