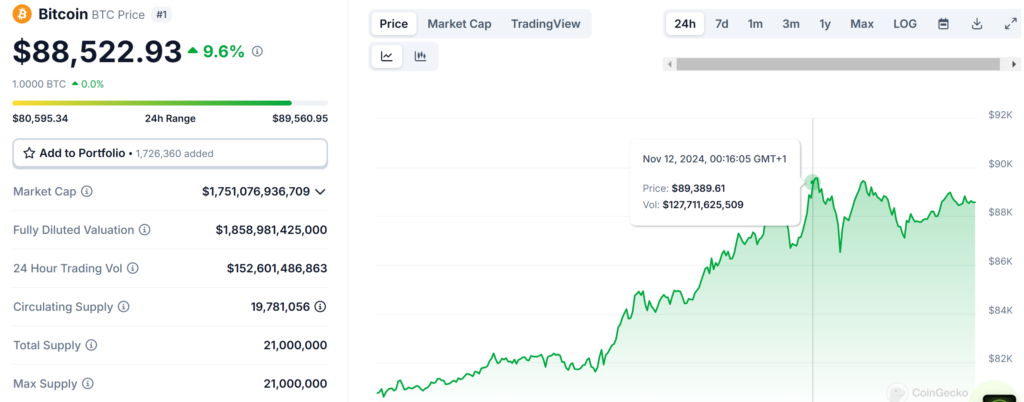

Bitcoin has achieved a remarkable milestone by reaching a new all-time high (ATH) of approximately $89,560, marking an impressive 8% surge in just 24 hours before settling at $87,930 on Tuesday, November 12, during the early Asian session.

This significant price movement follows Bitcoin’s successful breakthrough of the $73,000 resistance level last week, demonstrating sustained upward momentum with consecutive daily ATH records.

The unprecedented price action has captured the attention of both retail and institutional investors, suggesting a robust bull market phase that could potentially extend further into new territory.

Future Price Projections. Will Bitcoin cross 100k by the end of 2024?

Market sentiment regarding Bitcoin’s future price movements remains overwhelmingly positive, with leading prediction platforms providing optimistic forecasts.

Kalshi’s data indicates a 56% probability of Bitcoin reaching $100,000 by the end of 2024, while the likelihood of maintaining above $90,000 stands at an impressive 97%.

This bullish outlook is further corroborated by Polymarket’s predictions, which suggest a 62% chance of Bitcoin hitting the $100,000 milestone before year-end.

These predictions from multiple respected platforms reflect growing confidence in Bitcoin’s continued upward trajectory.

Short Squeeze and Market Dynamics

The recent price surge has triggered significant market movements in the derivatives sector, with the crypto-leveraged market experiencing over $1.2 billion in forced liquidations over just two days, primarily affecting short positions.

This massive liquidation event has prompted a notable shift in trader sentiment, with former short traders increasingly adopting bullish positions.

This transition has created a self-reinforcing cycle of upward price pressure, exemplifying a classic institutional-led short squeeze scenario that has further amplified the existing bullish momentum.

Also Read: Rich Dad Poor Dad’s Robert Kiyosaki Reveals Owning 73 Bitcoin, Targets 100 BTC

Institutional Adoption and Investment Flows

The current Bitcoin rally has been primarily driven by substantial institutional investment inflows.

As Bitcoin’s market capitalization surpassed $1.73 trillion for the first time in over three years, a noticeable trend has emerged where investors are increasingly shifting their allocations from traditional safe-haven assets like Gold and Silver ETFs to Bitcoin.

This institutional enthusiasm is evidenced by the remarkable performance of US spot Bitcoin ETFs, which recorded over $1 billion in net inflows on Monday alone.

Adding to this institutional momentum, MicroStrategy Inc. has further demonstrated its commitment to Bitcoin by announcing the acquisition of an additional 27,000 BTC, valued at over $2 billion, reinforcing the strong institutional backing behind Bitcoin’s current rally.

Also Read: Binance’s CZ Suggests A “Don’t Put All Eggs In One Basket” Approach Amid Bitcoin’s New Highs