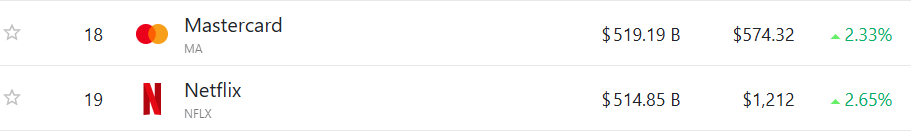

Ethereum’s market capitalisation has reached a new high, at one point surpassing the valuations of global corporations such as Mastercard and Netflix.

The cryptocurrency’s cap touched $519.27 billion, edging above Mastercard’s $519.19 billion and Netflix’s $514.85 billion before easing slightly below Mastercard. Even with that dip, Ethereum still holds a larger market value than Netflix. The rapid rise took place over a 7-day stretch that saw Ethereum grow by 26.02%.

ETH’s Price Actions

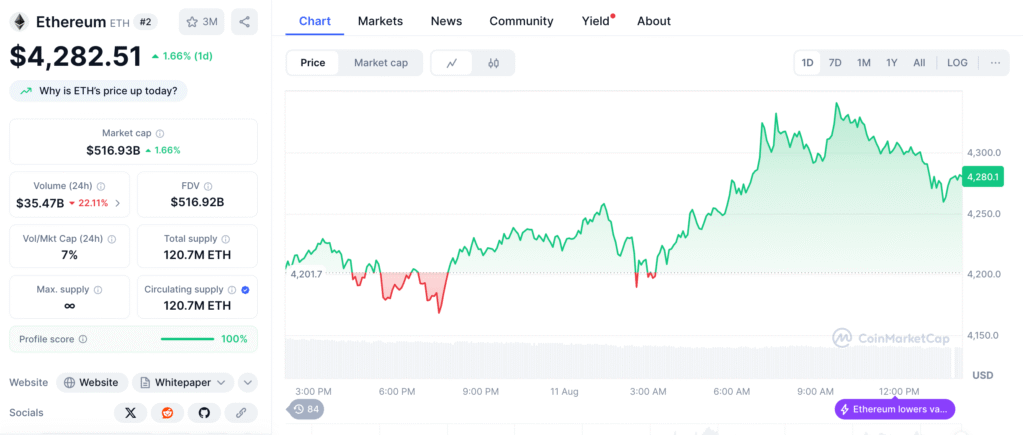

The rally has been fueled by a strong upswing in price, and as of late July and early August 2025, Ethereum climbed above $4,300, reaching levels not seen in years.

At present, ETH is trading at $4,280.22, up by 1.72% in the last 24 hours. Its 24-hour trading volume is lower, down 21.67%, suggesting some traders may be taking profits or stepping back after the strong move.

How is Ethereum’s value measured?

Unlike traditional companies, Ethereum’s value does not stem from its market profit or brand recognition. Rather, it derives from its ecosystem’s infrastructure. It facilitates DeFi platforms, smart contracts, and supports a considerably growing NFT market.

These uses give Ethereum a different growth compared to traditional stocks, and its expanding network activity has been key to the market cap increase.

Growing investor confidence

Market analysts attribute the spike to a change in investor attitude towards digital assets. Ethereum’s market capitalisation has now surpassed well-known multinational companies.

Also Read: Are ETH Treasuries Good? Ethereum Co-Founder Vitalik Says Yes, With A Stark Warning

This shift is interpreted as confidence in Ethereum and growing endorsement from retail and institutional investors. It has been bullish for Ethereum’s proponents, seeing it as validation that blockchain tools and infrastructure can rival leading companies in finance and entertainment.

Analysts point to bullish chart patterns

Technical analysts are also weighing in on the rally. Lord Hawkins noted that Ethereum is moving out of a Wyckoff Accumulation pattern. He says this stage, called a “Sign of Strength” zone, often precedes a small pullback before a larger uptrend.

If that pattern plays out, ETH could enter what traders call a markup phase, with prices potentially heading toward $6,000.

Another analyst, Titan of Crypto, describes Ethereum as “extremely bullish,” highlighting its breakout from a multi-year symmetrical triangle pattern. Analyst Crypto Rover added that the triangle’s size points to a target near $8,000 if momentum holds.

Meanwhile, Nilesh Verma sees similarities with rallies in 2017 and 2020, both of which followed retests of major support levels. Verma has set a minimum target of $10,000, with a bullish scenario between $16,000 and $20,000 within the next 6 to 8 months.

What comes next?

If these predictions become correct, Ethereum could continue rising into new highs, probably setting new records before the year’s end.

Traders will be watching whether the current move can sustain itself without a deep correction.

Also Read: Turkish Authorities Detain Ethereum Developer Over Allegations Of “Ethereum Misuse”