A crypto trader has faced a staggering $10.39 million loss after their highly leveraged 50x Bitcoin (BTC) long position was forcibly liquidated on the HyperLiquid exchange.

The trader with the address 0xad01…eb5cbf had maintained the position for approximately 2.5 months before the sudden liquidation wiped out their investment.

The loss is among the most significant individual liquidations in recent weeks, emphasizing the risks of high-leverage trading.

In leveraged trading, even minor fluctuations in price can lead to margin calls and liquidations, leaving traders exposed to severe financial setbacks.

The whale’s total recorded losses have now reached $10.41 million, marking a cautionary tale for traders employing aggressive leverage strategies.

Additional Losses on HYPE and HFUN Tokens Deepen Financial Struggles

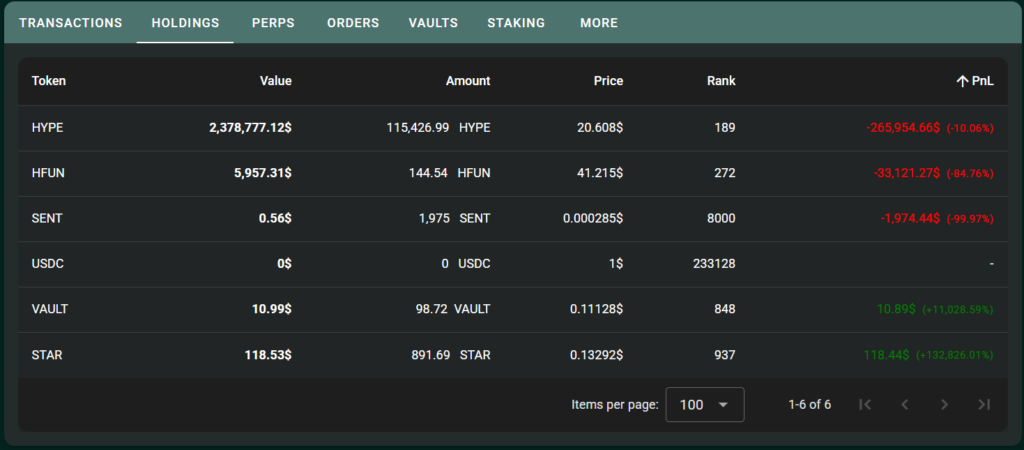

In addition to the BTC liquidation, the trader has suffered further losses on two altcoin investments—HYPE and HFUN tokens.

The whale currently holds 115,427 HYPE tokens, incurring an unrealized loss of $265,000, and 144.54 HFUN tokens, down by $33,000.

These positions remain open, meaning that further price declines could lead to even greater financial damage. This situation illustrates the compounding risk of trading in volatile assets, as losses in one area can spill over into other investments.

The trader’s exposure to both high-leverage BTC trading and speculative altcoin positions has placed them in a precarious financial situation, demonstrating the unpredictable nature of the crypto market.

Also Read: Massive Short Position on Hyperliquid Yields $44M in Unrealized Profits as Ethereum Price Plummets

Bitcoin’s Price Decline Increases Market Uncertainty

The broader cryptocurrency market downturn has played a critical role in the trader’s liquidation. Bitcoin is currently trading at $86,125.78, reflecting a 3.30% drop over the past 24 hours and an 11.38% decline in the past week.

With a total circulating supply of 20 million BTC, the cryptocurrency’s market capitalization stands at approximately $1.7 trillion.

The downward trend has heightened the risks for traders utilizing high leverage, as rapid price swings can trigger mass liquidations.

The declining BTC price has also contributed to bearish sentiment across the market, affecting various assets, including altcoins such as HYPE and HFUN. As Bitcoin struggles to stabilize, traders relying on leveraged positions face an increasingly uncertain landscape.

High-Leverage Trading Continues to Wreak Havoc in the Crypto Market

This case is just one of several major losses among crypto investors due to high-leverage trading.

Another whale recently faced a $17.5 million loss after long positions in BTC, SOL, HYPE, ONDO, HBAR, SUI, and TRUMP plummeted, with Bitcoin’s liquidation risk now set at $74,571.

Additionally, the second-largest MELANIA token holder suffered a $3.739 million loss after liquidating 6.688 million MELANIA tokens at a steep discount amid deteriorating market conditions.

Meanwhile, a desperate trader attempting to exit their position on TRUMP tokens incurred a staggering $24.4 million loss after selling 763,582 TRUMP tokens for just $9.48 million.

These events highlight the dangers of excessive leverage, market volatility, and the potential for cascading losses when multiple high-risk positions are exposed simultaneously.

Also Read: Bitcoin Whale Faces $6.75M Loss on BTC Long Position Loss Via Hyperliquid As Market Dips