Solana (SOL) is currently facing a critical moment in its price trajectory, with analysts warning of a potential drop to $65 if the $130 support level fails to hold.

Technical analyst Ali Martines has predicted via X that SOL is forming a right-angled ascending broadening pattern, which often signals increased volatility and potential downside risks.

Market sentiment has shifted drastically since the altcoin reached its all-time highs in January, with SOL losing over 55% of its value.

The steep decline has sparked extreme fear among investors, as the bullish momentum that previously supported Solana’s long-term structure has weakened.

Bears Take Control as Solana Struggles to Maintain Key Demand Zones

Over the past few weeks, selling pressure has dominated Solana’s price action, pushing the cryptocurrency below crucial demand levels. This has led to a shift in market dynamics, with bears now firmly in control.

The broader crypto market downturn has exacerbated SOL’s struggles, with speculative assets, particularly meme coins, experiencing sharp declines.

Liquidity concerns and investor confidence have been further impacted by the increasing number of rug pulls and scams within the Solana ecosystem.

As a result, traders are exercising caution, with many fearing that a break below $130 could trigger a deeper correction.

Solana’s Current Market Performance and Short-Term Recovery

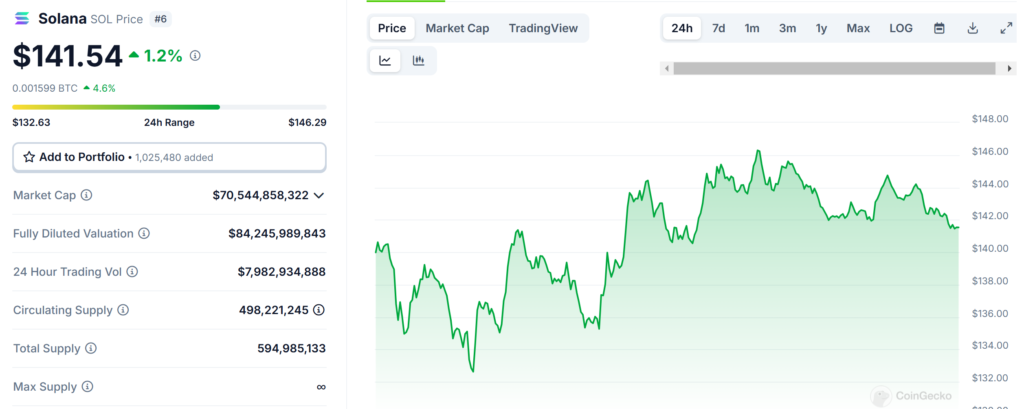

Despite these challenges, Solana has shown a minor price increase in the past 24 hours, rising 1.17% to $141.62.

However, this short-term rebound does little to offset the 15.02% decline in the past seven days. SOL’s market capitalization currently stands at approximately $70.5 billion, with a 24-hour trading volume of nearly $8 billion.

While these figures indicate that Solana remains a major player in the crypto space, the ongoing bearish sentiment suggests that further downside movement remains a strong possibility if critical support levels continue to weaken.

What’s Next for Solana? Key Levels to Watch

Looking ahead, the $130 price level will be a crucial battleground for Solana. If bulls manage to defend this support, SOL could attempt a recovery and stabilize above $140.

However, failure to hold this level could open the door for a significant plunge to $65, as predicted by analysts.

Such a decline would represent a major setback for Solana, potentially erasing further gains from its previous bull run.

Market participants will closely monitor trading volume, investor sentiment, and broader macroeconomic conditions to gauge whether Solana can reclaim its bullish momentum or succumb to further losses.