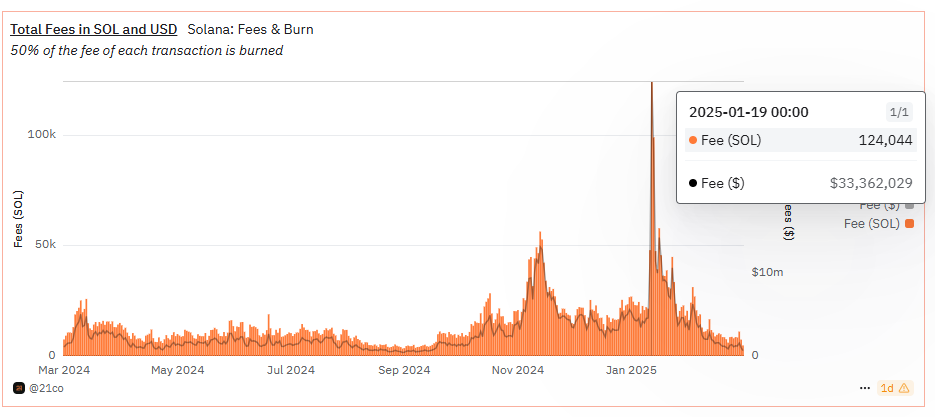

Solana’s network transaction fees have hit their lowest level since September 2024. Last week, the total transaction fees generated on the network were just 53,800 SOL. This marks a 10% drop from the previous week.

While that decline is smaller than the 25% average weekly drop over the last six weeks, it still signals a steady decrease.

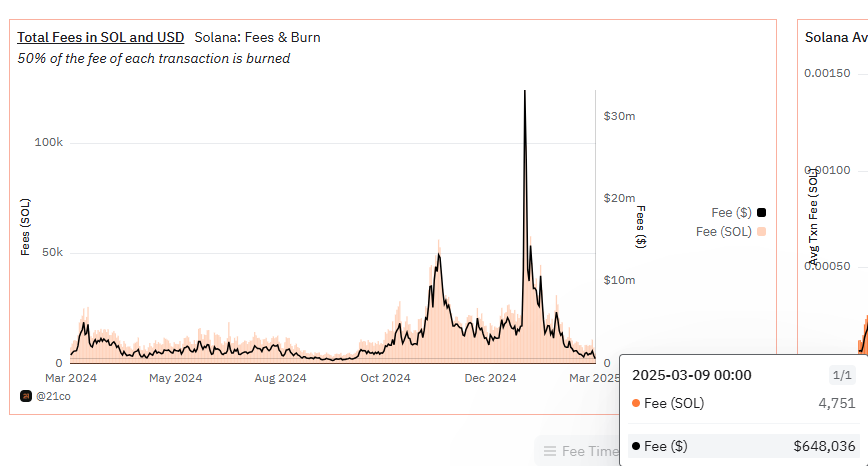

Solana’s Daily Transaction Fees Plunge to $648K

As of March 9, 2025, transaction fees have fallen to just $648,000. Most of these fees, 77%, came from non-vote transactions, as per the data from the Dune. These occur when users “tip” validators to speed up their transactions. Meanwhile, the average transaction fee for non-vote transactions now stands at 0.00846 SOL.

High Failure Rate Adds to Concerns

Another major issue for Solana is the increasing number of failed transactions. Right now, the failure rate has reached 41%. This raises concerns about network efficiency and whether Solana can maintain its reputation for speed and low costs.

A high failure rate means users are trying to push transactions through, but many are unsuccessful. While tipping validators can help transactions get processed faster, the rising failure rate suggests that congestion or inefficiencies might be creeping into the system.

What does This Mean for Solana?

Solana has long been praised for its low fees and fast transactions, making it a popular choice for developers and users. However, the recent decline in transaction fees and the rising failure rate suggest that network activity is slowing down. If this continues, it could impact validator incentives and overall network health.

Lower transaction fees might seem like a good thing for users, but they also indicate less demand. If fewer people are using the network, it could hurt Solana’s long-term growth. At the same time, a high failure rate could push users toward other blockchain networks that offer better reliability.

SOL’s Price Actions & Market Reactions

Solana’s price has also taken a hit. SOL is currently trading at $123.24, down 3.24% in the last 24 hours. However, trading volume has increased by 48.75%, indicating that investors are actively buying and selling in response to these changes. The total global market cap for Solana now stands at $62.72 billion.

Many are wondering if Solana has already seen its peak. The launch of the $TRUMP memecoin drove significant network activity, but since then, both fees and token prices have declined. The question now is whether Solana can regain momentum or if this downward trend will continue.

The crypto market is unpredictable, and Solana’s future remains uncertain. The network has proven resilient in the past, bouncing back from outages and slowdowns. However, with transaction fees dropping, failures rising, and market interest shifting, it faces a tough road ahead.