Bitcoin has achieved an unprecedented milestone in its trading history, reaching a new all-time high of $108,744.

The remarkable achievement comes at a particularly significant moment, coinciding with Donald Trump’s imminent inauguration as the 47th President of the United States.

The digital currency demonstrated extraordinary momentum with a sharp 5% surge occurring within minutes, highlighting the market’s intense reaction to political developments.

The surge follows a broader rally triggered by Trump’s unexpected victory in the November 6, 2024 election, which initially propelled Bitcoin beyond the psychological barrier of $100,000 in early December.

The timing proved especially notable as BTC briefly touched near $109,000 on January 20, just hours before Trump’s scheduled swearing-in ceremony at 4:00 PM UTC, demonstrating the market’s heightened sensitivity to political transitions.

Current Market Performance and Trading Metrics

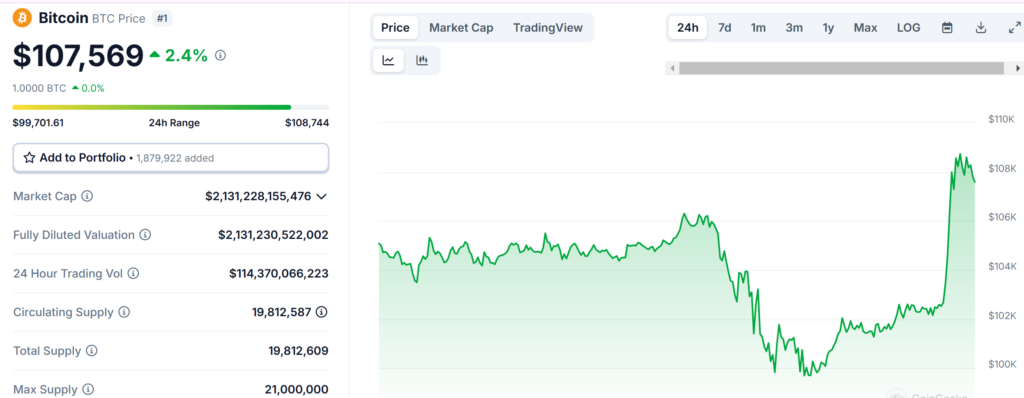

The cryptocurrency’s current trading position reflects robust market confidence, with Bitcoin maintaining strength at $107,569.

The recent increase represents significant short-term gains, including a 2.49% increase over 24 hours and an impressive 15.34% appreciation over the past week.

Perhaps most notably, trading volume has reached extraordinary levels, with 24-hour activity totaling $114.37 billion, indicating exceptional market participation and investor interest.

These metrics gain additional significance when considered alongside Bitcoin’s total market capitalization, which has now exceeded $2.13 trillion, supported by a circulating supply of 20 million BTC.

The combination of strong price action, high trading volume, and substantial market capitalization underscores Bitcoin’s dominant position in the cryptocurrency ecosystem.

Political Influence and Market Sentiment

The cryptocurrency market’s reaction to Trump’s return to the presidency highlights the growing intersection between digital assets and political developments.

Trump’s historical stance on decentralized financial systems and potential regulatory reforms has created a wave of optimistic market sentiment.

The optimism stems from expectations that his administration might implement policies favorable to the cryptocurrency industry, potentially easing regulatory constraints or introducing supportive frameworks.

The market’s response to these political developments has been particularly noteworthy, as traders and investors position themselves in anticipation of a more crypto-friendly regulatory environment.

The recent period of heightened geopolitical focus has consistently corresponded with Bitcoin setting new records, establishing a pattern of market behavior tied to significant political events.

Next Milestones: Can Bitcoin Push Past $110,000?

As Bitcoin continues to test new heights, market analysts are closely monitoring the $110,000 level as the next crucial psychological and technical threshold.

Current market dynamics suggest that Bitcoin may need to retest the $105,927 support level, which could serve as a springboard for future price appreciation if maintained.

The potential breakthrough beyond $110,000 carries significant implications, not only reinforcing Bitcoin’s position as a legitimate store of value but also potentially catalyzing increased institutional participation.

The confluence of factors supporting Bitcoin’s upward trajectory includes unprecedented trading activity, favorable macroeconomic conditions, and robust market sentiment.

These elements collectively suggest that Bitcoin’s strong performance in 2024 may continue, particularly as the market adapts to the new political landscape and institutional involvement potentially expands.

Also Read: Trump’s Portrait Embedded in Bitcoin Block By Bitcoin Miner MARA, Costs A Whopping $127K in Fees