A major Solana (SOL) investor has successfully secured a $4.5 million profit after strategically offloading 96,155 SOL tokens on Binance.

According to data from Lookonchain, the whale initially withdrew 88,493 SOL worth approximately $8.95 million a year ago at an average price of $101 per token.

Rather than selling immediately, the investor opted to stake the tokens, allowing them to accumulate additional rewards over time.

The decision proved beneficial, as the staking rewards increased their total holdings to 96,155 SOL.

Just two hours ago, the whale unstaked the entire amount—valued at $13.49 million at the time of deposit—and transferred it to Binance, signaling an intention to capitalize on their gains.

Solana Price Decline Raises Market Concerns

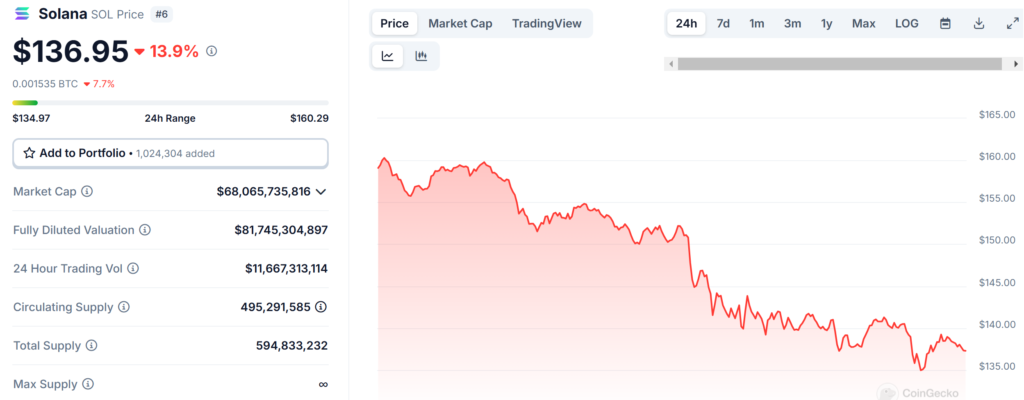

Despite the whale’s successful exit, Solana’s price has faced a sharp decline, creating uncertainty among investors.

SOL is currently trading at $136.94, marking a significant 13.92% drop within the last 24 hours. Over the past week, the token has fallen by 16.58%, reflecting broader market volatility.

Large sell-offs like this often impact market sentiment, as traders fear additional price corrections due to increased selling pressure.

However, with a total circulating supply of 500 million SOL and a market capitalization of approximately $68 billion, Solana continues to be a key player in the blockchain space, maintaining strong adoption and developer activity.

Whale’s Strategy Demonstrates Power of Staking and Market Timing

The whale’s strategy highlights the potential benefits of long-term staking in the crypto market.

By choosing to stake instead of selling immediately, the investor accumulated an additional 7,662 SOL in rewards over the year, significantly boosting their total holdings.

While Solana’s price fluctuated during this period—at one point reaching a valuation of $25 million for the whale’s stake.

The decision to unstake and transfer funds at the right moment allowed them to secure a sizable profit despite recent price dips.

The move exemplifies how large investors utilize staking to maximize returns while mitigating the risks associated with short-term trading and market fluctuations.

Broader Solana Market Trends and Whale Activity

The Solana ecosystem has witnessed other notable trades in recent days, further showcasing the volatility and opportunity within its market.

One crypto whale recently dumped $4.3 million in SOL to participate in the $PAIN presale, ultimately securing a $2.3 million profit.

Another trader turned 35.5 SOL worth just $8,193, into an astonishing $2.4 million by investing in $JellyJelly, a token that surged 111% in 24 hours.

Meanwhile, another investor recovered from a $270K initial loss and converted 20 SOL into 26.6 million $VINE, ultimately securing a $5 million profit.

These dramatic price movements reflect the speculative nature of the crypto market, with some traders capitalizing on sudden opportunities while others face steep losses.

As Solana’s ecosystem evolves, market participants will continue monitoring whale activity for clues about future price trends.