The digital asset market experienced a continuation of inflows last week, totalling $308 million. However, these inflows mask the larger picture, with significant outflows observed, particularly on December 19th, when a single day saw outflows of $576 million, CoinShares reported.

Digital Assets Outflows Reaches $1 Billion

Over the final two days of the week, the total outflows reached an alarming $1 billion. This can be mainly attributed to the fall of the market and the bears setting in. Especially after the U.S. Fed’s comments on no plans for Bitcoin Reserve have set the marker to the Fear zone. Hence resulting in the outflows.

Despite these short-term fluctuations, the impact on total assets under management (AuM) for Digital Asset Exchange-Traded Products (ETPs) appears minimal in the grand scheme of things, with the total reduction amounting to $17.7 billion.

The recent market corrections, driven by a hawkish dot plot released by the Federal Open Market Committee (FOMC) on December 20th, contributed to the volatility.

The market responded to the prospect of continued rate hikes, which is often perceived as a negative for riskier assets, including cryptocurrencies.

Also Read: Digital Asset Inflows Reach Record Levels Despite Low Trading Volumes

Despite the outflows in the final days of the week, they accounted for just 0.37% of total AuM, ranking as the 13th largest single-day outflow in the history of the digital asset market.

How did Bitcoin Perform?

While the overall picture includes a mix of inflows and outflows, Bitcoin remains resilient, continuing to see net inflows despite some fluctuations. For the week, Bitcoin investment products garnered $375 million in net inflows.

In contrast, multi-asset investment products saw the most dramatic flows last week, experiencing $121 million in outflows. This suggests that investors are becoming more cautious and selective, opting to invest in specific digital assets rather than broad-based investment products.

Many altcoins, however, continued to see positive inflows. XRP saw a notable $8.8 million in inflows, while Horizen and Polkadot experienced more modest inflows of $4.8 million and $1.9 million, respectively. These inflows into specific altcoins indicate that investors are looking for opportunities in individual projects rather than diversifying broadly.

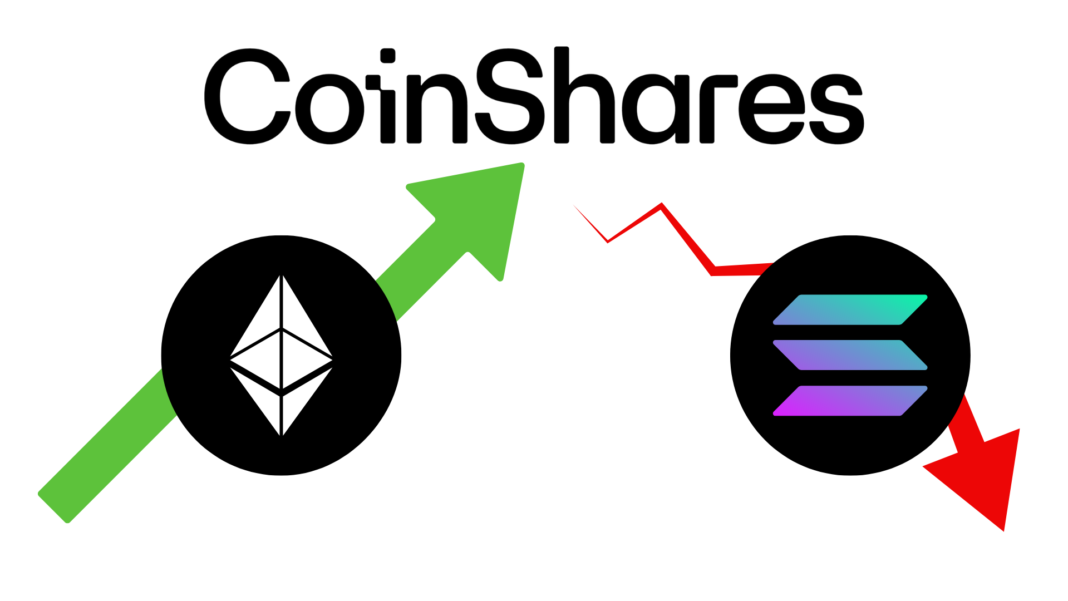

Ethereum Shines Out with $51 Million Inflows

Ethereum also attracted significant interest, with $51 million in inflows, continuing its trend of positive momentum. However, Solana, another popular altcoin, faced $8.7 million in outflows, suggesting a shift in investor preferences.

Solana’s outflows, coupled with Ethereum’s inflows, reflect the ongoing evolution of investor sentiment in the broader crypto market, where larger projects like Ethereum are drawing more attention compared to smaller or less developed ones like Solana.

Overall, while the digital asset market faced volatility and outflows last week, certain segments of the market, particularly Bitcoin and Ethereum, demonstrated resilience.

The selective inflows into altcoins such as XRP and Polkadot indicate that investors are carefully navigating the market, with a preference for assets with proven potential or strong market fundamentals.

Also Read: Crypto Investments See $147M Outflows As Canada Records Highest Inflows