In a bold and far-reaching statement made on June 9, 2025, Coinbase CEO Brian Armstrong declared that “Bitcoin is a better form of money than gold,” igniting widespread discussion across both crypto and traditional financial sectors.

Armstrong’s comments, shared via X, reflect a growing belief among financial leaders that Bitcoin is no longer just a speculative asset but a viable alternative to traditional stores of value.

He emphasized Bitcoin’s performance as the best-performing asset of the past decade and urged governments to begin allocating at least a small percentage of their reserves to Bitcoin.

Armstrong also pointed out Bitcoin’s superior utility over gold, citing its ease of transfer, digital-native architecture, and global accessibility.

Financial Giants Echo Bitcoin’s Role as “Digital Gold” Amid Institutional Embrace

Armstrong’s statement aligns with a broader sentiment echoed by influential figures like Binance CEO Richard Teng, who recently referred to Bitcoin as both a “hedge” and “digital gold.”

Teng highlighted Bitcoin’s capped supply and consistent market strength as reasons it is gaining favor in volatile economic climates.

Veteran trader Peter Brandt also joined the conversation, drawing technical comparisons between gold’s current chart structure and Bitcoin’s previous breakout patterns.

These analyses reinforce the growing perspective that Bitcoin is entering a new phase as a globally recognized store of wealth.

As institutions deepen their involvement and analysts track market correlations, the digital asset’s reputation as “21st-century gold” continues to solidify.

Also Read: Tim Draper Revives Bitcoin vs. Gold Debate, Says “Gold Just Sits There, Bitcoin Moves”

Governments Eye Bitcoin for Strategic Reserves in Historic Policy Shift

Following Armstrong’s remarks, major geopolitical players are actively considering Bitcoin as part of their national reserves.

The U.S. Treasury is reportedly preparing to release a pivotal report on how it will manage a Strategic Bitcoin Reserve based on previously seized BTC, drawing comparisons to how gold has historically been held in national vaults.

Meanwhile, Ukraine is advancing discussions with Binance to establish its own national Bitcoin reserve, signaling the country’s intent to integrate cryptocurrency more deeply into its economic system.

Pakistan has gone a step further, announcing the launch of its own Bitcoin reserve and the creation of a regulatory authority.

The aim is to oversee the crypto and digital economy, as part of a broader transformation that also includes powering mining with surplus energy.

Also Read: “Bitcoin Has Failed To Benefit From Safe Haven Flows,” Says JPMorgan As Gold Attracts Record Inflows

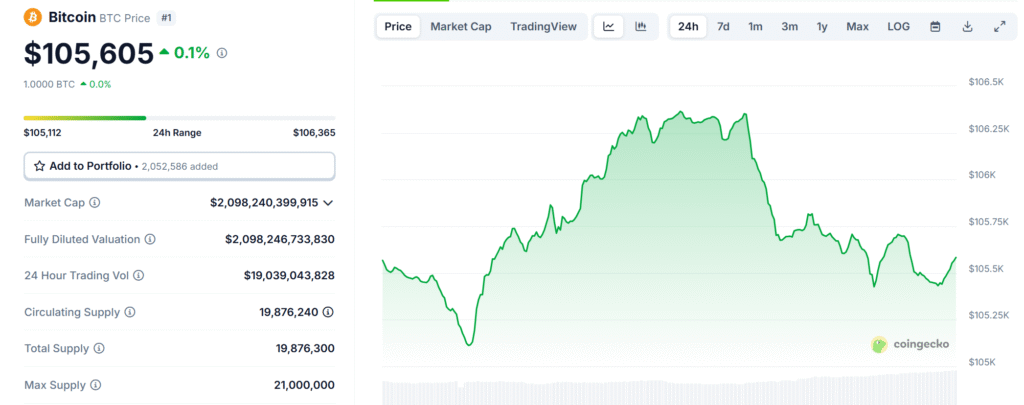

Bitcoin Holds Strong as Price Climbs Past $105K With Rising Global Interest

Amidst this surge in institutional and governmental interest, Bitcoin’s market performance remains robust.

As of today, Bitcoin is trading at $105,663, marking a 0.06% price increase over the past 24 hours and a 0.77% rise over the past week.

With a 24-hour trading volume exceeding $19 billion and a circulating supply of 20 million coins, Bitcoin’s market capitalization has now reached over $2.1 trillion.

The price resilience, coupled with its increasing acceptance as a sovereign asset, suggests Bitcoin is transitioning from a volatile tech experiment into a core element of global financial infrastructure.

As traditional institutions and national governments begin treating Bitcoin as a strategic reserve asset, the future of finance appears increasingly decentralized and digital.