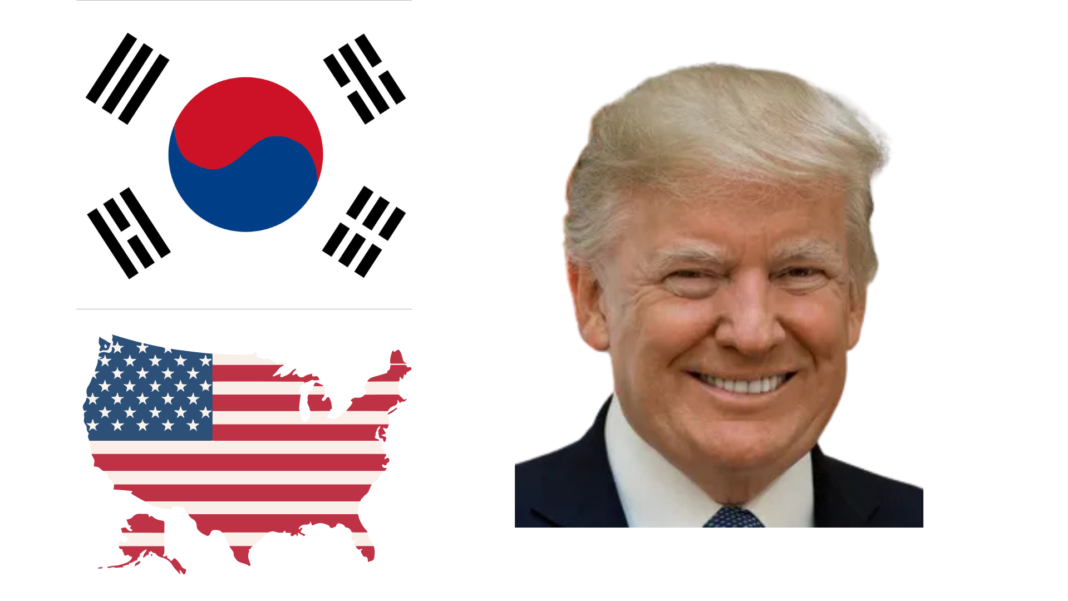

In response to the volatility stemming from the U.S. presidential election, the Financial Supervisory Service (FSS) of South Korea has decided to bolster its market surveillance efforts.

According to the FSS, Governor Lee Bok-hyun held a meeting to review the financial conditions related to the election results and the Federal Open Market Committee (FOMC) decisions.

Following this review, Lee has ordered the FSS staff to strengthen their monitoring of related Trump theme stocks and virtual assets, such as Bitcoin.

The regulators have vowed to take strict measures, with “zero tolerance,” when discovering any unfair trading practices, including the spread of rumors, insider trading, or price manipulation.

Expected Impact of U.S. Policy Changes

The FSS governor acknowledged that the changes in U.S.-China policy direction under the new administration are expected to have a significant impact on the South Korean market.

Director Lee stated that the agency must closely re-examine these potential impacts and prepare active response measures.

It is anticipated that the incoming Trump administration may impose tariffs, reduce or abolish subsidies for electric vehicles and solar power plants related to the Inflation Reduction Act (IRA), and decrease ESG investments.

Also Read: Trump-Backed ‘Bitcoin Act’ Could Allow US Govt to Purchase 1 Million BTC: CoinShares

Concerns Over Domestic Financial Stability

Despite the U.S. FOMC’s decision to lower the policy interest rate, the FSS believes that the uncertainty in the domestic financial situation remains high.

Director Lee emphasized the need to be alert to the possibility of unexpected situations arising in vulnerable sectors due to the accumulated high interest rates.

The regulator has expressed the importance of being prepared to respond quickly according to a contingency plan that assumes an emergency scenario.

Ongoing Monitoring and Readiness to Respond

The Financial Supervisory Service heightened market surveillance and preparedness to act swiftly in the face of potential volatility and unfair trading practices.

This demonstrates South Korea’s commitment to maintaining the stability and integrity of its financial markets.

As the U.S. political landscape continues to evolve, the FSS has pledged to closely monitor the situation and adapt its regulatory approach to mitigate any adverse impacts on the South Korean economy.