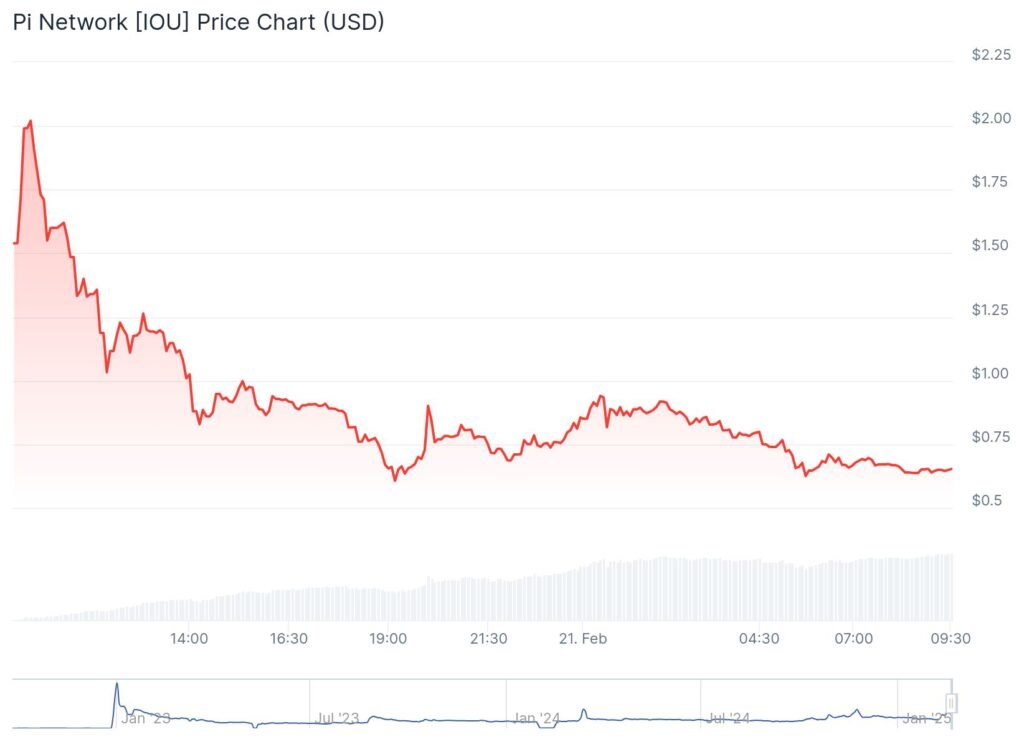

The highly anticipated Pi Network coin (PI) has suffered a severe market crash, plummeting 68.65% in just 24 hours.

The PI Network token reached its all-time high of $2.10 on February 20, 2025 after its listing, the token collapsed to $0.6578, leaving investors shocked by its rapid decline.

The sell-off was part of a broader seven-day downturn, during which Pi’s value fell by an astonishing 98.95%.

Despite recording a significant 24-hour trading volume of $29.8 million, the overwhelming selling pressure has raised concerns about Pi’s long-term stability.

Many investors who initially fueled the price surge are now questioning whether the coin has the potential to recover or if it was simply a short-lived speculative bubble.

Early Investors Cash Out, Fueling the Market Sell-Off

One of the main reasons behind Pi’s drastic price collapse is the mass sell-off by early adopters. Since its launch in 2019, Pi has been mined through a mobile-based system, allowing millions of users to accumulate tokens without any financial investment.

With the coin now tradable on exchanges, these early miners have rushed to liquidate their holdings, creating an excessive supply that outpaced demand.

Digital currency analyst Kim H Wong noted on X, “Trading in Pi is disappointing as pioneers keep selling and buy orders are small. No big capital is in sight.”

While this heavy selling pressure has caused a steep decline, Wong suggests that once early adopters deplete their holdings, prices may stabilize as new investors enter the market.

Also Read: GIGA Token Crashes 10% As Hacker Dumps $6M Worth In Massive Selloff

Binance Snub and Liquidity Issues Slow Pi’s Growth

Despite being listed on several exchanges, including OKX, Gate.io, and Bitget, Pi Network has yet to secure a listing on Binance, the world’s largest cryptocurrency exchange.

The absence has significantly impacted Pi’s liquidity and overall investor confidence. Binance’s platform often acts as a major validator for emerging tokens, providing both credibility and market depth.

Recently, Binance engaged its followers on X, seeking opinions on Pi Network, fueling speculation about a potential listing.

However, without official confirmation, Pi remains at a disadvantage compared to more established cryptocurrencies.

Further adding to investor skepticism, Bybit CEO Ben Zhou labeled Pi Coin a scam, deterring institutional investors and raising questions about the project’s legitimacy.

Pi’s Future Remains Uncertain Amid Limited Utility and Industry Skepticism

While Pi Network boasts a massive user base, critics argue that the token lacks real-world utility, making its long-term viability uncertain.

Unlike Bitcoin and Ethereum, which support thriving decentralized applications (dApps) and financial ecosystems, Pi’s functionality remains underdeveloped.

The Pi Browser and Pi Wallet offer basic features, but there are few incentives for users to hold onto the token beyond speculation.

For Pi to secure its place in the crypto market, it must establish concrete use cases and expand its ecosystem.

Skepticism surrounding the project has only deepened with Ben Zhou’s remarks, in which he dismissed Pi as a “ridiculous” venture, citing his past negative experiences in forex trading.

Until Pi secures broader exchange support and proves its utility, its path to stability remains highly uncertain.

Other Crypto Market Crashes Highlight Industry Volatility

Pi Network’s crash is not an isolated incident, as other tokens have also suffered significant declines amid market instability.

Aiccelerate Token ($AICC) plummeted 24% despite the much-anticipated launch of its DAO, with a website outage raising concerns over its technical readiness.

Meanwhile, the infamous Squid Game token scam resurfaced, with a fraudulent token named “SQUID” leading to a devastating 99% crash.

Investors lost millions in a classic pump-and-dump scheme, emphasizing the ongoing risks in the cryptocurrency space.

These incidents serve as a stark reminder of the volatility and speculative nature of digital assets, reinforcing the need for strong fundamentals and due diligence before investing.

Also Read: Memecoins Tied to Trump See Huge Crash Of Over 60% As Hype Around the Victory Fades