The United States Securities and Exchange Commission (SEC) has approved two spot Ethereum exchange-traded funds (ETFs) for listing on the New York Stock Exchange’s (NYSE) Arca electronic trading platform, according to a filing on July 17. The approved ETFs are the Grayscale Ethereum Mini Trust and ProShares Ethereum ETF.

“Grayscale is excited to share that the SEC has approved Grayscale Ethereum Mini Trust’s (proposed ticker: ETH) Form 19b-4,” a Grayscale spokesperson stated. “The Grayscale team continues to engage constructively with SEC staff as we seek full regulatory approval for US spot Ethereum ETPs.”

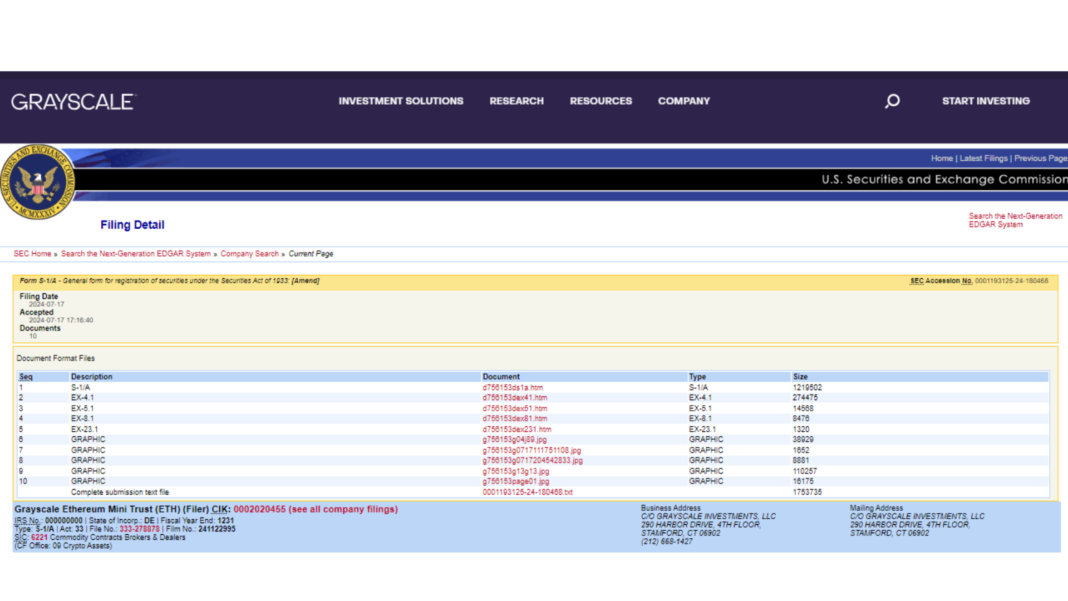

Document:https://www.sec.gov/Archives/edgar/data/2020455/000119312524180468/0001193125-24-180468-index.htm

A First Green Light for SEC on the Ethereum ETF

Grayscale’s initial proposal was to convert its longstanding Grayscale Ethereum Trust into a spot Ethereum ETF. This fund operates like a closed-end fund, where redeeming shares is more challenging.

Grayscale then filed for its mini trust, seeded with assets backing the larger ETF. Bloomberg Intelligence ETF analyst James Seyffart noted on Twitter that the mini fund “should help alleviate some of the likely Grayscale outflows” expected from the conversion of the larger fund.

Bloomberg reported, that in addition to Grayscale and ProShares, other major issuers including BlackRock, Fidelity, Invesco, and Bitwise have submitted paperwork with the SEC, outlining the fees for their respective Ether ETFs.

BlackRock announced it would charge 0.25% for its product, with a fee waiver for the first 12 months or until $2.5 billion in assets is gathered. Similarly, Fidelity plans to charge 0.25%, also waiving the fee through the end of the year.

The proposed fees for these ETFs range from as low as 0.19%, as suggested by Franklin, to as high as 2.5% for Grayscale, which plans to convert an existing fund into an Ether ETF and potentially debut another version with a lower expense ratio.

A Significant Milestone for the Cryptocurrency Industry

This approval marks an important milestone for the cryptocurrency market, imparting buyers with new avenues for Ethereum exposure and probably growing the mainstream adoption of digital currencies. As those ETFs begin buying and selling, the market will intently watch their overall performance and the effect on Ethereum’s price dynamics.

This development could pave the way for more crypto-based financial products in the future, further integrating digital assets into traditional financial markets.

Also read:

ETH ETFs Approval Can Make It Outperform Bitcoin, Says Koiko