Ethereum ($ETH) has seen a volatile trading session in the past couple of months, making many wonder how the token might perform in the future.

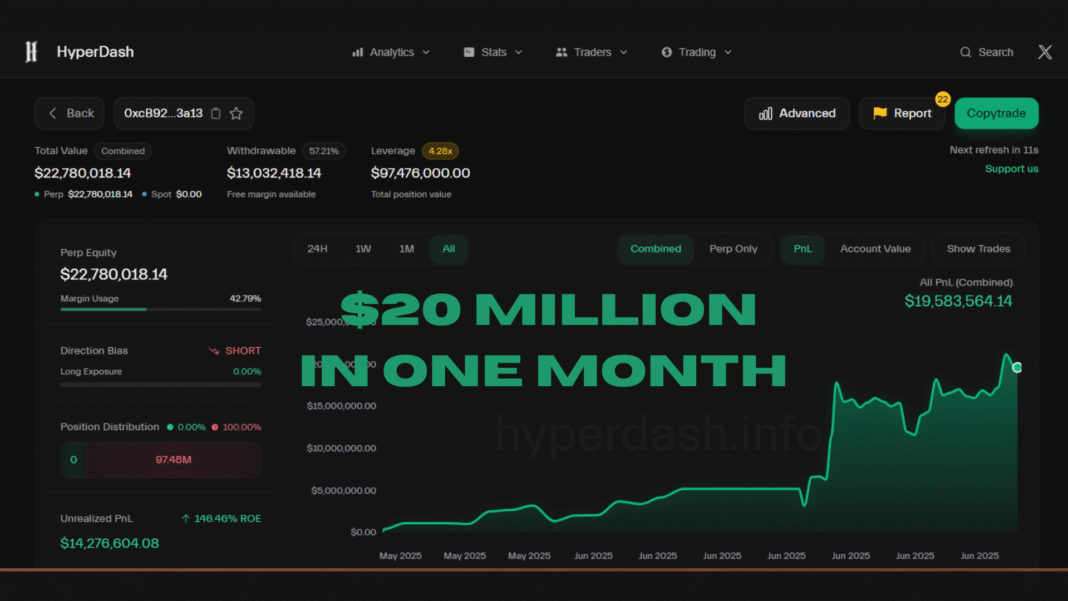

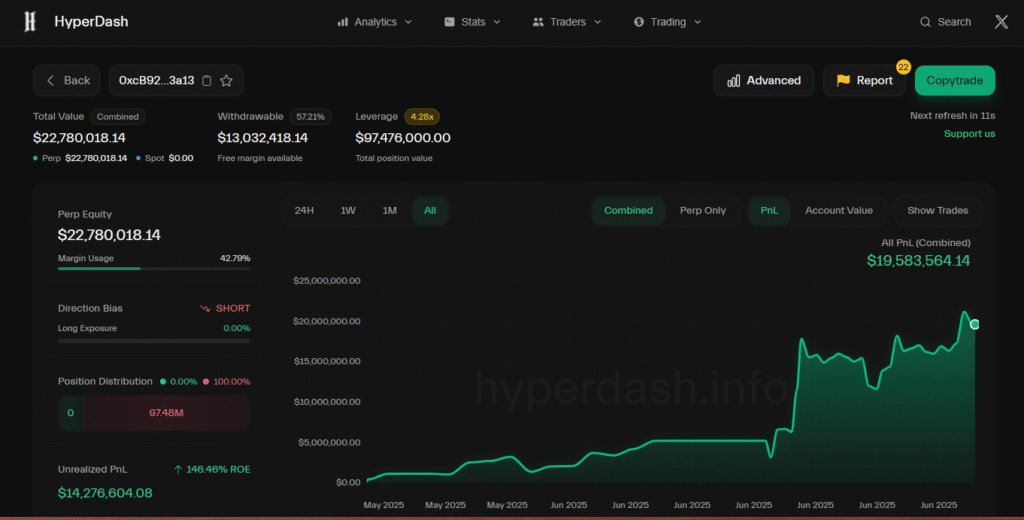

Despite this, a savvy Ethereum trader known by the wallet address 0xcB92, dubbed “Smart Trader,” has made waves with a series of near-perfect trades, earning over $20 million in less than a month, according to on-chain analytics platform Lookonchain.

The trader has consistently demonstrated exceptional market timing—going long on ETH near cycle bottoms, exiting positions just before significant price drops, and entering shorts at local tops.

Ethereum Trader Mints Heavy Amount

Lookonchain reports that as of yesterday, Smart Trader had over $12 million in unrealized profits, yet chose not to exit the position, signaling strong conviction in further downside.

Shortly afterward, Ethereum’s price dropped again, pushing his unrealized gains past $14.8 million.

This trader’s performance stands out not just for its profitability but also for its precision and discipline—traits rare even among top-tier institutional investors.

The wallet has quickly become a key address to monitor for ETH traders and on-chain analysts alike. As retail and professional traders look for market direction amid volatility, Smart Trader’s wallet has become a kind of sentiment barometer, offering insight into potential near-term moves.

While it’s unclear whether the trader is an individual, a team, or a fund using automated strategies, the results speak for themselves.

For those trading Ethereum, following 0xcB92’s moves could provide valuable context or even signals—though, as always, caution is advised.

Market timing this precise is extremely rare, and copying trades without understanding the underlying strategy carries significant risk. Nonetheless, this wallet’s track record is currently one of the best on-chain.

Ethereum Price Movement: What is Happening?

As of June 21, 2025, Ethereum is trading around $2,436.19, down 4.61%, entering a consolidation phase near key support levels.

Despite recent pullbacks, its longer-term trend remains bullish, supported by strong institutional inflows—over $1 billion in ETH ETFs this month alone.

Whales continue to accumulate, with one address buying nearly 49,000 ETH (around $127 million). On the technical side, Ethereum is showing neutral momentum with the RSI near 48, while a golden cross on the stochastic oscillator suggests potential upside.

Analysts believe a breakout above the $3,500 resistance could open doors to a $6,000+ rally later this year. However, risks remain: geopolitical tensions like the Israel-Iran conflict have triggered short-term volatility, and increased activity from long-term holders may signal profit-taking.

Ethereum’s price action in the coming weeks will likely depend on broader market sentiment and macroeconomic stability, but overall, the asset appears to be building a foundation for its next major move.

Also Read: Ethereum Foundation Adopts New Treasury Policy With 2.5-Year Expense Buffer & 15% Spending Cap