Nearly $5 million was lost from Hyperliquid’s Hyperliquidity Provider (HLP) vault as a consequence of a concerted attack against the decentralised derivatives platform. Lookonchain reported that the loss resulted from an unidentified trader purposefully giving up $3 million in order to control the POPCAT market and set off a series of liquidations.

Details of the attack

The sequence started on Thursday, according to Lookonchain, when the attacker took out $3 million USDC from the OKX exchange and dispersed it across 19 new wallets.

The trader then used the money on Hyperliquid to establish leveraged long bets worth over $26 million linked to HYPE, the protocol’s perpetual contract denominated in POPCAT.

By building a $20 million purchase wall close to the $0.21 line, the attacker created the appearance of enormous demand, which momentarily sent the price higher.

Price support vanished, liquidity dried up, and scores of overleveraged positions were immediately liquidated as the wall abruptly vanished.

Hyperliquid takes the hit

The repercussions were absorbed by Hyperliquid’s vault, which recorded a $4.9 million deficit, making it one of the worst single-event losses in its history.

Paradoxically, the manipulator completely wiped his own $3 million stake. According to analysts, this suggests that the incident was a purposeful stress test on Hyperliquid’s liquidity architecture, with a motivation of structural disruption rather than financial gain.

This tactic seemed to be intended to reveal systemic flaws in automated liquidity provider vaults, in contrast to traditional market manipulations intended for financial gain.

Reactions from the community varied from incredulity to dark humour. One observer compared it to “performance art with real money,” while another referred to it as the “costliest research ever.”

Others referred to the incident as “peak degen warfare,” highlighting the dangers of running eternal markets in the absence of robust liquidity buffers. One user commented on X, “Perp markets are open season for anyone willing to light money on fire.”

Community member Conor said that Hyperliquid momentarily halted withdrawals in reaction to the chaos, claiming the platform’s “vote emergency lock” feature as a preventative measure to stop more manipulation.

Not the first attack

A cryptocurrency trader lost almost $21 million from his wallet on Hyperliquid only last month due to a private key breach. The attacker transferred the money to Ethereum after a recent heist on the Hyperliquid platform.

The hacker crossed 17.75 million DAI and 3.11 million MSYRUPUSDP into Ethereum before transferring them further.

POPCAT price actions

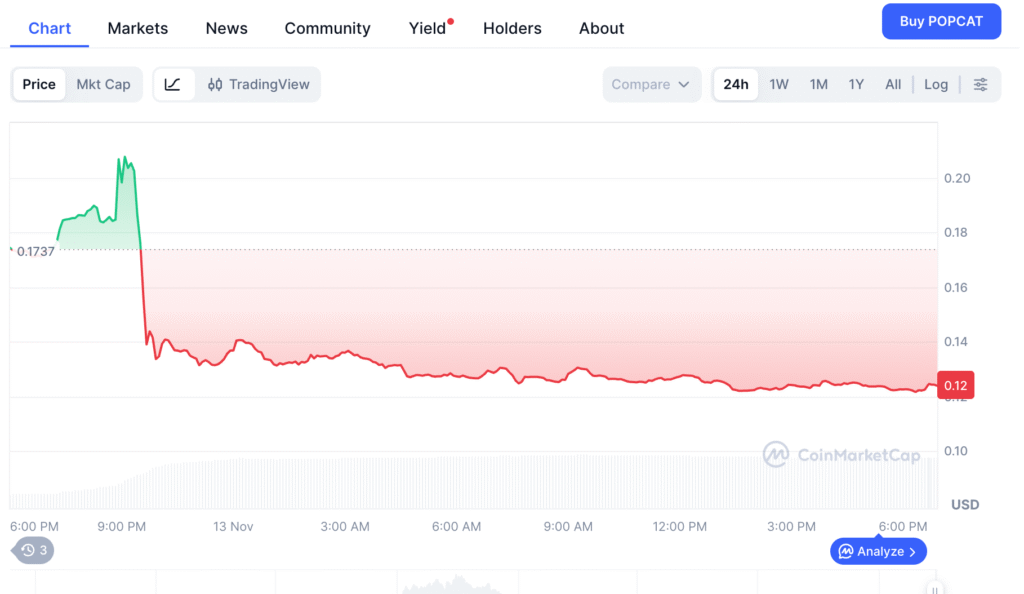

POPCAT memecoin have taken the hit due to this attack. The coin is down almost 33% in the last 24 hours, and is trading at $0.1224.

The global market cap is at $119.99 million while the 24-hour trading volume is up by a whopping 189%.

The instance demonstrates how a single breach may cause tremendous damage. It also illustrates how rapidly attackers shift cash across chains to hinder recovery.

Also Read: Bitwise Files For Spot Hyperliquid ETF As Crypto Perpetual DEX Platforms Volumes Reach Record Highs