Solana’s blockchain has achieved a remarkable milestone in its stablecoin ecosystem, with the total supply reaching $5.89 billion, marking its highest level since September 2022.

The figure places the network merely 5.76% below its all-time high of $6.25 billion, recorded on June 4, 2022, according to DefiLlama data.

The substantial growth is primarily attributed to Circle’s aggressive minting activities, with the company having created 1 billion new USDC tokens on the Solana network in 2025 alone.

USDC maintains its dominance in the ecosystem, commanding 74.4% of the network’s total stablecoin supply, solidifying its position as Solana DeFi’s preferred stablecoin option.

Expanding Stablecoin Ecosystem and Innovation

The Solana network has witnessed unprecedented diversification in its stablecoin offerings throughout 2024.

Major traditional finance players like PayPal have deployed tokens on the network, while established Ethereum DeFi entities such as Sky (formerly MakerDAO) have chosen Solana for their token launches.

The ecosystem now encompasses a wide range of fiat-pegged assets beyond USD, including stablecoins linked to the Euro, Japanese Yen, and Australian Dollar.

Additionally, Solana’s Real World Asset (RWA) sector has introduced innovative yield-bearing stablecoins, such as Solayer’s $sUSD and Ondo Finance’s $USDY, collectively contributing over $138 million to the network’s Total Value Locked (TVL).

Strategic Partnerships and Future Developments

The Solana ecosystem continues to expand through strategic partnerships and innovative initiatives.

A notable development is the collaboration between DeFi platform Raydium and Orderly Network, which aims to bring perpetual contract trading to Solana’s 600,000 daily users, offering access to over 90 perpetual markets and addressing historical trading limitations.

Looking ahead to mid-2025, Solana Mobile plans to launch its second phone, the Seeker, which will include a Seeker Genesis Token – a soulbound NFT granting VIP access to special events, content, and benefits within the Solana ecosystem.

These developments underscore Solana’s commitment to expanding its technological capabilities while fostering broader ecosystem adoption.

Market Performance and Technical Developments

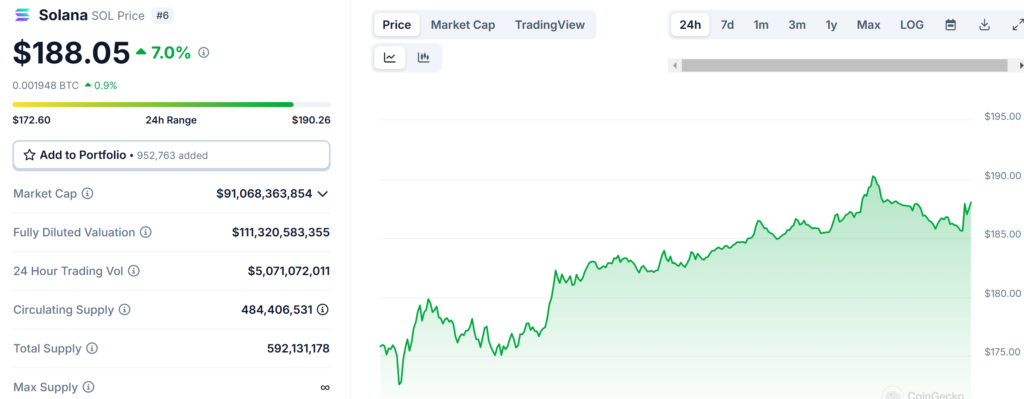

Solana’s native token (SOL) demonstrates strong market performance, trading at $188.00 with a substantial 24-hour trading volume of $5,071,072,011, representing a 6.93% increase in the last 24 hours despite a 7-day decline of 11.75%.

The network’s market capitalization stands at $91,068,363,854, supported by a circulating supply of 480 Million SOL.

On the technical front, Solana has made significant strides in security and functionality, notably developing the Solana Winternitz Vault.

A quantum-resistant solution that generates new keys for each transaction using hash-based signing techniques, enhancing the network’s long-term security against potential quantum computing threats.

Also Read: Solana Unveils Quantum-Resistant Vault With New Keys Generation for Each Trade