A prominent crypto whale with the address 0xead….9d55 has significantly increased its long positions in five major cryptocurrencies, Solana ($SOL), Ethereum ($ETH), Dogwifhat ($WIF), Bitcoin ($BTC), and kPEPE, despite currently facing a massive floating loss of $14.39 million.

According to Onchain Lens, the investor’s decision to double down on these assets suggests a strong conviction in their future price appreciation, even amid short-term market volatility.

Such large-scale trades by high-net-worth investors often influence market sentiment, as they indicate strategic moves based on extensive analysis and long-term outlook.

Whale Maintains Open Order Worth $8.43M Amid High-Risk Strategy

In addition to the already established positions, the whale still holds an open order of $8.43 million for the same set of tokens, reinforcing the aggressive nature of the investment approach.

Open orders of this magnitude suggest the investor is positioning for potential rebounds or price surges in these assets.

The move indicates a willingness to absorb short-term losses in exchange for expected future gains.

However, such a strategy carries substantial risk, especially in the highly volatile crypto market, where price swings can either lead to massive profits or deepen losses.

Funding Strategy: Large ETH Supply and USDC Borrowing

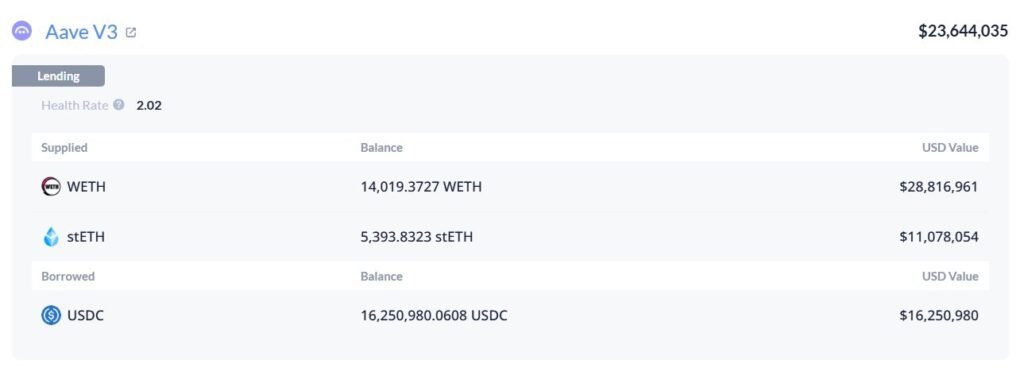

To finance these high-stakes trades, the whale supplied 19,413 Ethereum ($ETH) and borrowed $16.25 million in USDC stablecoin.

The strategy of leveraging borrowed capital to go long on cryptocurrencies, particularly on the HyperLiquid platform, demonstrates a calculated yet risky bet on a market upswing.

Leveraged trading amplifies both potential gains and losses, meaning that if market conditions do not move favorably, the investor could face liquidations or further financial setbacks.

On the other hand, if prices recover as anticipated, this whale’s positions could yield substantial profits.

Market Implications: Will the Whale’s Bet Pay Off?

The whale’s aggressive positioning in these key cryptocurrencies highlights an interesting dynamic in the market. It signals confidence in the resilience of $SOL, $ETH, $WIF, $BTC, and $kPEPE, despite ongoing price fluctuations.

Large investors like this often have access to sophisticated market insights and strategies that retail traders may lack, making their moves worth watching.

However, if the market fails to turn bullish in the coming weeks, this trade could serve as a cautionary tale about the risks of high-leverage positions.

The crypto community will be closely monitoring whether this bold bet pays off or results in further losses.