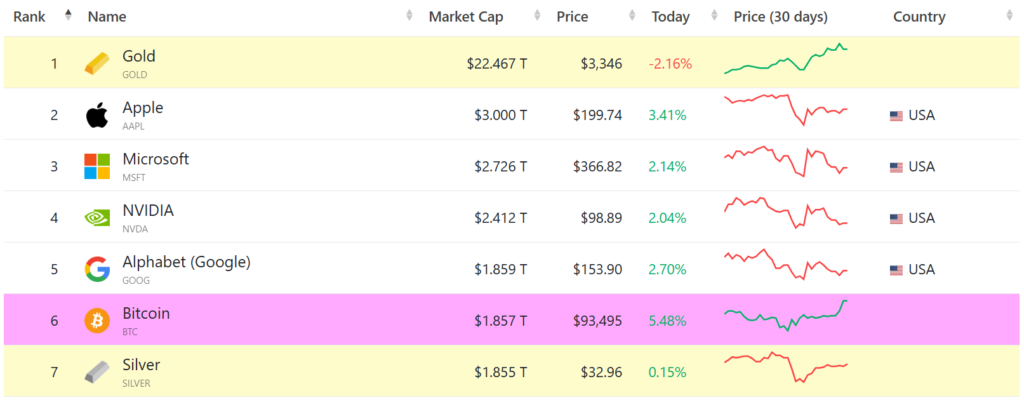

Bitcoin officially became the fifth-largest asset in the world by market valuation, surpassing Alphabet, the parent company of Google.

However, the milestone was short-lived as the market cap soon fell back into the sixth place.

This milestone still shows that Bitcoin is becoming more widely accepted as a valid store of value and is being adopted by more institutions.

The market capitalization of Bitcoin recently surpassed that of Google, which is just under $1.86 trillion, according to market figures.

Why is Bitcoin Seeing Rise in Market Cap?

Increased accumulation by big players like Strategy and other hedge funds, spot Bitcoin ETF approvals, and rekindled investor confidence all contributed to the rise.

Bitcoin’s impressive increase since its launch in 2009 is demonstrated by the fact that it currently ranks behind only Gold, Apple, Microsoft, and Nvidia in terms of overall value.

The move demonstrates how attitudes in international banking are changing and how digital assets are no longer viewed as fringe investments.

Rather, they are being included in portfolios with conventional commodities and stocks. Proponents contend that Bitcoin’s fixed quantity and increasing popularity make it a strong hedge against inflation and economic instability, even though detractors continue to warn of volatility.

As the cryptocurrency market develops, Bitcoin’s ascent over tech behemoths like Google is interpreted as a sign of a more significant shift in the way value is perceived, moved, and held in the digital era.

How is Bitcoin Beating Conventional Assets?

Bitcoin has been consistently beating a lot of conventional assets, which indicates a big change in the way that people invest globally.

Its market valuation soared beyond national fiat currencies and internet titans like Google in 2024 and 2025, making it the world’s fifth-largest asset.

Increased institutional use, the acceptance of spot Bitcoin ETFs, and the rising need for decentralized repositories of value are the main drivers of this rise.

Similar to gold, investors are using Bitcoin as a hedge as long as inflation and economic instability continue. Its global accessibility, high liquidity, and stable supply make it a more alluring option than stocks, bonds, and fiat money.

The performance of Bitcoin is indicative of growing trust in digital assets and their changing place in the larger financial system.

Bitcoin’s Hedge Against Inflation Value Helps Garner Investor Attention

Bitcoin’s distinctive value proposition as a decentralized, limited, and international digital asset is drawing in more and more investors.

Bitcoin, which has a fixed number of 21 million coins, is sometimes regarded as a hedge against currency devaluation and inflation, particularly in uncertain economic times.

Its place in contemporary portfolios has been further validated by the emergence of spot Bitcoin ETFs, regulatory clarity in some areas, and institutional adoption.

Both ordinary and institutional investors looking for diversification, long-term development potential, and protection from conventional market volatility find Bitcoin appealing because to its high liquidity and worldwide accessibility.

Also Read: Bitcoin Top Buyers Face Mounting Losses Amid Market Shift to Long-Term Holding, Volatility Ahead?