The U.S. Senate agreed on a three-part budget plan to end the government shutdown, which might soon provide much-needed respite to the cryptocurrency market, according to a report.

Following this revelation, the cryptocurrency market surged today as significant legislative and regulatory changes in the United States boosted investor confidence and liquidity expectations.

Bitcoin surpassed $106,000 as Senate Leader John Thune stated, “After 40 long days, I’m hopeful we can bring this shutdown to an end”

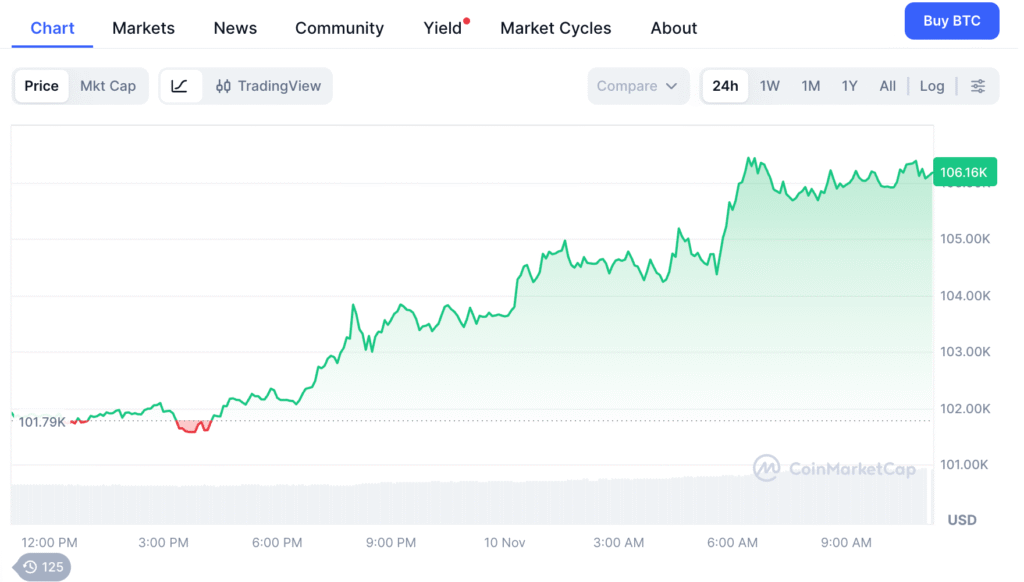

Bitcoin’s Price Action

Bitcoin is trading at $106,149.18, up by 4.25% in the last 24 hours. The global market cap is at $2.11 trillion, and the 24-hour trading volume is up by 35.59%.

Due to favourable macroeconomic and policy signs, the price of Solana rose along with Ethereum and is continuing its weekend comeback. Solana and Ethereum are both up by 6% in the last 24 hours, showing strong signs of recovery.

Since President Donald Trump declared that most American adults will get a $2,000 tariff dividend, the cryptocurrency market has skyrocketed.

Over $400 billion in tariff proceeds will be distributed under the plan. The operation is similar to earlier stimulus checkouts and has the potential to significantly boost the crypto market economy’s liquidity.

Following US President Donald Trump’s declaration of 100% tariffs on China, which sent shockwaves through the markets, Bitcoin fell by double-digit percentage points on October 10.

The cryptocurrency market cap increased by $83 billion in a single day, according to data from TradingView, making it one of the best sessions of November. According to Trump, historic investment in American industry and trillions of dollars gathered from tariffs make the payouts feasible.

A strong crypto market ahead

At least ten Senate Democrats are willing to move forward with a bipartisan budget proposal that could reopen the government into January, according to an Axios story. The agreement calls for extending Affordable Care Act tax benefits and reversing recent government layoffs.

Caroline Pham, the interim head of the Commodities Futures Trading Commission, has announced that she is trying to introduce regulated spot cryptocurrency trading products. The initiative would proceed without waiting for a new law, she added.

A lot has been happening in the U.S. government since Trump took office earlier this year. However, the end of the government shutdown can be a real positive sign for the cryptocurrency industry, especially since the bloodbath the crypto market experienced in October.

How investors and the market collectively react to this ending of a long government shutdown holds a very crucial future for the crypto industry in the USA.