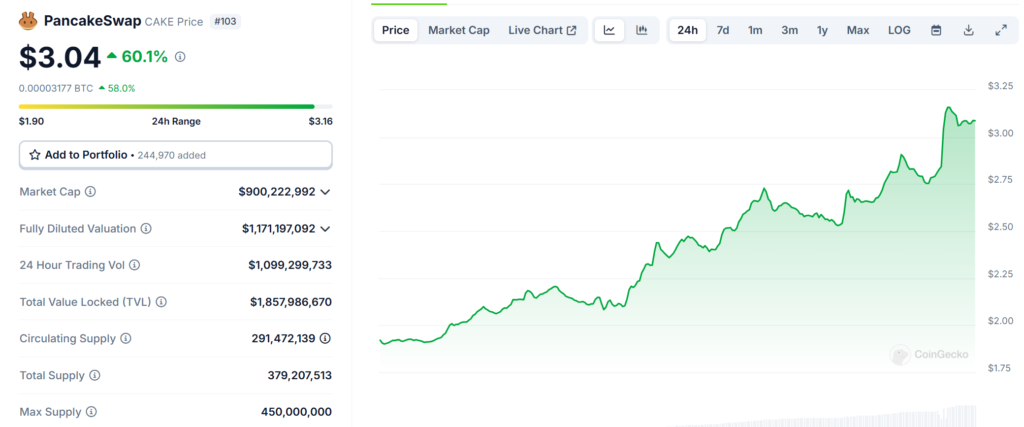

PancakeSwap (CAKE) has experienced an extraordinary 60% surge in price within the past 24 hours, reaffirming its status as the leading decentralized exchange (DEX) in the market.

According to DeFiLlama data, PancakeSwap ranked first in both daily and weekly trading volumes, recording an impressive $3 billion in trading volume over the past day and a staggering $20 billion over the past week.

The significant growth has driven CAKE’s price up to $2.99, pushing its total market capitalization close to $900 million.

The spike in price and trading activity underscores increasing demand and liquidity on the platform, positioning PancakeSwap at the forefront of the rapidly evolving DeFi sector.

CZ’s Endorsement: “This Is Just the Beginning”

Binance founder Changpeng Zhao (CZ) weighed in on PancakeSwap’s recent milestone, stating, “It’s not about competing with other ecosystems, but this is just the beginning.”

His remarks suggest that PancakeSwap’s current momentum is only the start of a much larger expansion. CZ’s endorsement carries significant weight, as Binance has historically backed PancakeSwap due to its integration with the Binance Smart Chain (BSC).

The strong relationship between Binance and PancakeSwap has been instrumental in fostering its adoption, contributing to its soaring trading volumes and price appreciation.

As one of the largest figures in the crypto space, CZ’s support hints at continued development and long-term sustainability for PancakeSwap.

Also Read: Chainlink Introduces DeFi Yield Index To Enhance Market Transparency And Capital Efficiency

CAKE’s Market Performance and Expanding Influence

Over the past week, CAKE has seen an astonishing 60.1% price increase, with its 24-hour trading volume exceeding $1 billion.

The token currently has a circulating supply of 290 million, bringing its market capitalization closer to the $1 billion mark.

These figures indicate growing trust and participation in PancakeSwap’s ecosystem, as more traders turn to the platform for liquidity, yield farming, and decentralized trading.

Meanwhile, other DEXs in the industry are also evolving. Solana’s Raydium recently overtook Uniswap, securing 27% of the DEX market volume, highlighting the increasingly competitive nature of the DeFi landscape.

Despite this, PancakeSwap’s ability to sustain high trading activity and capitalize on its integration with BSC keeps it ahead in the race for DeFi dominance.

Sustaining Growth Amid a Competitive DeFi Landscape

As PancakeSwap continues to dominate the DEX market, it faces challenges in maintaining its momentum amidst competition from Uniswap, SushiSwap, and the rising influence of Raydium.

To sustain its growth, PancakeSwap is making strategic moves, such as launching “Springboard,” a new token creation and listing platform on BNB Chain, which simplifies the process for developers and creators.

However, the platform has also announced that it will halt its DeFiEdge Treasury Management on October 10, 2024, urging users to withdraw funds before the deadline.

While PancakeSwap’s recent success is undeniable, the DEX sector remains highly dynamic.

Its continued leadership will depend on strategic innovation, ecosystem expansion, and its ability to adapt to the rapidly evolving DeFi landscape.

Also Read: Solana DEX Jupiter Acquires Majority Stake In Moonshot Memecoin App