A major event recently unfolded in the cryptocurrency space as a whale investor unlocked 63,081.6 Solana (SOL) tokens, which had been staked for over 1.6 years, netting an impressive profit of approximately $6.2 million.

The investor moved the staked tokens to the Kraken exchange, which sparked significant attention in the crypto community.

According to Onchain Lens monitoring on X, the total value of the staked Solana was around $7.49 million at the time of the transaction.

The move highlights not only the profitability of long-term staking in cryptocurrencies but also the potential for substantial returns when dormant assets are finally unlocked.

The Strategic Timing Behind the Unlocking and Profit Realization

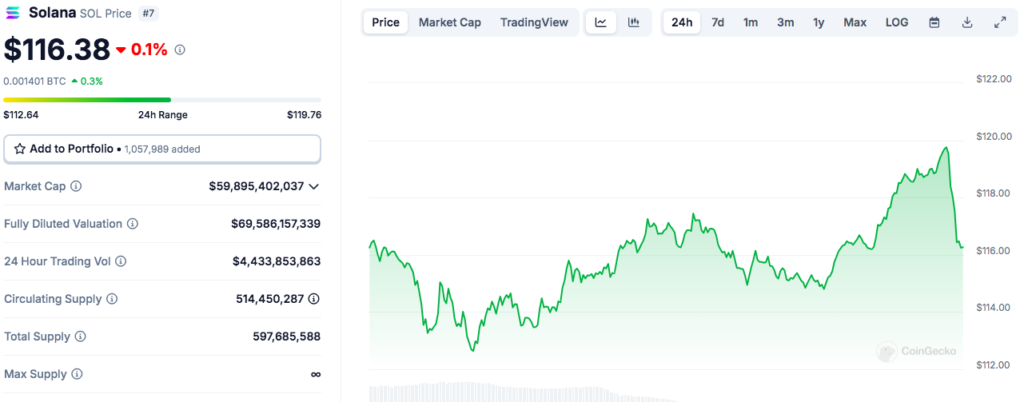

The timing of this major unlock coincided with a moderate increase in the price of Solana. On the day the whale unlocked their tokens, Solana’s price stood at BTC0.001414, marking a 1.40% increase over the past 24 hours.

Despite this short-term growth, Solana had experienced an 8.80% decline over the past week, which signals the volatile nature of the cryptocurrency market.

The whale’s decision to liquidate their holdings at this moment suggests a strategic move to capitalize on the price uptick before the market potentially experienced a downturn.

The event illustrates the unpredictability of the crypto market, where large investors often have to balance the risk of holding against the potential for significant rewards by seizing favorable market conditions.

Solana’s Market Position and Ongoing Growth

Solana continues to be a major player in the cryptocurrency market, currently boasting a market cap of approximately $4,674,372,584.

With a circulating supply of 510 million SOL, the network has grown significantly and remains a top contender among other digital assets.

Although the past week saw an 8.80% decline in Solana’s price, the cryptocurrency has maintained a strong market presence with substantial trading volume, around $4.67 billion.

The incident reflects its ongoing popularity and liquidity, attracting institutional investors and crypto whales.

The large transaction involving over 63,000 SOL further highlights the confidence placed in Solana’s future growth, making it an attractive asset for both long-term holders and short-term traders alike.

Also Read: Ethereum Investor Offloads $2.93M After 2-Months Of Dormancy While Facing $5.34M Unrealized Loss

The Role of Staking in Cryptocurrency Investment

Staking plays a crucial role in cryptocurrency investment strategies, providing a means for investors to earn passive income while supporting the network’s operations.

In the case of the whale investor, the 63,000 SOL tokens were staked for over 1.6 years, allowing them to accumulate profits through staking rewards.

However, the decision to unstake and liquidate their holdings at this specific moment highlights the importance of timing in staking.

For knowledgeable investors who understand market dynamics, staking offers a way to generate returns while retaining flexibility in terms of liquidity.

The strategic flexibility is key in a volatile market, where investors need to be able to react to changing market conditions to maximize profits.

Other Crypto Investors Cash In on Long Dormant Assets

This recent move by the Solana whale is part of a larger trend of dormant crypto assets being unlocked for profit realization.

Similar events have occurred across the crypto space, showcasing the potential gains investors can achieve by holding onto their assets for an extended period.

For instance, a crypto whale recently offloaded $83.51 million worth of $OM tokens after a year-long dormancy, securing $107.25 million in profits.

Additionally, other high-profile traders have cashed in on their investments, with notable examples such as a top TRUMP trader earning $6.03 million in profits, and an Ethereum whale securing a $65.68 million profit after holding 34,125 ETH for eight years.

These cases highlight the lucrative opportunities in long-term crypto investment, where patience and timing can yield substantial rewards for investors willing to hold their positions.