A major crypto investor, commonly referred to as a “whale,” has faced a devastating $17.5 million loss due to the sharp decline in multiple cryptocurrencies.

The investor with the address 0x153C…4e319A held leveraged long positions in Bitcoin ($BTC), Solana ($SOL), HYPE ($HYPE), Ondo ($ONDO), Hedera ($HBAR), Sui ($SUI), and TRUMP ($TRUMP), all of which have seen significant drops in value.

The most critical risk lies in Bitcoin, where a key liquidation level of $74,571 threatens to further exacerbate losses if prices continue to decline.

The incident highlights the inherent dangers of leveraged trading in an unpredictable market, where sudden price swings can erase millions in unrealized profits within hours.

Breakdown of Heavy Losses Across Multiple Assets

The investor’s largest exposure is in Bitcoin, with a 10X leveraged long position worth $23.69 million, which has already incurred a $4.89 million unrealized loss as BTC fell from an entry price of $102,079 to approximately $84,608.

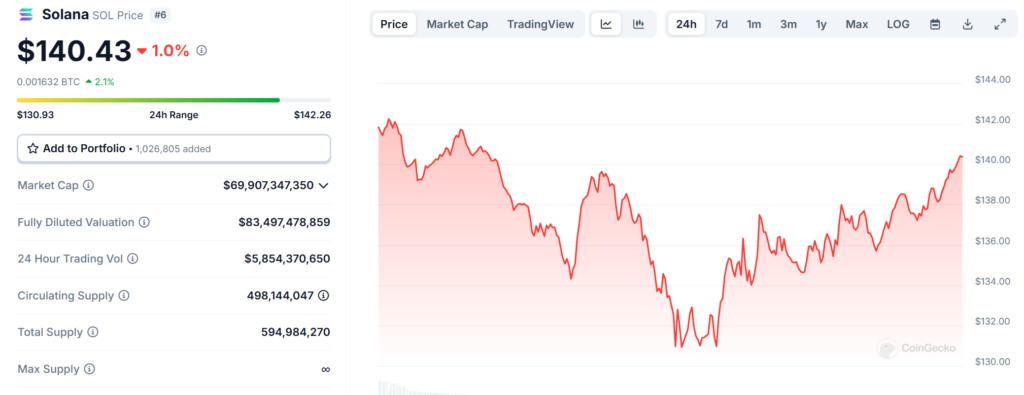

Solana, another major holding, was acquired with 20X leverage on $6.15 million, resulting in a staggering $4.49 million loss after its price dropped from $235.18 to $135.97.

The investor’s position in HYPE, using 3X leverage on $6.05 million, has shed over $1 million, while ONDO, a 10X leveraged asset, has declined by $1.46 million.

Additional losses include over $1 million each for HBAR and SUI, with TRUMP holdings suffering a $2.25 million loss.

The magnitude of these losses underscores the high-risk nature of leveraged trading, particularly when the market moves against a position.

High-Leverage Trading and Liquidation Risks Escalate

The whale’s extensive use of leverage, ranging from 3X to 20X, has significantly amplified both potential gains and losses, making the current downturn especially damaging.

The most critical concern is the looming liquidation of the Bitcoin position, which will be triggered if BTC falls to $74,571.

At this level, the investor risks losing the entire position unless additional capital is injected to sustain the trade.

The situation serves as a stark warning about the fragility of leveraged trading, where even minor market fluctuations can spiral into massive liquidations.

The ongoing volatility has forced many traders to reassess their risk management strategies, as overexposure to leverage can result in irreversible financial setbacks.

Market Impact and Investor Sentiment in the Wake of Declines

The widespread losses in these tokens have broader implications for the overall crypto market.

Large-scale liquidations by whales can create cascading sell-offs, further driving down prices and triggering panic among retail and institutional investors alike.

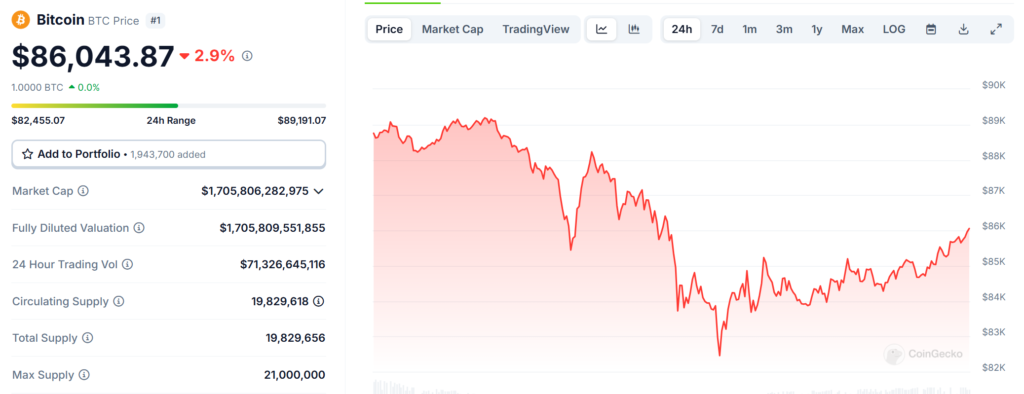

Bitcoin is currently trading at $86,043.87, down 2.89% in the last 24 hours and 11.25% in the past week, with a market cap of $1.7 trillion.

Solana, another heavily impacted asset, is priced at $140.54, reflecting a 0.77% daily drop and an 18.50% decline over the past seven days.

These declines, combined with heavy losses suffered by leveraged traders, highlight the extreme volatility of the crypto market and the importance of cautious risk management.

As Bitcoin approaches a crucial support level, investors will be closely monitoring price movements to determine whether a recovery is on the horizon or if further losses are inevitable.

Also Read: Bitdeer Sees $531.9M Loss In Q4 As Crypto Miners Struggle Globally, Aims At 40 EH/S Hashrate