Grayscale has officially launched its new fund, the Horizen Trust, providing qualified investors with the opportunity to gain exposure to the cryptocurrency ZEN without the need to directly purchase, store, or safeguard the digital asset.

This new product aims to offer a more accessible and secure way for investors to gain exposure to ZEN, the native cryptocurrency of the Horizen Network, a decentralized blockchain that operates on cryptographic protocols.

What is the Grayscale Horizen Trust?

The Grayscale Horizen Trust is described as one of the first securities solely invested in and deriving value from the price of ZEN.

As Grayscale notes, this allows investors to access ZEN in the form of security, effectively bypassing the complexities involved in directly managing and storing the cryptocurrency.

ZEN operates on the Horizen Network, a peer-to-peer decentralized platform that enables the exchange of tokens of the value recorded on a public blockchain. The Horizen Network is known for its scalability and privacy features, providing a secure and transparent way for users to interact with the blockchain.

ZEN, as a digital asset, is created and transmitted through the operations of this network, which further strengthens its utility as an emerging digital currency.

The Hurdles on the Way

Despite the potential appeal of the Horizen Trust, reports indicate that the product has not yet reached its investment target. Shares of the Trust have been trading on the OTC Market Group, but the market price of these shares has not consistently reflected the underlying value of the ZEN held by the product.

Also Read: Grayscale Considers Dogecoin In Top 35 Investment Products, Price Jump By 3.50%

In some cases, the shares have traded at a premium or a discount to the value of the underlying asset, with fluctuations sometimes being significant. This volatility could present challenges for investors looking for stable returns.

Grayscale and Crypto Assets

Grayscale is no stranger to launching innovative investment products. The firm, which is well-known for its Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust ETF (ETHE), has been a key player in providing exposure to cryptocurrencies through traditional investment vehicles. The firm’s GBTC was one of the 11 Bitcoin spot ETFs launched in January 2024, followed by the ETHE fund.

Grayscale has been a significant force in the cryptocurrency investment landscape, creating accessible and regulated products for institutional and retail investors alike.

Recently, Grayscale submitted a new request to the U.S. SEC to launch a Solana spot ETF, further expanding its portfolio of cryptocurrency-related exchange-traded funds.

As the market for crypto ETFs continues to grow, Grayscale’s new Horizen Trust represents the firm’s continued effort to offer innovative products in the evolving digital asset space.

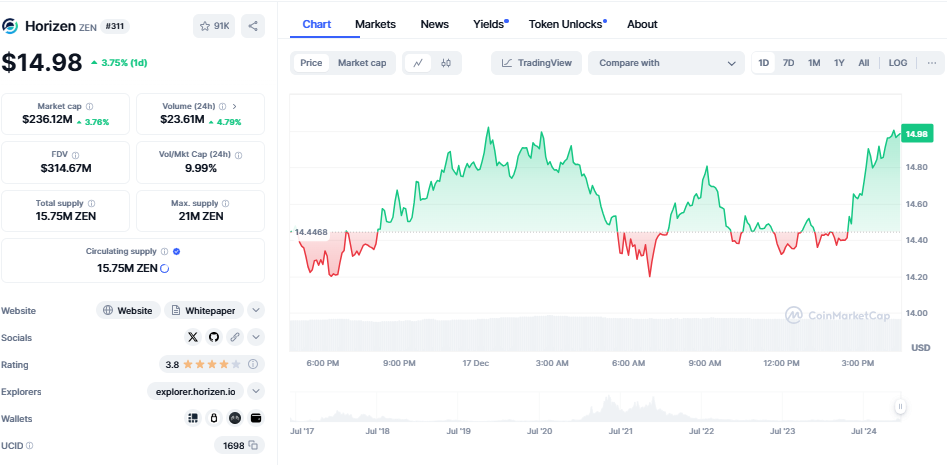

ZEN’s Price Actions

Currently, ZEN is trading at $14.82, up by more than 2% in the last 24 hours. The global market capitalization of ZEN stands at approximately $233.62 million, with the 24-hour trading volume seeing a 6.38% increase. These figures suggest that ZEN is seeing healthy market activity, although its future price fluctuations remain uncertain given the product’s volatility.

The launch of Grayscale Horizen Trust provides a new avenue for qualified investors to gain exposure to ZEN, but market volatility and fluctuations in the Trust’s share price may present challenges.

As the cryptocurrency market continues to evolve, it will be interesting to see how Grayscale’s new product performs in comparison to its other successful funds.

Also Read: Grayscale Digital Large Cap Fund Eyes Crypto ETF Market With 77% Bitcoin Holdings