Bitcoin fell to $92,971.17, matching levels of severe anxiety not seen since the bottom of the 2022 bear market. As rate reduction expectations crashed, traders wiped $617.45 million in liquidations in a single day, and the Crypto Fear & Greed Index fell to 10, its lowest value since July 2022.

The selloff is part of a much larger rout, and over the last 41 days, the crypto market has lost approximately $1.1 trillion in value, an average decline of about $27 billion per day, leaving total market cap roughly 10% below levels seen during the record $19 billion liquidation event on October 10.

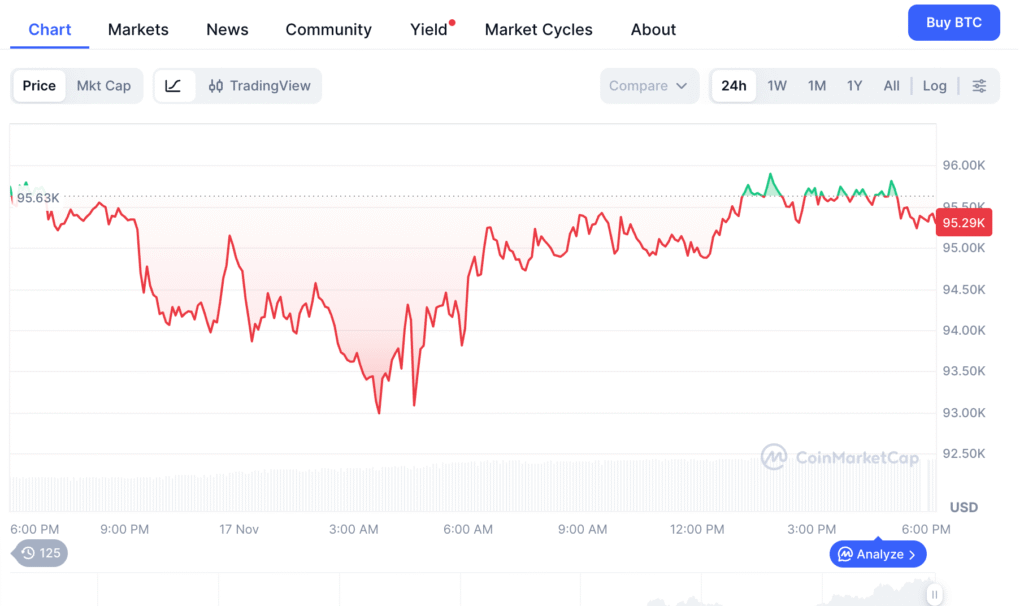

Bitcoin’s price actions

Bitcoin is trading at $95,427.41 and is down by 1% in the last 24 hours. The global market cap is at $1.9 trillion. The 24-hour trading volume is up by 80.57%.

Following Wall Street’s Friday decline, which left key indexes down more than 1.6%, the sell-off picked up speed throughout Asian trading hours. Ethereum accounted for $169.06 million in liquidations, the biggest single wipeout on a Hyperliquid BTC investment was $30.60 million.

Investors moved away from riskier assets and toward cash as market pricing for a December Federal Reserve rate decrease fell from over 60% the week before to about 40%.

The market conditions

An analyst at CryptoQuant came to the conclusion that short-term holder capitulation, not long-term holder distribution, was the primary cause of Bitcoin’s slide from the $126,000 top.

Since September, long-term investors have increased their selling, although the pattern has stayed consistent with typical mid-cycle profit-taking rather than the dramatic blow-off distribution that occurs at cycle tops.

Bitcoin’s Realised Cap rose in spite of falling prices, suggesting that new short-term investors were bringing in more money. When paired with a continuous LTH distribution, these inflows proved inadequate to absorb capitulation from earlier STH cohorts.

STH deleveraging and forced selling during stressful times were the main causes of marginal price pressure, according to CryptoQuant experts.

“Even if LTHs sold more in total over months, markets react to marginal flows during stress,” the analysis stated. “On dump days, leveraged STHs triggered rapid sell-offs and liquidations, creating the steepest downward momentum.”

ETF outflows grow

From November 10 to 14, US spot Bitcoin ETFs saw weekly withdrawals of $1.11 billion, the third straight week of institutional retreat. The greatest net outflow was $532.41 million from BlackRock’s IBIT, while Grayscale Bitcoin Mini Trust had weekly losses of about $290 million.

Spot Bitcoin ETFs had a net asset value of $125.34 billion, or 6.67% of the market capitalisation of Bitcoin. The market is going through a tough time and has faced severe liquidation in the past two months, along with the Bitcoin price coming down from $100K for multiple times.