In a momentous event for the cryptocurrency market, Bitcoin (BTC) has surged past the critical $100,000 price level.

This historic milestone was reached at 4:00 GMT on Wednesday, December 5th, 2024.

This marks a significant psychological and financial achievement for digital asset investors and enthusiasts worldwide.

Putin’s Endorsement of Cryptocurrencies

Adding to the bullish momentum, the break above $100,000 coincided with a bold statement from Russian President Vladimir Putin.

Just hours before the price milestone was reached, Putin firmly asserted that “Who can ban Bitcoin? Nobody.”

The Russian leader’s endorsement of digital assets as essential tools for reducing costs and enhancing financial reliability has been widely interpreted as a strategic move to leverage cryptocurrencies for geopolitical and economic advantages.

Putin’s remarks on Bitcoin reflect Russia’s growing acceptance of the trailblazer crypto and cryptocurrencies at large.

Earlier this year, the country passed legislation that formally recognizes cryptocurrencies as property, exempting crypto mining and sales from value-added tax (VAT) and removing tax liabilities for transactions conducted via electronic payment systems.

This clear legal framework is expected to accelerate the adoption of digital assets within Russia’s financial ecosystem.

Also Read: France Set To Ban Polymarket After Citizens Make Big Bets On Trump’s Win

Implications for Global Adoption and Mainstream Integration

The Bitcoin price surge and Putin’s pro-crypto stance come amidst a broader trend of increased global acceptance and integration of cryptocurrencies.

A good number of companies in China have cited Bitcoin as a strategic reserve asset following the approval of spot BTC ETFs in Hong Kong in the first half of 2024.

Moreover, the recent BRICS summit highlighted the potential use of cryptocurrencies for cross-border payments, showcasing their ability to challenge traditional financial systems.

Additionally, President-elect Donald Trump’s plans to build a strategic Bitcoin reserve, coupled with Russia’s previous signals to accept Bitcoin as a form of payment.

Particularly in the oil business, suggest that digital assets are becoming increasingly recognized as vital tools for navigating geopolitical and economic challenges.

Exponential Market Cap Growth Projected

As a result of these developments, the cryptocurrency market capitalization is expected to grow exponentially in the coming years, potentially surpassing the combined market cap of gold and silver.

Bitcoin’s ability to break through the $100,000 barrier, coupled with the growing global adoption and integration of digital assets, underscores the transformative potential of this technology and its profound impact on the future of finance.

Also Read: Memecoins Tied to Trump See Huge Crash Of Over 60% As Hype Around the Victory Fades

Crypto Market Responds to Political Shifts

The price surge comes on the heels of the Republican victory in the November 2024 U.S. presidential election, which signaled an end to the Biden administration’s perceived “war on crypto” led by former SEC Chair Gary Gensler.

The shift in the political landscape has fueled optimism within the crypto community, driving increased investor confidence and a renewed wave of buying pressure.

Bitcoin (BTC) surge started weeks back,it had earlier shattered its previous long time all-time high of $73,770, surging past $75,000 amid Donald Trump’s presidential victory.

This surge occurred as early election results showed Trump taking the lead in the Electoral College, triggering a massive wave of buying pressure across cryptocurrency markets.

The appointment of pro-crypto SEC Commissioner Paul Atkins as the next U.S. SEC Chair has further fueled optimism within the crypto industry, paving the way for more favorable regulatory policies in the United States.

Bitcoin’s Latest Price Surge

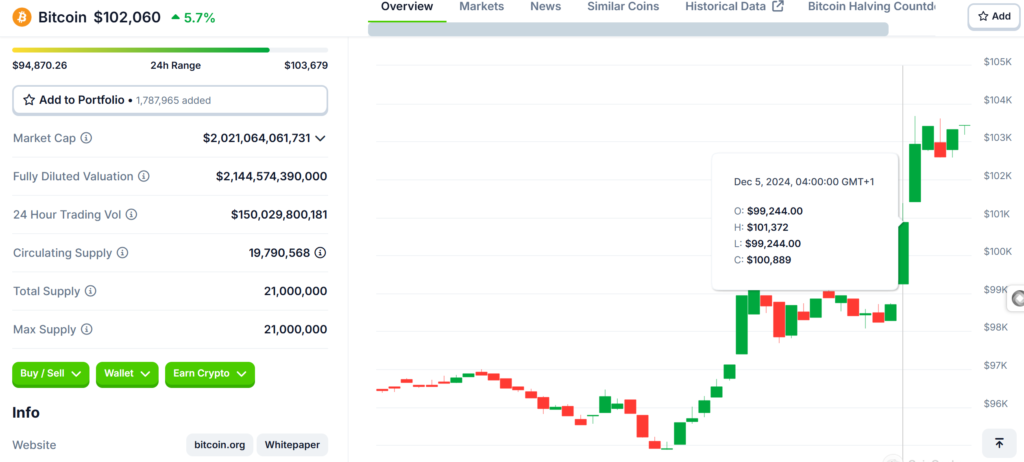

To further illustrate the scale of Bitcoin’s recent price movements, let’s take a closer look at the current market data:

According to data from Coingecko, the price of Bitcoin (BTC) is trading at $101,904 today with a massive daily trading volume of over $150 Billion.

This represents a 5.33% price increase in the last 24 hours and a 6.31% price increase in the past 7 days.

Bitcoin has proven its trailblazer mark with a whooping circulating supply of 20 Million BTC, BTC is valued at a market cap of $2,021,064,061,731.

This latest surge has pushed Bitcoin’s market capitalization past the $2 trillion mark for the first time in history.

As a result, the asset class is now very close to overtaking tech giants like Alphabet and Amazon, potentially positioning it as one of the top five global assets worldwide.

Also Read: Gemini Admits Issuing Wrong Bitcoin Price Alert, Apologizes For Posting BTC Reaching $110K