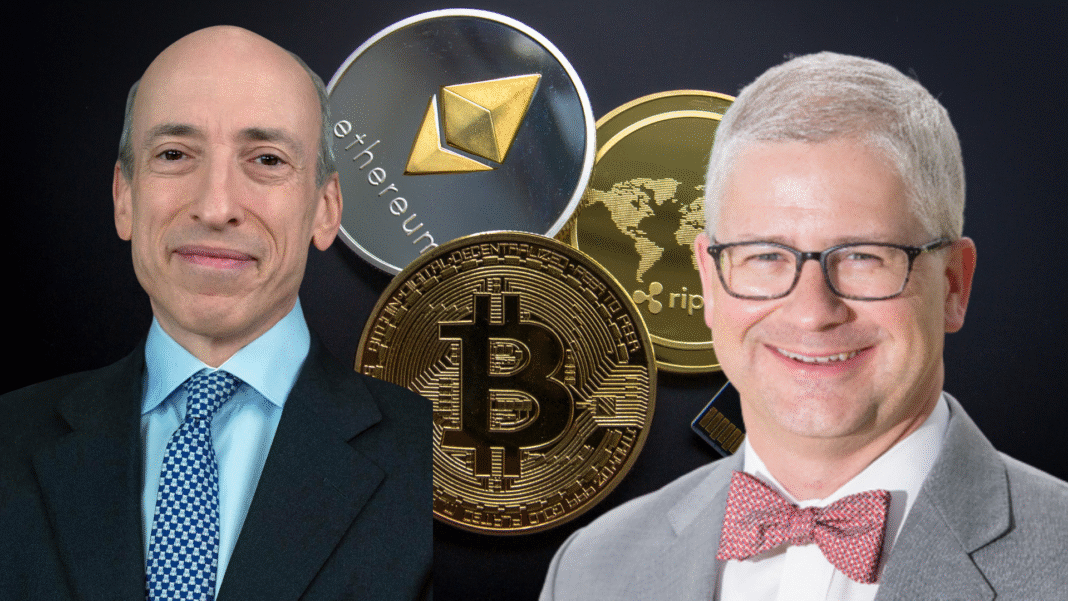

Former SEC Chair Gary Gensler may not have been as hostile to cryptocurrencies behind closed doors as he seemed in public, former US Representative Patrick McHenry revealed on the Crypto in America podcast.

McHenry said private talks at MIT showed Gensler understood digital assets and blockchain, but his tone changed once he took the SEC top job, likely driven by politics and the need for Senate approval.

Inside Private Meetings

McHenry recalled meeting Gensler at the Massachusetts Institute of Technology, where Gensler had taught and helped shape key ideas like the airdrop.

In those sessions, he praised aspects of digital tokens and recognised the promise of blockchain to improve transparency in finance. McHenry described these early chats as clear and upbeat, with Gensler open to new ideas.

Shift in Public Stance

Once Gensler became SEC chair, McHenry said, everything felt different. He admitted he had been wrong to expect a moderate approach.

According to McHenry, Gensler’s tone grew tough and resistant whenever crypto issues came up in public statements. What started as friendly discussions in academic settings turned into sharp warnings about risks and the need for strict rules.

Confusing Regulatory Talks

McHenry said he often found himself puzzled by Gensler’s logic on crypto rules. In meetings, Gensler might agree that certain digital tokens did not fit existing definitions of securities.

Also Read: Bitwise CIO Predicts $500B Stablecoin Market After Gensler’s Exit

Minutes later, he would reverse and insist that the tokens needed tight oversight. This flip-flop left industry leaders unsure where they stood and how to shape their projects to meet SEC requirements.

Political Pressures

McHenry suggested much of Gensler’s hard line was a result of Washington politics. During confirmation hearings, senators of both parties pushed for strong action after high-profile collapses in the crypto world.

McHenry believes Gensler chose a more combative public voice to satisfy critics on Capitol Hill rather than sticking to the balanced view he once held in private.

Return to Academia

In January, Gensler left the SEC and rejoined MIT’s Sloan School of Management as a Professor of Practice in the Global Economics and Management Group and the Finance Group.

This move brought him back to a setting where he could speak freely about blockchain and digital finance without the weight of regulatory office.

Gensler’s tough public stance has not gone unchallenged. Gemini co-founder Tyler Winklevoss responded by banning the hiring of MIT graduates. Winklevoss said institutions that fuel regulation against crypto should not benefit from the talent they train.

This dramatic step underscores the deep rift Gensler’s policies created within the digital asset community.

As Gensler settles back into academia, the debate over fair and clear crypto rules continues. Regulators in other countries watch the US experience closely. Industry players hope for guidance that balances innovation with investor safety.

Also Read: Winklevoss Brother Calls Gary Gensler Evil Amid Stern Attack, Here’s Why