Eugene believes the cryptocurrency market will remain in a “PvP (player-versus-player) regime” until Bitcoin can break above the psychologically significant $100,000 milestone.

He expects that Ethereum and Solana will experience “outstanding performance moments” during this period, and he also anticipates that lower-risk tokens will follow suit and benefit from the potential market upswing.

Crucially, Eugene predicts that Bitcoin’s price will ideally not fall below $85,000, as he believes such a decline would be “pretty disastrous for risk in general” in the broader cryptocurrency market.

This forecast underscores Eugene’s view that maintaining Bitcoin’s price above the $85,000 level is crucial for preserving the overall risk profile and stability of the entire digital asset ecosystem.

Bitcoin (BTC) Price and Market Dynamics

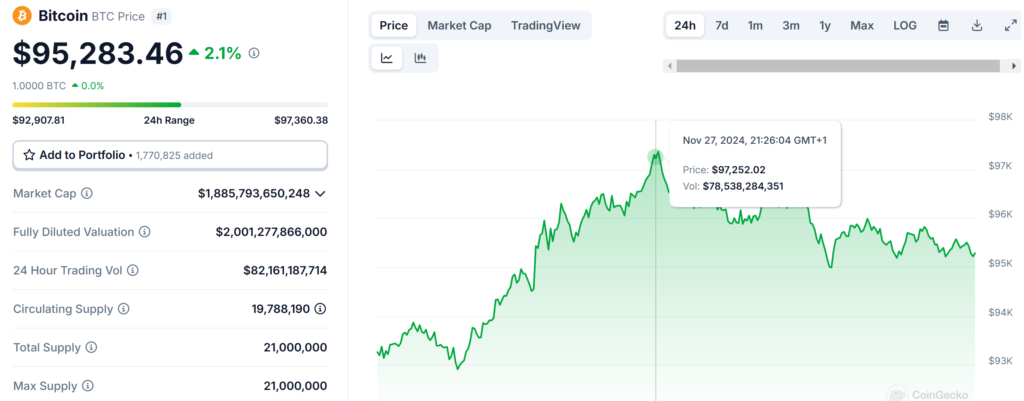

According to the latest data, the price of Bitcoin is currently $95,283.46, representing a 2.14% increase over the last 24 hours.

However, the cryptocurrency has seen a 2.02% decline in the past 7 days.

The 24-hour trading volume for Bitcoin stands at a substantial $82,161,187,714, indicating strong market activity and liquidity.

With a circulating supply of 20 million BTC, the overall market capitalization of Bitcoin is a staggering $1,885,793,650,248.

This data paints a mixed picture for Bitcoin’s recent performance. The uptick in price over the last day is a positive sign, but the slight decline over the past week suggests some volatility and uncertainty in the market.

Trader Eugene’s November Performance Review

In a recent post on the X platform, top trader Eugene provided an in-depth review of his trading experience in November.

Despite achieving personal bests in several key metrics, including the number of total operations (70), winning rate (75%), and overall profitability.

Eugene candidly acknowledged that he had almost completely missed the market trends for major cryptocurrencies like Bitcoin (BTC), Dogecoin (DOGE), XRP, and Cardano (ADA).

Eugene attributed this oversight largely to the “violent 35% move up” in Bitcoin’s price during the month. When the benchmark cryptocurrency experiences such a rapid and significant rally.

Eugene explained that it can be easy to miss out on multiple “home run” trading opportunities in a row. This feeling of missing out on market opportunities, coupled with the fear of missing out (FOMO), can be an overwhelmingly difficult experience for traders, even those with a strong track record of success.

Also Read: Bit Global Claims Coinbase Suspends Trading of Wbtc to Boost Its Own Bitcoin Wrapper

Lessons Learned and Market Adaptations

Despite the missed chances, Eugene was able to achieve some notable wins by successfully trading other prominent altcoins, including Solana (SOL), Ethereum (ETH), and Dogecoin (above 40 cents).

These gains helped to partially offset his relative underperformance compared to the broader cryptocurrency market movement.

One of the key adaptations Eugene highlighted was his ability to quickly adjust his trading strategy in response to the unexpected victory of the “Trump win” on November 6th.

By demonstrating mental agility and a willingness to rapidly re-evaluate his positions, Eugene was able to move aggressively to put more risk back on as the election results were unfolding. This quick thinking and adaptability proved crucial in helping him navigate the volatile market conditions.

Missed Opportunities and Insights

In his detailed review, Eugene identified two specific missed opportunities that, in hindsight, could have significantly boosted his returns for the month.

The first was his failure to recognize the impact of Robinhood’s listing of XRP and ADA, which led to a substantial surge in trading volume and price appreciation for those assets.

Secondly, Eugene admitted that he did not pay enough attention to the behavior of the Korean markets, which were “aping XRP with ferocity.”

This oversight meant he missed out on potentially lucrative trades in XRP, which could have “basically doubled” his book.

Also Read: VanEck Digital Asset Analysts See Crypto Bull Run as “Just Beginning”, Expect BTC to Hit $180K