The cryptocurrency market witnessed a remarkable surge in the Frodo the Virtual Samurai (FROG) memecoin, which has captured attention following its inclusion in Binance Alpha’s fourth batch of project listings.

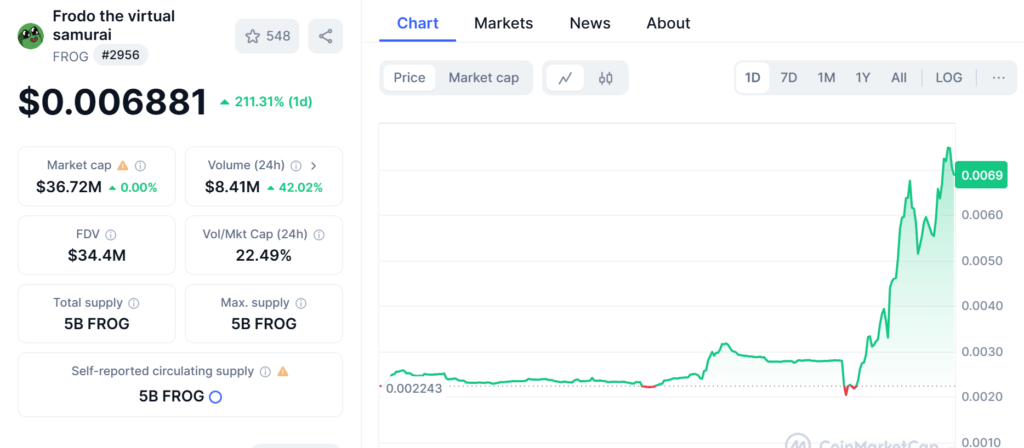

The token’s performance has been notably strong, with its current price standing at $0.006819, accompanied by a substantial 24-hour trading volume of $15,481,892.

This represents an extraordinary price increase of 211.95% within just 24 hours, building upon an already positive weekly trend.

The project’s market capitalization has reached $37,135,310, calculated against a circulating supply of 5 billion FROG tokens. This dramatic price movement highlights the significant impact that Binance Alpha listings can have on token valuations in the cryptocurrency market.

Introduction of Binance Alpha Platform

Binance, maintaining its position as the world’s leading cryptocurrency exchange, has launched an innovative new platform called ‘Binance Alpha’ as an integral component of its Binance Wallet (previously known as Binance Web3 Wallet).

This strategic initiative serves a crucial role as a “pre-listing token selection pool,” designed to enhance transparency and fairness in Binance’s token listing process.

The platform’s primary objective is to identify and showcase promising early-stage cryptocurrency projects that demonstrate significant growth potential within the Binance ecosystem.

By making this selection process more public and transparent, Binance Alpha aims to foster greater trust within the cryptocurrency community while providing valuable insights to users about tokens that may experience substantial growth in the future.

Also Read: Binance Alpha Lists KOMA, CHEEMS, APX, AI16Z, And AIXBT In The First Slot

Cautionary Developments and Risk Considerations

Recent events have highlighted the critical importance of accurate data and proper risk management in cryptocurrency trading, particularly concerning new platforms like Binance Alpha.

A significant incident involved a crypto trader suffering a substantial loss of $102,000 due to incorrect data provided by Binance Alpha during an $ARC to $ELIZA token swap.

This situation underscores the inherent risks in cryptocurrency trading and the potential consequences of relying on platform-provided information.

Additionally, regulatory concerns have emerged, with Australian authorities raising questions about Binance Australia Derivatives’ client classification practices, specifically regarding the potential exposure of retail investors to high-risk products.

These developments serve as important reminders of the need for thorough due diligence and risk awareness when engaging with new cryptocurrency platforms and tokens, even those associated with established industry leaders like Binance.