Peter Schiff, a renowned economist and well-known Bitcoin critic, has once again stirred the cryptocurrency community with his latest comments directed at Michael Saylor, the CEO of MicroStrategy Inc.

Schiff took to social media platform X (formerly Twitter) to sarcastically suggest that Saylor should have MicroStrategy borrow an additional $4.3 billion to purchase Bitcoin that the U.S. government is preparing to sell.

This recommendation comes in light of the government’s decision to liquidate 69,370 BTC seized from the dark web marketplace Silk Road. Schiff’s tweet, while clearly intended as a jab at MicroStrategy’s Bitcoin-heavy strategy, has reignited discussions about corporate Bitcoin holdings and government cryptocurrency sales.

The U.S. Government’s Silk Road Bitcoin Sale

The Supreme Court’s decision to decline hearing a case challenging the government’s ownership of the seized funds has paved the way for the potential sale of Silk Road’s 69,370 BTC, valued at approximately $4.3 billion at current market prices.

This move by the government represents a substantial liquidation of cryptocurrency assets and has caught the attention of both supporters and critics of Bitcoin. The sale could potentially have implications for the broader cryptocurrency market, depending on how and when the government chooses to execute the sale.

Schiff’s Criticism and MicroStrategy’s Strategy

Although clearly sarcastic, Schiff’s suggestion holds true to the message that he has constantly been conveying about how MicroStrategy and Saylor’s approach to investing in Bitcoin is simply a failed effort. He’s previously criticized the practice of companies listing Bitcoin on their balance sheets, as a means of referring to it as gambling with shareholders’ funds.

Schiff has also questioned the ‘never sell your Bitcoin’ strategy advocated by Saylor, which has gained traction even in political circles, with presidential hopeful Donald Trump endorsing similar views on the campaign trail. Despite Schiff’s criticisms, it’s worth noting that MicroStrategy’s “Bitcoin strategy playbook” has been remarkably successful in financial terms. The company’s stock has surged by an impressive 1208% since August 2020, significantly outperforming Bitcoin itself, which rose by 445% in the same period.

Market Impact and Current Bitcoin Price

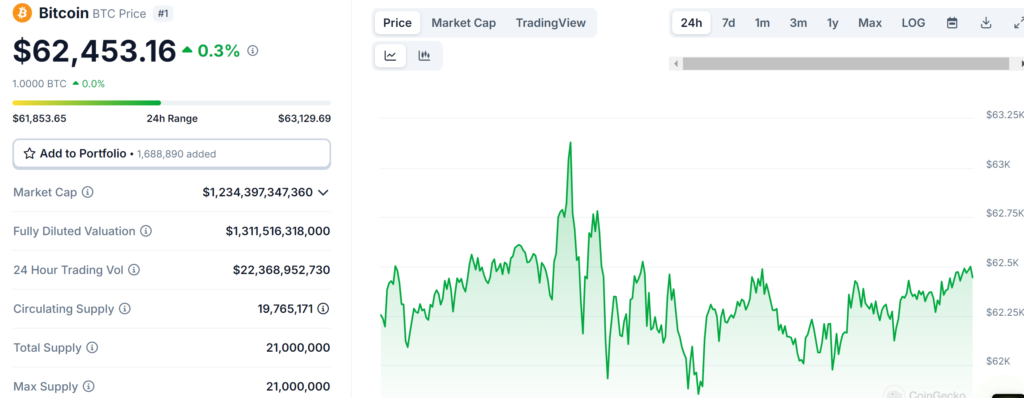

The news of the potential government sale and the ensuing debate have occurred against the backdrop of ongoing market fluctuations. As of the time of reporting, the Bitcoin (BTC) price stands at $62,453.16, with a 24-hour trading volume of $22,368,952,730. This represents a modest 0.31% price increase in the last 24 hours and a more substantial 1.54% price increase over the past 7 days.

With a circulating supply of 20 Million BTC, Bitcoin’s current market capitalization is valued at $1,234,397,347,360. These figures underscore the significant financial implications of the government’s planned sale and provide context for the ongoing debate between Bitcoin critics like Schiff and proponents like Saylor.

As the situation develops, market participants will be closely watching for any signs of how the potential government sale might impact Bitcoin’s price and overall market dynamics.