In a notable market development, cryptocurrency lending platform Nexo has executed a massive transfer of Ethereum (ETH) to Binance earlier today, totaling 109,251 ETH with an approximate value of $405 million.

The transfer was conducted in two distinct phases: an initial movement of 101,756 ETH (valued at approximately $380 million) at an average price of $3,737, followed by a subsequent transfer of 7,495 ETH (worth about $25 million) just hours later.

The substantial movement of assets to one of the world’s largest cryptocurrency exchanges has drawn significant attention from market participants and analysts, as such transfers often signal potential selling pressure.

Also Read: Ethereum Attracts $51M Inflows, While Solana Faces $8.7M Outflows, CoinShares Reports

Current Market Status and Price Analysis

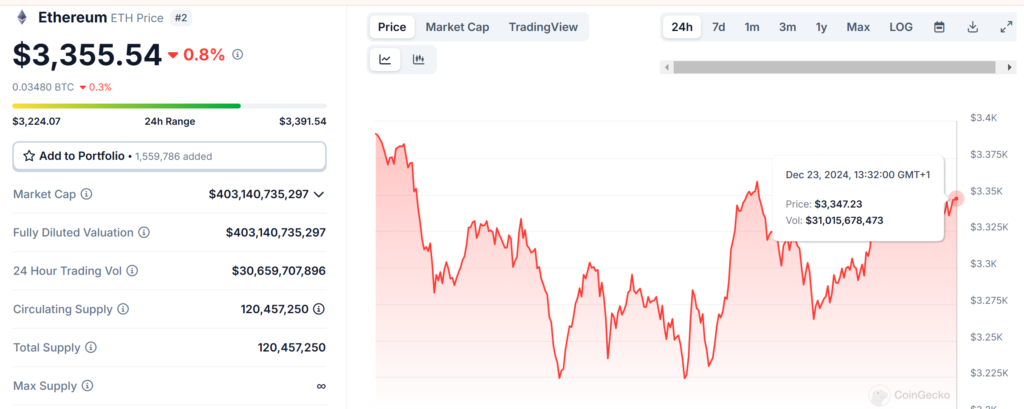

Ethereum’s current market performance presents a mixed picture. While the cryptocurrency showed resilience by gaining 1.6% on Monday, trading at $3,332, it has experienced significant pressure over the past week with a 15.3% decline.

The current price of $3,355.54 comes with a substantial 24-hour trading volume of $30,659,707,896, indicating active market participation.

Ethereum’s market capitalization stands at $403,140,735,297, supported by a circulating supply of 120 Million ETH.

Despite recent volatility, the maintenance of support above $3,300, a crucial level over the past month, suggests potential stability.

Will Ethereum Dump?

Ethereum’s price movements have shown strong correlation with Bitcoin, demonstrated by a correlation coefficient of 0.75.

The relationship has been particularly evident in recent weeks, with Ethereum’s performance closely mirroring Bitcoin’s descent from its all-time high of $108,364.

Beyond the direct price impact, Ethereum’s broader ecosystem has experienced challenges, with both DeFi protocols and decentralized applications showing decreased performance metrics.

The recent market dynamics have created a complex environment where both macro factors and ecosystem-specific elements are influencing price action.

Market Implications and Future Outlook

The significant transfer by Nexo has raised concerns about potential market implications, particularly regarding selling pressure.

Large institutional movements of this magnitude typically warrant close market observation, as they can precede significant price adjustments.

The current market metrics show a -0.75% price decline in the last 24 hours and a more substantial -14.31% decrease over the past week, indicating ongoing market pressure.

Market participants are advised to maintain vigilance, as the combination of Nexo’s large transfer and current market conditions could lead to increased volatility.

Trading volumes and market sentiment will be crucial indicators to monitor in the coming period as the market processes this substantial transfer of assets.

Also Read: Ethereum Gas Reform Gets 10% Validator Backing, Transaction Fees Set To Drop 33%