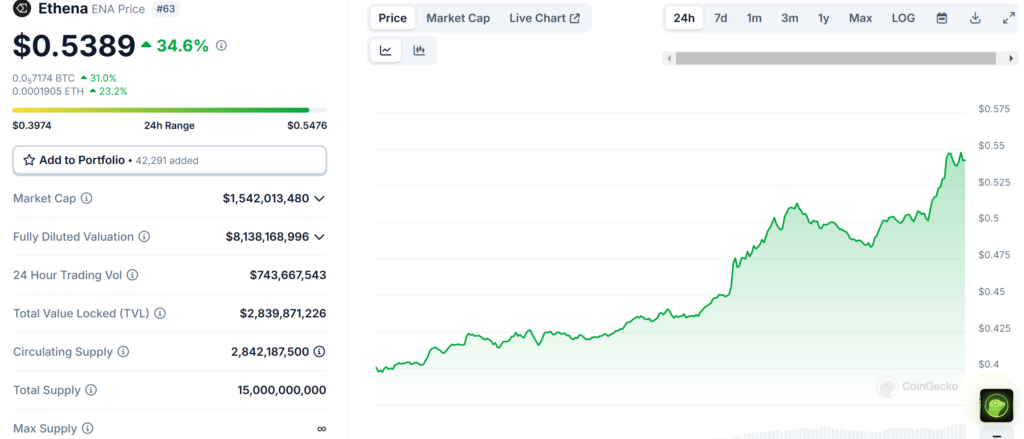

Ethena (ENA), a financial protocol built on the Ethereum blockchain designed for synthetic dollar solutions, has demonstrated remarkable market performance with its price reaching $0.5389.

The token has recorded an impressive 34.63% increase in the last 24 hours and a substantial 50.19% gain over the past week.

Trading volume has surged to $743,667,543, reflecting intense market activity. With a circulating supply of 2.8 billion ENA tokens, the project now commands a market capitalization of $1,542,013,480, marking a significant milestone in its market presence.

Whale Activity and Transaction Analysis

A dramatic surge in whale activity has been a key driver of Ethena’s recent price movement. The protocol has witnessed an extraordinary 400% increase in large-scale transactions.

The number of significant trades (valued over $100,000) jumping from 23 to 128 within a 24-hour period.

The total transaction volume experienced a massive leap from $26 million to $142 million, indicating strong institutional and high-net-worth investor interest.

This substantial increase in whale activity has contributed to ENA’s rapid price appreciation, suggesting growing confidence among major market participants.

Technical Analysis and Price Levels

The technical indicators for ENAUSD paint a bullish picture, with the pair maintaining strong positions above both short-term (34 and 55 EMA) and long-term moving averages.

Trading activity has been notably robust, with weekly volume peaks reaching $411.74 million. The token has established critical support levels at $0.4350, with additional backstops at $0.370, $0.300, and $0.260.

The bull run could face invalidation if prices close below $0.260, marking a crucial level for traders to monitor. The current trading range hovers around $0.38605, having recovered from a low of $0.3961.

Future Outlook and Key Price Targets

The immediate resistance level for Ethena sits at $0.5375, and a breakthrough above this mark could trigger a minor price correction.

The token shows potential for further upside movement, with key targets set at $0.6350 and $0.7000.

A decisive move above $0.700074 could open the path to test these higher resistance levels.

The strong buying pressure, coupled with increased institutional interest, suggests that ENA might maintain its bullish momentum, though traders should remain vigilant of the established support levels for potential retracements.

Also Read: Ethereum Staking Investor Banks $2.42M Profit As ETH Price Jumps 7.48%