Changpeng Zhao (CZ), founder of Binance and a leading figure in the global crypto space, has ignited major conversation across the blockchain community with his recent proposal to significantly reduce gas fees on the BNB Smart Chain (BSC).

In a tweet posted earlier today, CZ suggested reducing BSC gas fees by “3x, 10x?”, opening the door for a drastic cost cut that could transform user experience and blockchain accessibility.

The post quickly gained traction, with over 54,000 views and hundreds of interactions, reflecting widespread interest in the potential shift.

A substantial reduction in transaction costs could attract more developers and users to BSC, increasing its competitiveness among other Layer-1 chains.

Community Reacts Enthusiastically, But Questions Arise

The response from the crypto community was swift and enthusiastic. Notably, the official BNB Swap account replied with a bold “No fee” suggestion, sparking further debate on how far fee reductions could or should go.

While many users welcomed the idea, citing BSC’s high transaction volume and user base, others raised valid concerns about the economic sustainability of such a change.

A reduction of this magnitude would make BSC more appealing to small traders and app developers, but could also impact validator earnings and potentially encourage spam transactions.

These trade-offs highlight the complexity of implementing structural changes on an active, high-throughput blockchain.

Also Read: Ethereum Gas Reform Gets 10% Validator Backing, Transaction Fees Set To Drop 33%

CZ Cautions About Validator and Builder Considerations

In a follow-up tweet, CZ acknowledged that while reducing fees is an exciting idea, it must be approached carefully.

“Lots of spam,” he warned, highlighting the potential downside of ultra-low fees leading to network congestion and abuse.

He also noted the importance of considering the needs of validators and builders, key players who secure the network and develop on top of it.

These comments suggest that while CZ is open to ambitious reforms, any actual implementation will likely require consensus from stakeholders and thorough analysis to maintain long-term chain performance and economic viability.

Implications for BNB Ecosystem and Broader Crypto Market

If BSC successfully implements a gas fee reduction of this scale, it could trigger a significant ripple effect across the blockchain industry.

Lower transaction costs would likely boost daily active users, smart contract deployment, and decentralized application (dApp) activity on the chain.

Such a move could also pressure other Layer-1 networks, like Ethereum, Avalanche, and Solana, to revisit their own fee structures to remain competitive.

For the BNB token itself, this news could drive increased utility and demand, reinforcing its role at the center of Binance’s expanding ecosystem.

However, careful balancing will be needed to ensure the chain remains secure, scalable, and economically sustainable as it evolves.

Also Read: Ethereum Fees Slide To Five-Year Low To $0.168 Amid Quiet Network Activity, Details Inside

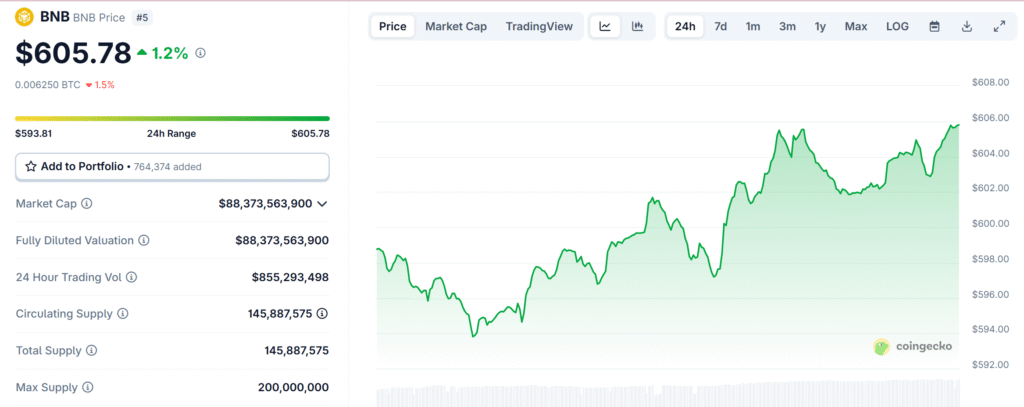

Market Reaction and BNB Price Movement

Following CZ’s announcement, the price of BNB (BNB) showed modest upward momentum.

As of today, BNB is trading at $605.78, reflecting a 1.10% increase over the last 24 hours and a 0.20% rise over the past week.

With a circulating supply of 150 million BNB, the token’s market capitalization stands at approximately at $88.3 billion

These numbers suggest that while the market hasn’t seen a massive reaction yet, investors are watching developments closely.

The potential gas fee reduction could become a major bullish catalyst for BNB if plans are confirmed and implemented effectively, reinforcing its value as a transactional and governance token within the expanding Binance ecosystem.