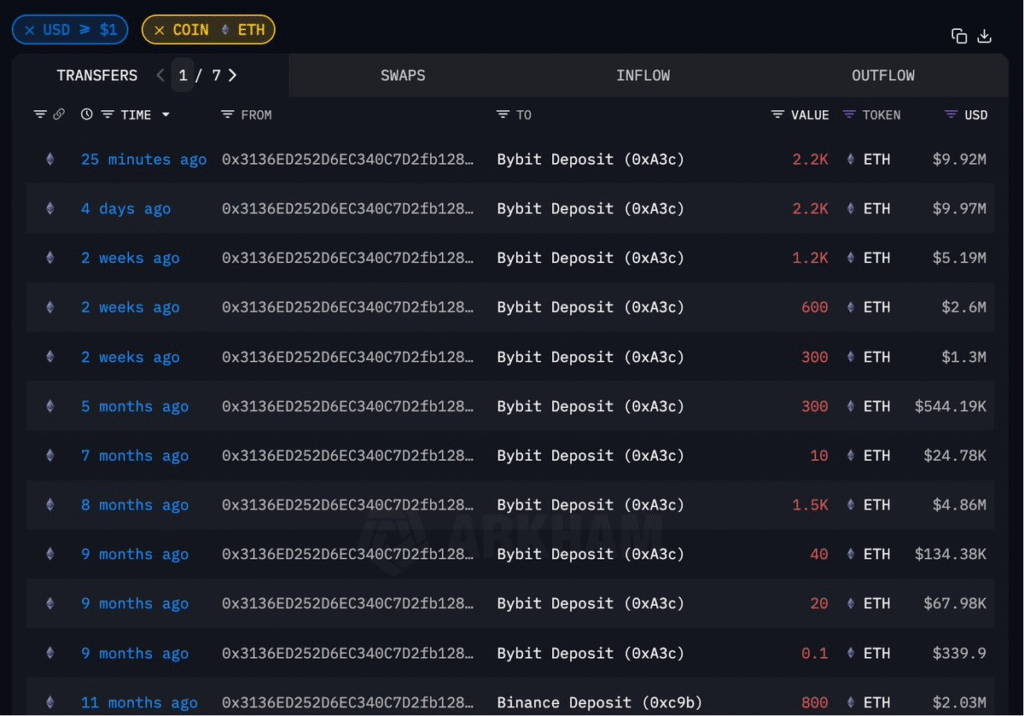

In a recent development, on-chain data has shown that a long-term Ethereum (ETH) holder often referred to as an “OG whale” has transferred 2,200 ETH to the Bybit exchange in the last hour.

The transfer is worth approximately $9.92 million at current prices and is suspected of being a move in advance of a sell.

If the whale does sell these assets, based on yesterday’s purchase price, the transaction would have generated a profit of approximately $9.5 million for the whale.

Whale’s Early Accumulation and Returns Since 2017

This wallet was first active in 2017, during which time it received ETH between May 2017 and February 2020.

During that time, the address purchased 16,830.64 ETH at an average of $181.35 per token. This advantageous entry point placed the whale in a compelling position when the Ethereum price increased in the years afterward.

At present price levels, the address is now more than 21 times its original investment, demonstrating how dramatically wealth can be created for early users in cryptocurrency.

Also Read: Whale Transitions From Short To Long On GMX Exchange, Securing $177K Profit In ETH

Exchanges Deposits Indicate Continued Realizations

The “OG whale” has already made a 2024 deposit of 8,310 ETH across various exchanges within this year. These deposits are estimated to cost $41.4 million, based on $4,140 per ETH deposit.

Those sales have produced a cumulative profit of almost $32.9 million to the whale this year, which means that so far, this whale is experiencing a phenomenal return rate of 21.82x their original investment.

If the most recent transfer of 2,200 ETH is sold, the wallet would lock in an additional $9.5 million in profits.

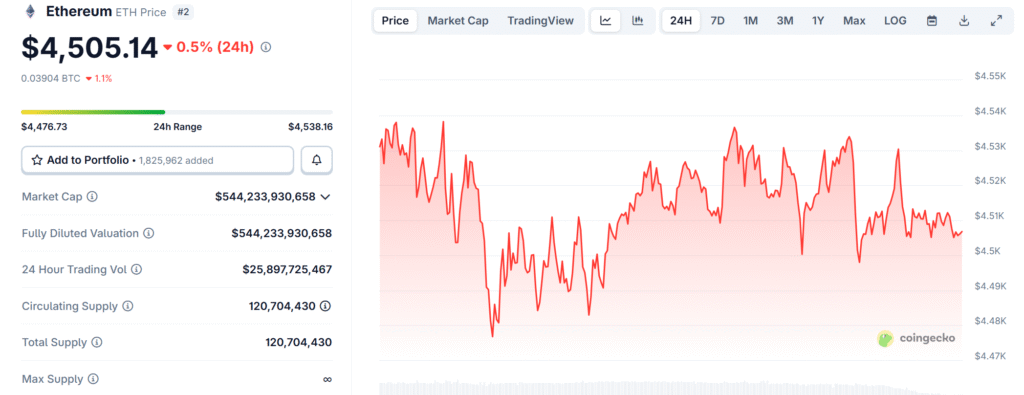

Ethereum Market Conditions During the Transfer

The activity of the whale comes as Ethereum’s price is slightly cooling down. Currently, ETH is trading at $4,498.09, reflecting a 0.84% decline over the last 24 hours.

Nonetheless, ETH still remains up weekly, with a +3.34% increase and is still seeing a strong 24-hour trading volume of nearly $25.9 billion.

With a circulating supply of 120 million ETH, Ethereum’s market capitalization sits at approximately $544 billion.

The activity indicates that whale movements such as this most recent one on Bybit can still impact market sentiment, as they potentially might have a psychological effect on short-term traders even when ETH seems to be stable.

Other ETH Whales Experience Contrasting Outcomes

Although the 2017 whale has experienced gains, not every Ethereum whale has had success at the same level.

A particular case is investor James Fickel, who liquidated 6,429 ETH for $21.45 million and used the funds to repay loans of WBTC, all while losing $68 million in one year due to a poor ETH/BTC exchange rate, UnoCrypto reported.

Early this year, we reported another Ethereum whale traded 12,178 ETH, gaining $267,000 on the first trade of the year and generating total earnings of $7.19 million.

These situations show both the ability for whales to potentially profit but also produce a variable level of risk for someone attempting a whale-level strategy.