On 13th August, The Non-fungible Token (NFT) space has reached a total market capitalization of $9.3 billion, showing a jaw-dropping 40% increase from the $6.6 billion seen in July days ago.

The significant rise has coincided with a price rally in Ethereum, with many top NFT collections being built on the Ethereum blockchain.

Data from NFT Price Floor confirmed the milestone’s confirmation, while the figures from DappRadar reinforced the jump’s magnitude.

With the rally of Ethereum towards $4,700, another catalyst was born, whereby the value of NFTs, often priced in ETH, rose along the bullish momentum of the cryptocurrency.

Ethereum Rally Gives Impressive Boost for NFT Prices

At reporting time, Ethereum (ETH) was trading at $4,698.12, 9.55% higher over the last 24 hours and 27.19% higher over the previous week.

The circulating supply is 120 million ETH, and the market capitalization exceeds $557 billion.

The strong rally has infused life into NFT prices in general, especially those on Ethereum.

Since NFTs are usually valued in ETH, the appreciation in Ethereum’s value also results in a higher USD value for the digital tokens by default.

Surprisingly, all the top 10 largest collections by market cap of NFTs are constructed on the Ethereum blockchain, pointing toward the platform’s dominance of the NFT world.

Also Read: NFT Sales Jump 47.6% To $574M In July, Despite Several NFT Platforms Shutting Down

CryptoPunks Remains at Number One, BAYC and Pudgy Penguins Follow

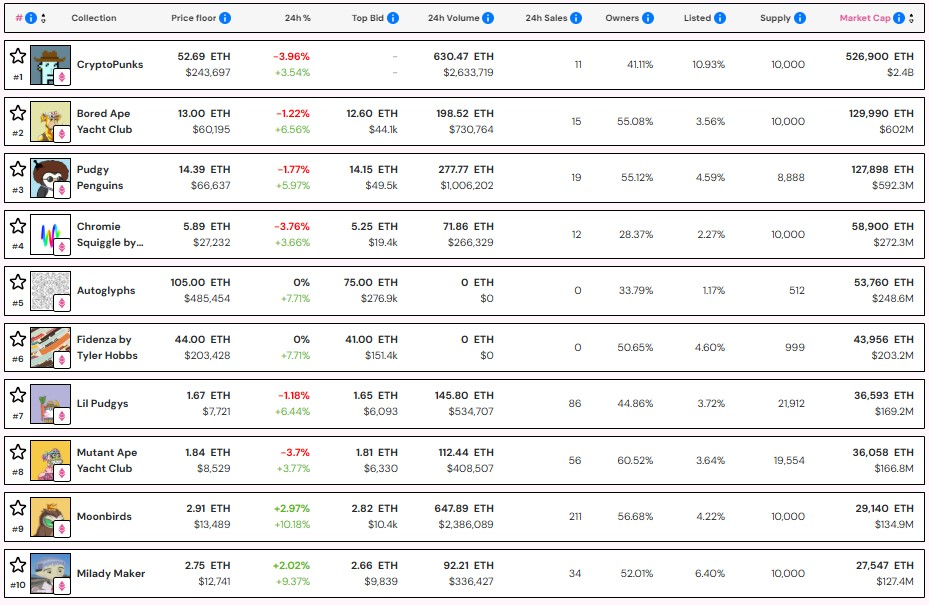

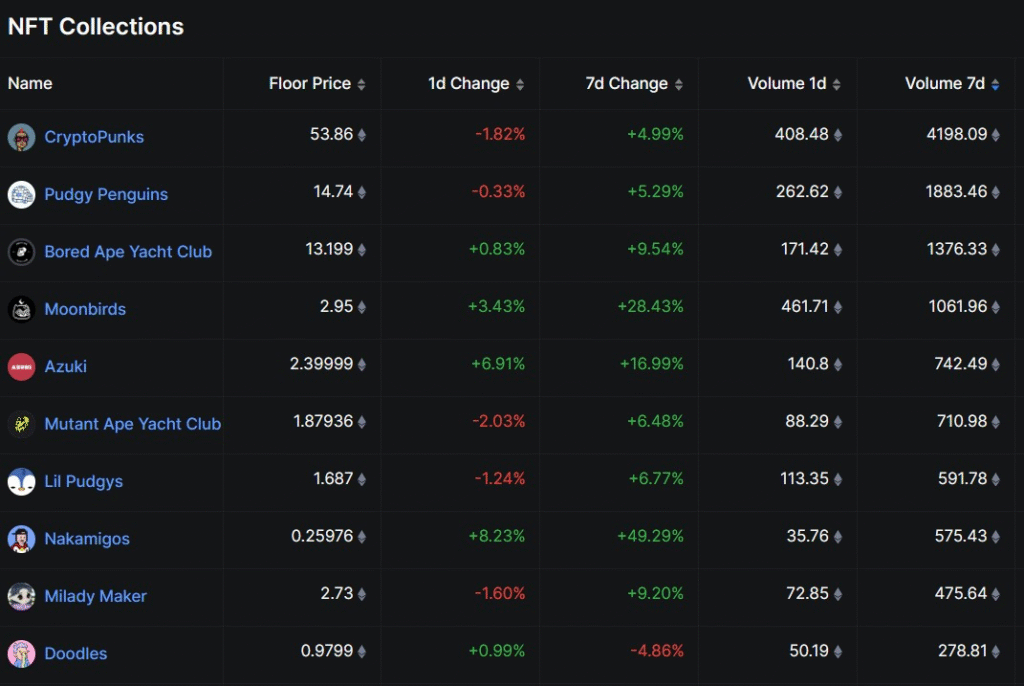

CryptoPunks is still the market capitalization leading NFT collection with an approximate value of 526,900 ETH, or approximately $2.4 billion.

Within the week, around 4,200 ETH worth of trading happened in this collection, amounting to nearly $20 million from 90 sales.

That comes out to an average selling price of around $217,331 per NFT. Bored Ape Yacht Club, on the other hand, stood second with a valuation of $602 million, closely followed by Pudgy Penguins at $591 million.

Pudgy Penguins has, however, been better off on weekly trading volumes at $8.7 million versus BAYC’s $6.3 million, even though it is second in market cap.

Also Read: Snoop Dogg Sells 996K NFTs On Telegram In 30 Minutes, Earning $12M

Pudgy Penguins’ Rise and Physical Brand Expansion

The Pudgy Penguins series has seen remarkable growth since coming close to bankruptcy in 2022.

Luca Netz, credited the brand’s resurgence with expanding into real-world toys, and this has placed the series on the radar as one of the leading players in the NFT sector.

Earlier in the week, blockchain firm BTCS Inc. acquired three Pudgy Penguins NFTs to include in its corporate treasury, further proving it is a top-most sought-after asset.

Their excellence has leveled them with long-established blue-chip sets, demonstrating that brand diversification into the real world can be a powerful catalyst for NFT growth.

Also Read: Solana Based Protocol Solsniper Shuts NFT Marketplace, Returns User Assets By June 14

Other Notable NFT Collections in the Top 10

Apart from the gigantic trio, the rest of the top 10 in the world of NFTs will include Art Block’s Snowfro Chromie Squiggle, Autoglyphs, Tyler Hobbs’s Fidenza, Lil Pudgys, Mutant Ape Yacht Club, Moonbirds, and Milady Maker.

Now, similar to their larger brethren, these collections have also received the updrafts from Ethereum rallies and renewed interest in NFTs.

Together, these do present a diverse selection of art styles, models of community engagement, and cultural influence in the digital assets realm.

With Ethereum becoming bullish once more, the NFT market may find additional room to expand further in the coming weeks, courtesy of speculative activities and growing mainstream acceptance.

Also Read: Hashling NFT Investors Sue Founder Over Millions In Misappropriated Funds