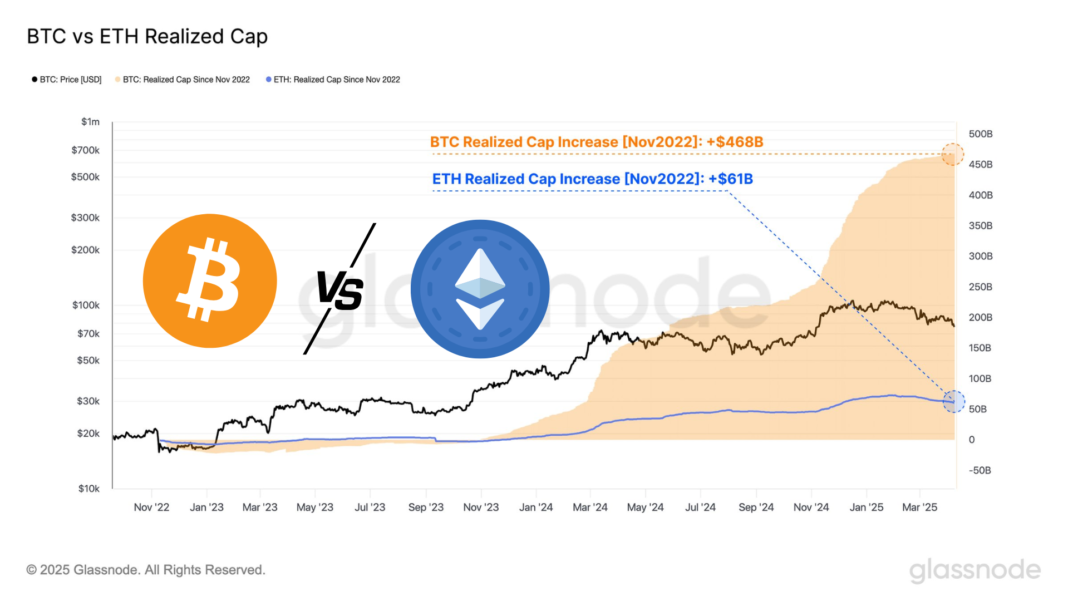

Bitcoin’s realized capitalization has increased by $468 billion, or 117%, since the collapse of FTX in November 2022, demonstrating its incredible resilience and domination in the cryptocurrency market.

According to Glassnode data, by comparison, Ethereum’s realized capitalization has increased by just $61 billion, or 32%, in the same time frame.

Compared to standard market cap, realized cap offers a more accurate picture of real capital inflows since it bases the worth of coins on the price at which they last changed.

Long-Term Holders Still Prefer Bitcoin Over Ethereum

Increased network activity, larger money inflows, and greater investor confidence are all shown by the steep growth in Bitcoin’s realized cap.

Even if Ethereum has grown as well, the difference indicates that in the post-FTX recovery environment, institutional players and long-term holders still choose Bitcoin over Ethereum.

This pattern shows changing market sentiment following one of the largest crashes in the sector and highlights Bitcoin’s status as a safe-haven asset in the cryptocurrency space, particularly in difficult times.

Bitcoin Holders Cash Bigger Gains Than Ethereum

According to the MVRV (Market Value to Realized Value) ratio, investors in Bitcoin have continuously maintained bigger unrealized profits than Ethereum holders since January 2023, per Glassnode research.

An asset’s current market value and the average price at which it was purchased are compared using the MVRV ratio. A ratio below 1.0 indicates that holders are losing money, whilst a larger ratio indicates that they are making money.

Ethereum’s MVRV ratio fell below 1.0 in March 2025, indicating that investors in the cryptocurrency market are generally now underwater and holding their holdings at a loss.

Bitcoin’s MVRV has remained above this level in the interim, indicating improved market performance and increased investor confidence. With Bitcoin continuing to lead as the most stable and profitable asset in the current market cycle, this divergence demonstrates a change in opinion.

Also Read: Bitcoin Decline Could Trigger Michael Saylor’s Strategy to Sell-Off Holdings for Debt Payment

Bitcoin MVRV Delta Also Indicates The OG-Crypto’s Dominance

Bitcoin has beaten Ethereum for 812 days in a row, setting a record, according to the MVRV delta, which calculates the difference in investor profitability between the two currencies.

This indicates that for more than two years, Bitcoin owners have continuously enjoyed more unrealized earnings than Ethereum owners.

A fundamental difference between the two assets throughout this market cycle is shown by the persistent gap, which indicates increased investor confidence and money flow into Bitcoin.

The MVRV divergence indicates that Bitcoin is increasingly seen as the more stable and rewarding investment during times of market fluctuations and volatility, even though both assets are still significant players in the cryptocurrency field.

Why is Ethereum Behind Bitcoin?

This market cycle, Ethereum has underperformed Bitcoin for a variety of technical, narrative, and regulatory reasons.

Ethereum faces more regulatory ambiguity because of its wider use in DeFi and token issuance, whereas Bitcoin is generally regarded as “digital gold” and a safe-haven asset.

Its switch to Proof-of-Stake raised questions about validator dominance and centralization. High gas prices and competition from quicker smart contract platforms like Solana are some issues that Ethereum’s network is still facing.

Bitcoin is a more appealing alternative in a risk-averse atmosphere, which has resulted in larger inflows and steady outperformance over Ethereum over the current cycle due to its maturity and clarity.

Also Read: Analysts Spot Bitcoin Flashing TD Sequential Buy Signal, Eyes on $88,000 Level