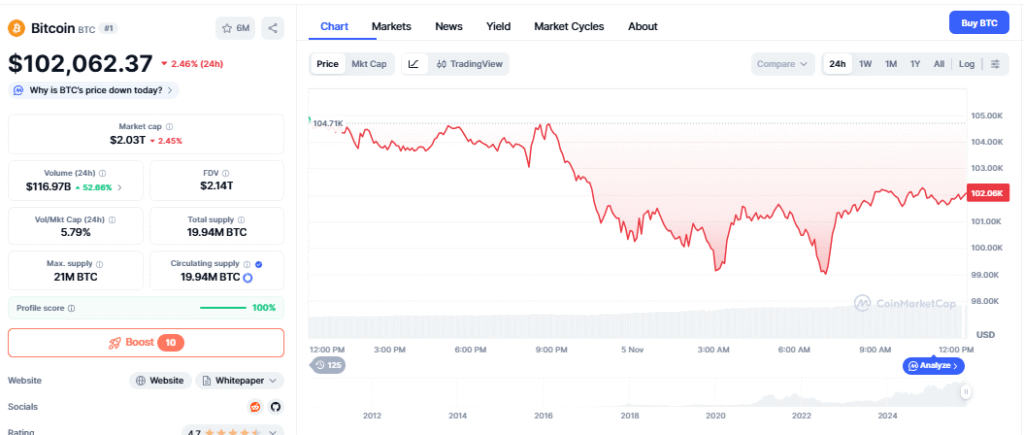

Earlier this week, on tuesday, 4th November, Bitcoin wiped away its enormous summer surge, falling far below $100,000 on Tuesday. Amid a wider slide for the cryptocurrency market, the cryptocurrency dropped as much as 7.4% to reach a five-month low of $98,794.

As the US Federal Reserve reluctantly approaches interest rate decreases, investors have increasingly moved away from riskier assets. In October, investors in cryptocurrencies lost billions of dollars in bullish positions due to a violent wave of liquidations.

Crypto liquidations hit $2 billion

Tuesday’s crypto market bloodbath only got worse as the afternoon dragged on, with Bitcoin nearly touching the $98,000 mark, Ethereum falling to a four-month low, and total daily liquidations topping $2 billion, according to Coinglass.

Also Read: Global Crypto Investment Outflows Reach $795 Million Amid Tariff Impacts, Report

For the first time since June, Bitcoin has dropped below $100,000 after hitting a record high of almost $126,000 on October 6. The decline is consistent with an equity bear market, according to a Bloomberg analysis.

Similar drops were seen in several altcoins, taking losses for several of the less liquid and readily traded tokens to over 50% this year. According to reports, Ether dropped as much as 15% on Tuesday, followed by a 3% decline in XRP and a 2% decline in BNB, in the last 24 hours.

Ethereum fell from a 24-hour high of $3,649 to as low as $3,097, the lowest level since July. ETH is currently down more than 6% on the day at $3,326.66, surpassing all other cryptocurrencies in the top 10 by market capitalisation.

Crypto market faces the bear season

According to data from CoinMarketCap, the total market value of the global cryptocurrency market has dropped by over $840 billion in the last month. Additionally, when US President Donald Trump’s trade battle took a new turn in October, Bitcoin recorded its worst monthly performance since 2018.

Other challenges for cryptocurrencies include withdrawals from exchange-traded funds and worries about possible sales by treasury businesses that deal in digital assets.

Even while $2 billion in liquidations is a significant sum, it still falls short of the record $19 billion in liquidations established in October, at least for the time being. However, after that slaughter, some traders have definitely gotten more cautious.

Tuesday’s correction coincided with a decline in stock market indexes as the Nasdaq and S&P 500 ended the day lower, as tech companies suffered due to increased macroeconomic uncertainty.

Also Read: Bitcoin Falls Over 2% as Trump Proposes 50% Tariff on EU Imports Starting June 1, 2025