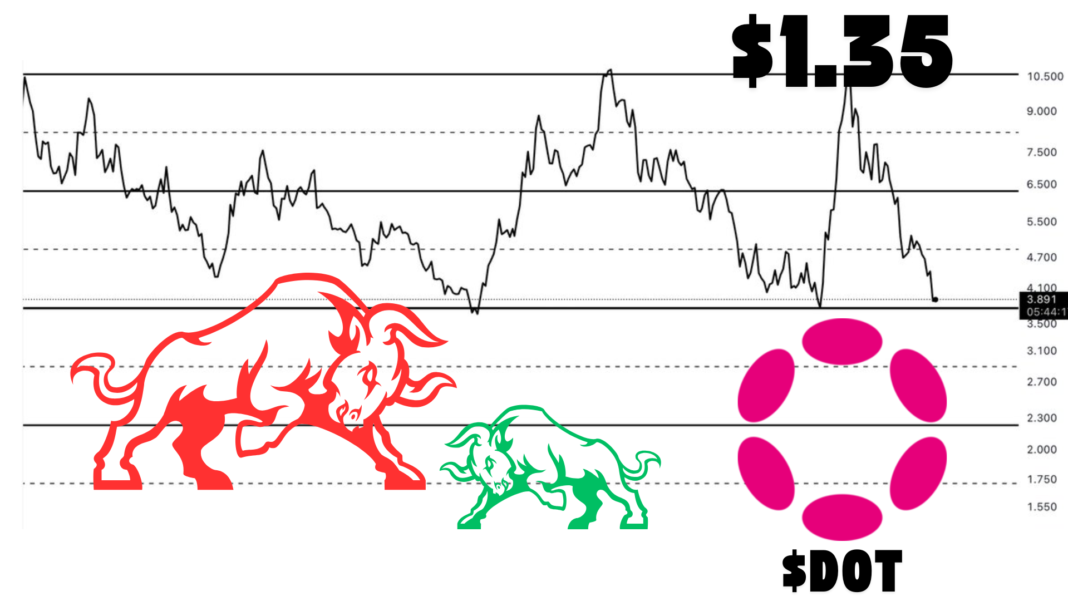

Renowned crypto analyst Ali Martinez has issued a bearish warning for Polkadot (DOT), predicting that the asset could plummet to as low as $1.35 if it fails to hold its current support levels.

According to Martinez, DOT is currently trading within a parallel channel, with a crucial resistance level set at $3.89.

If the price breaks below this level, a sharp downtrend could follow, increasing selling pressure across the market.

Given the broader crypto landscape and historical trends, this analysis has sparked intense discussions among investors and traders, as they assess the risks and potential trading strategies around DOT’s price action.

Polkadot’s Current Market Standing Amid Price Fluctuations

As of today, Polkadot (DOT) is trading at $4.06, reflecting a 3.31% increase over the last 24 hours, despite the recent market volatility.

The asset has recorded a 24-hour trading volume of approximately $192.8 million, indicating sustained investor interest.

However, over the past week, DOT has seen a decline of 10.56%, suggesting that bearish sentiment has been dominant.

With a circulating supply of 1.5 billion DOT, Polkadot maintains a total market capitalization of $6.18 billion, making it a significant player in the blockchain industry.

Despite the short-term price recovery, analysts remain cautious about the asset’s ability to maintain key support levels.

The Importance of the Parallel Channel in DOT’s Price Movement

Martinez’s analysis hinges on a technical pattern known as a parallel channel, which consists of two parallel trendlines guiding price movements.

These trendlines act as resistance and support levels, with DOT currently trading near the upper boundary at $3.89.

If Polkadot fails to hold this level, it could trigger a major sell-off, driving the price as low as $1.35.

Such a decline would mark a steep drop from current levels and could cause panic among holders.

Traders closely monitoring this setup will be watching for either a breakout above resistance, which could lead to a bullish reversal, or a breakdown, which would confirm Martinez’s bearish scenario.

Investor Sentiment and Growing Interest in Stablecoin Integration

Despite the concerns surrounding DOT’s price movement, there are positive developments within the Polkadot ecosystem.

The total supply of stablecoins on Polkadot has reached an all-time high, with native USDT and USDC now integrated with major exchanges like Binance, KuCoin, and Gate.io.

Also Read: Analyst Forecasts $0.000044 for $FLOKI After Channel Breakout

The growing stablecoin adoption strengthens Polkadot’s utility as a blockchain network. Additionally, the cost of transferring USDx stablecoins on Polkadot remains exceptionally low at less than $0.006, making the network an attractive option for transactions.

These fundamental improvements could help Polkadot sustain investor interest even if its token price faces short-term challenges.

What’s Next for Polkadot? Key Factors to Watch

With DOT currently holding above the $3.89 resistance level, the coming days will be crucial in determining its price direction.

A continued push above this threshold could invalidate Martinez’s bearish outlook and pave the way for a stronger recovery.

Moreover, the open interest in Polkadot futures has surged by 1.96% in the past 24 hours, with a total valuation of $196.4 million.

The incident indicates growing trader participation and suggests that the market remains highly engaged with DOT’s movements.

Whether DOT can sustain its momentum or faces the predicted downturn remains to be seen, but investors will be watching closely for key technical and fundamental signals.