Robinhood, the widely used online trading platform, has agreed to pay $29.75 million to settle an investigation by the U.S. Financial Industry Regulatory Authority (FINRA) over regulatory compliance failures.

The settlement consists of a $26 million fine imposed by FINRA, along with an additional $3.75 million in restitution to customers impacted by the company’s regulatory shortcomings.

The investigation focused on Robinhood’s handling of cryptocurrency transactions and its overall compliance measures.

The settlement reflects the growing pressure on financial platforms to ensure regulatory adherence, especially in the evolving landscape of digital asset trading.

Compliance Failures in Transaction Oversight and Security

The FINRA investigation uncovered multiple deficiencies in Robinhood’s compliance and supervisory systems.

The company failed to properly oversee its clearing system, which led to transaction delays affecting thousands of customers.

Additionally, Robinhood did not adequately monitor suspicious transactions, failing to detect irregular fund movements or respond effectively to hacking incidents targeting customer accounts.

These lapses have raised concerns about the platform’s ability to maintain a secure and transparent trading environment. Regulators have emphasized that such failures could compromise investor trust and expose users to heightened financial risks.

Also Read: Crypto.com Delists Tether USDT, WBTC, DAI & Many More To Abide By MiCA Regulations

Lax Identity Verification and Unregulated Account Openings

Another major issue identified in the investigation was Robinhood’s inadequate identity verification process when opening new trading accounts.

FINRA found that the company had opened thousands of accounts without proper identity checks, increasing risks associated with fraud, money laundering, and other illicit financial activities.

The revelation has intensified regulatory scrutiny over digital trading platforms, as authorities push for stricter measures to prevent financial crimes.

With cryptocurrency markets expanding rapidly, regulators are now prioritizing stronger safeguards to ensure that trading platforms maintain compliance with anti-money laundering (AML) and know-your-customer (KYC) standards.

Rising Regulatory Pressure on Robinhood and the Crypto Industry

This settlement marks the second major regulatory penalty for Robinhood in just two months, highlighting the increasing regulatory oversight of online trading platforms.

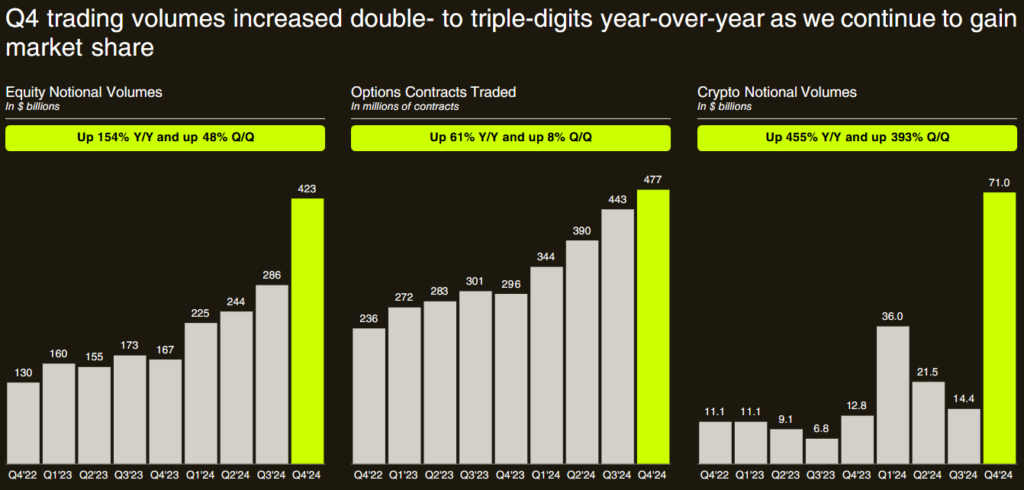

Despite these challenges, Robinhood has reported strong financial performance, particularly in the cryptocurrency sector.

In the fourth quarter of 2024, the company recorded record-breaking net revenue of $916 million, with a significant boost from crypto trading.

Meanwhile, the broader crypto industry is facing heightened regulatory scrutiny, with companies like Deribit exiting Russia due to EU sanctions and Tether potentially needing to sell Bitcoin to comply with new U.S. stablecoin regulations.

These developments signal a shifting regulatory landscape as authorities enforce stricter measures to protect investors and stabilize digital asset markets.

Also Read: Vietnam To Launch State-Licensed Digital Asset Exchange In March Amid Growing Crypto Regulations